Global Stock Markets: Keep Your Eye on This Remarkable "Divergence"

Stock-Markets / Stock Markets 2020 Oct 01, 2020 - 06:20 PM GMTBy: EWI

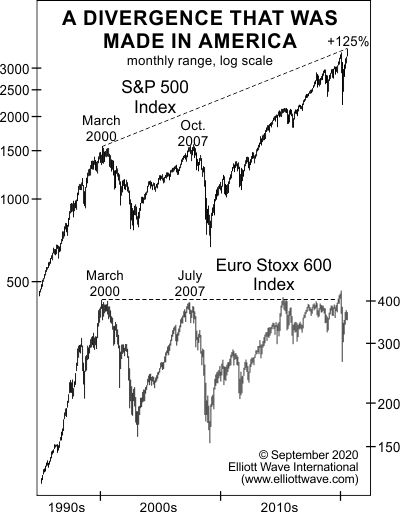

Incredibly, the Stoxx 600 is lower today than it was in March 2000

As you probably know, a "divergence" occurs when one financial market behaves differently from a related financial market.

Such occurrences often portend trend changes, albeit, divergences may stretch out for months before a trend change occurs.

Remarkably, one global divergence has been unfolding for more than 20 years!

The September Global Market Perspective, a monthly publication which covers financial markets in Europe, the Asian-Pacific, the U.S. and other regions, tells the story with this chart and commentary:

Incredibly, Europe's broad market has made no net progress over the past 15 long months, as this chart of the past 25 years shows. More incredibly, the Stoxx 600 is lower today than it was in March 2000, almost 21 years ago. Perhaps most incredibly, however, is that the great U.S.-European stock market divide has grown even wider. The S&P 500, in fact, has more than doubled since March 2000 and more than quintupled since the last financial crisis ended in March 2009.

Can this 20-plus year divergence continue?

Well, here's what U.S. News & World Report had to say on August 4:

Europe May Finally Be Compelling for Investments

It's time for U.S. investors to change their outlook on European investments.

On August 9, the Wall Street Journal expressed a similar sentiment:

Why It Might Be Time to Invest in Non-U.S. Stocks

U.S. stocks have been the better bet for a decade. With those valuations now so high, the question is whether it makes sense to shift some exposure overseas.

Also, the Global Market Perspective is filled with Elliott wave analysis of 40-plus markets worldwide.

An ideal way of learning how to analyze and forecast financial markets by using the Elliott wave model is to read the Wall Street classic, Elliott Wave Principle: Key to Market Behavior, by Frost & Prechter.

Here’s a quote from the book:

All waves may be categorized by relative size, or degree. The degree of a wave is determined by its size and position relative to component, adjacent and encompassing waves. [Ralph N.] Elliott named nine degrees of waves, from the smallest discernible on an hourly chart to the largest wave he could assume existed from the data then available. He chose the following terms for these degrees, from largest to smallest: Grand Supercycle, Supercycle, Cycle, Primary, Intermediate, Minor, Minute, Minuette, Subminuette. Cycle waves subdivide into Primary waves that subdivide into Intermediate waves that in turn subdivide into Minor waves, and so on. The specific terminology is not critical to the identification of degrees, although out of habit, today’s practitioners have become comfortable with Elliott’s nomenclature.

The online version of Elliott Wave Principle: Key to Market Behavior is freely available to Club EWI members. Club EWI is the world’s largest Elliott wave educational community and is free to join. In addition to free access to Elliott Wave Principle: Key to Market Behavior, Club EWI membership allows you to access a wealth of Elliott wave resources on financial markets, trading and investing – free.

Follow the link to get your free access to Elliott Wave Principle: Key to Market Behavior.

This article was syndicated by Elliott Wave International and was originally published under the headline Global Stock Markets: Keep Your Eye on This Remarkable "Divergence". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.