The Prospects of the Rocky S&P 500 Stock Market Recovery

Stock-Markets / Stock Markets 2020 Oct 01, 2020 - 06:27 PM GMTBy: Paul_Rejczak

Quite an eventful period since the last Stock Trading Alert on Sep 11 – stocks rose both on Sep 14 and 15, validating the short-term bullish outlook presented in the said Alert. Next, the S&P 500 made two downswings before rebounding from the 3200 level proximity on Sep 24. Friday's session brought us a daily upswing, and so did Monday. Where does yesterday's stumble fit in?

Volatility has been moving generally lower after making a lower high days ago. Technology plunged but didn't make a new low on Thursday. Otherwise, there have been few sectoral bright spots, with financials and energy still looking precarious. On the bright side, consumer discretionaries, utilities and consumer staples (the latter two are defensives) have held up reasonably well – better than healthcare.

But what moved the markets when it comes to headlines? Political uncertainties remain, the first presidential debate is over, and there is still no stimulus bill, while corona is getting worse overseas. New lockdowns are hanging in the air, with the U.K. and Israel leading the way. Then, the Fed hasn't done all that much lately, leaving the credit markets relatively unfazed. Continuing claims are trending lower only painfully slowly, and U.S. tensions with China haven't seen a turnaround.

So, are we witnessing a typical pre-election correction? I think that's most likely the case. September brought us a bigger storm than October based on the 2016 experience would, and it's reasonable to expect the remaining S&P 500 downside (unless the current upswing turns into a dead cat bounce) to be relatively modest.

Let's check the charts' messages.

S&P 500 in the Medium – and Short-Run

I’ll start with the weekly chart perspective (charts courtesy of http://stockcharts.com ):

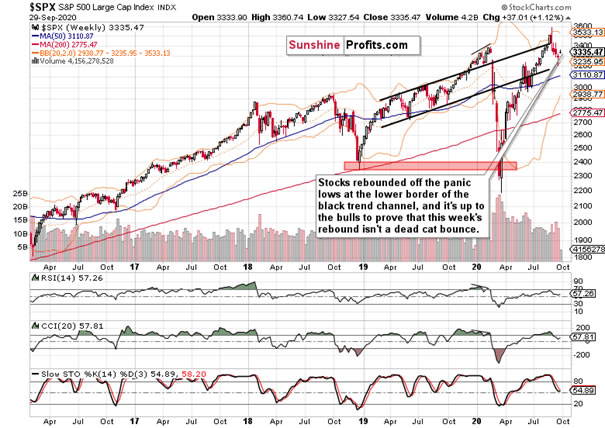

Stocks plunged all the way to the lower border of the rising black trend channel, and subsequently rebounded. The lower knot of last week's candle and the upper knot of the week in progress, hint at a short-term indecision. The weekly indicators support the notion of not that much downside left in this correction.

Let's check the daily chart whether it supports my assessment or not.

Having visited the 3200 level, S&P 500 futures rebounded, but the volume isn't totally convincing. That makes the recovery less credible. On one hand, there hasn't been a selling climax thus far yet, on the other hand unless momentum and volume pick up to the downside, any potential second local bottom would be made on lower volume (or, prices would insitead consolidate sideways before another leg higher).

Either way, the bulls are in a slightly more advantageous position now. That's especially so given the smaller volume of yesterday's daily stumble.

The Credit Markets’ Point of View

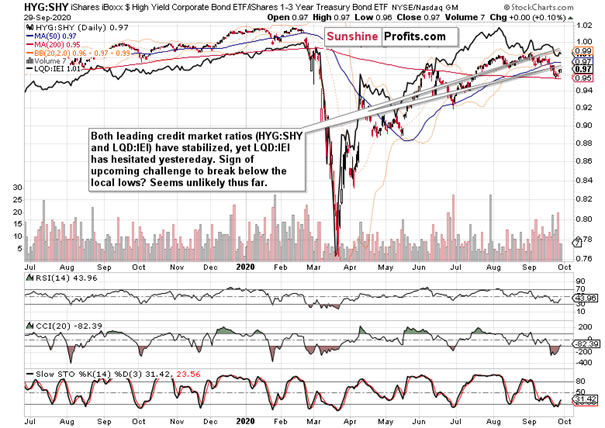

High yield corporate bonds (HYG ETF) have rebounded, but the weak volume is a cautionary sign. In my opinion though, it's more likely than not that Thursday intraday lows would hold. Examination of investment grade corporate bonds (LQD ETF) though still warrants short-term caution, until resolved.

A glance at both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – highlights that perfectly. LQD:IEI hesitated yesterday in what appears to be a daily pause. Again, I don't see a break below either's local lows as my go-to scenario at the moment.

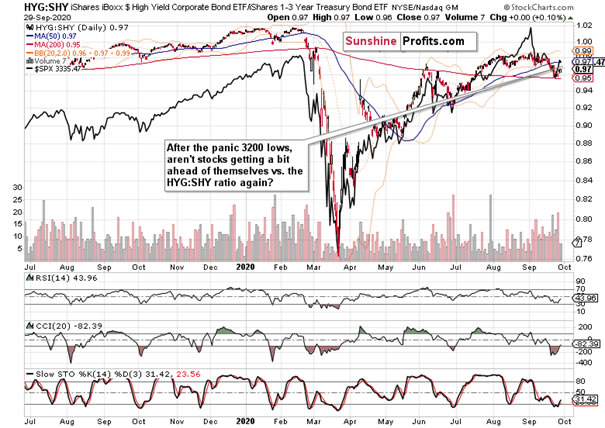

Finally, let's check whether stocks are extended relative to the HYG:SHY ratio, or not. And they are. Or is it that stocks are leading higher? Both points are true in my opinion right now, and I look for stocks to facilitate the HYG:SHY ratio's eventual upswing. Yes, that means I see quite limited downside potential in stocks.

Summary

Summing up, stocks have rebounded from a relatively protracted local bottom, and appear ready to gradually assume trading with a bullish bias again. Market breadth indicators appear favoring the bulls with each passing day without a profound downswing that would pull the advance-decline line dramatically lower.

The U.S. dollar has met its fair share of short-term selling pressure, and unless the bulls assume the initiative and overcome the September peak, I'm not looking for risk assets to get under too much pressure.

Cautiously bullish outlook is warranted, and the bulls that have been waiting on the sidelines for the dust to clear up, wouldn't be hurt by exercising patience in the lookout for a more favorable short-term entry point than is the case this very moment (S&P 500 futures at 3318).

We encourage you to sign up for our daily newsletter - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Monica Kingsley

Stock & Oil Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

Monica Kingsley is a trader and financial markets analyst. Apart from diving into the charts on a daily basis, she is very much into economics, marketing and writing as well. Naturally, she has found home at Sunshine Profits - a leading company that has been publishing quality analysis for more than a decade. Sunshine Profits has been founded by Przemyslaw Radomski, CFA - a renowned precious metals investor and analyst.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.