The Smart Way to Play the Hottest IPO Market in Years

Companies / IPOs Oct 05, 2020 - 02:03 PM GMTBy: John_Mauldin

By Justin Spittler

The biggest software IPO is officially in the books. Two weeks ago, in one of the most hyped events of the year, Snowflake (SNOW) went public.

Snowflake is a data warehousing company. It helps companies better access and make sense of their data. We’ve been “stalking” Snowflake for over a year. And yet, we held off from recommending it to our readers.

There’s nothing wrong with Snowflake’s business. In fact, it’s a phenomenal company. Its customers include some of the world’s most cutting-edge companies, including Adobe (ADBE), Square (SQ), DocuSign (DOCU), and Overstock.com (OSTK).

Not only that, Snowflake is one of the world’s fastest-growing businesses. Its sales have surged an incredible 174% over the past year. That’s faster than Zoom Video (ZM) was growing before it went public.

And Snowflake has barely scratched the surface of its potential. In fact, the global cloud storage market is growing at 22% per year. By 2025, it’s poised to be a $137 billion industry. The cloud analytics market, on the other hand, is poised to be worth $72 billion by 2026.

In short, Snowflake’s growth potential is staggering. So, why didn’t we jump on this opportunity?

There Was Way Too Much Hype Around Snowflake’s IPO

Big, hyped IPOs usually don’t deliver. Last year, Uber (UBER) and Lyft (LYFT) disappointed investors. Both stocks crashed 35%+ during their first six months of trading.

Even Facebook’s (FB) IPO was a flop. It plunged 54% in its first five months as a publicly traded company before ultimately bottoming out. This happens all the time in the IPO market.

When there’s a ton of hype around an IPO, that enthusiasm gets “priced in.” And most of the upside is captured before retail investors like us even have a chance to buy it.

In the case of Snowflake, its shares were originally priced between $75 and $85. A few days later, Snowflake bumped its price range up to $120. That’s 50% higher than where it was originally priced! As if that weren’t crazy enough, Snowflake opened its IPO day at over $250 per share. Its shares later hit $319, four times its original IPO price.

At its peak, Snowflake was worth $80 billion on the day of its IPO. That’s more than 431 companies in the S&P 500 are worth.

Investing Isn’t Just About The Stocks You Buy

The price you pay for that stock is just as important, if not more so. Of course, Snowflake isn’t the only high profile “unicorn” that has recently IPO’d. A flurry of tech companies have gone public in the past week.

Dev ops platform JFrog (FROG) also went public last Tuesday. The next day, cloud log management company Sumo Logic (SUMO) and telemedicine company Amwell (AMWL) IPO’d. And on Friday, 3D gaming company Unity Software (U) made its debut.

And that’s just a taste of what’s to come. Data mining company Palantir (PLTR), workforce collaboration company Asana (ASANA), and home-sharing giant Airbnb (AIRB) are also gearing up to go public.

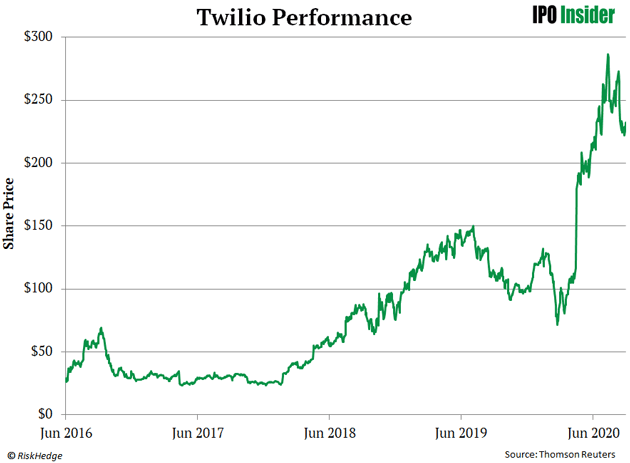

We haven’t seen an IPO pipeline like this since 2016–2017. During that time, a number of exciting IPOs went public. Software giant Twilio (TWLO) IPO’d in June 2016. It has since 10X’d in value.

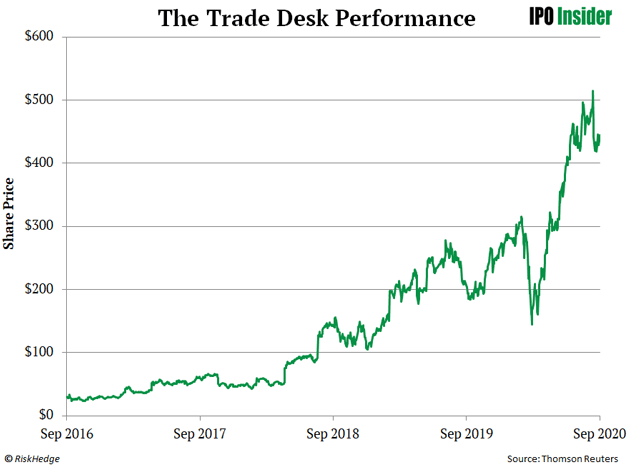

A few months later, The Trade Desk (TTD) went public. It has soared more than 1,600% since September 2016.

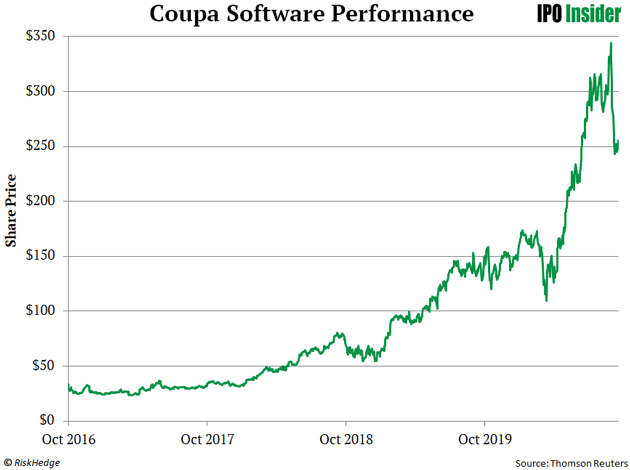

Cloud computing company Coupa Software (COUP) went public in October 2016. It has also surged nearly 1,000% since its IPO.

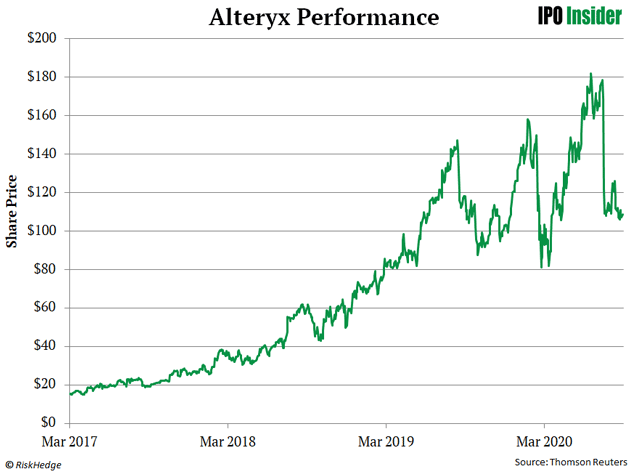

Data analytics company Alteryx (AYX) is another top-tier software company. It went public in March 2017 and has soared nearly 1,100% since.

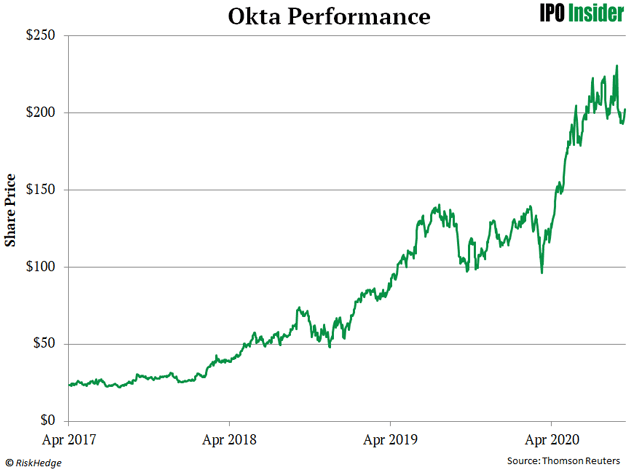

Cybersecurity company Okta (OKTA) IPO’d in October 2017. And it’s also been a high-flyer, surging nearly 900% since its IPO.

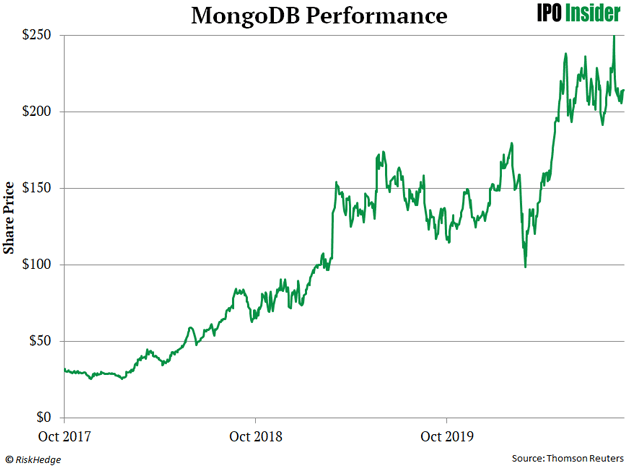

Then in October 2017, MongoDB (MDB) went public. It skyrocketed more than 700% over the next three years.

These are incredible gains. And I believe the recent crop of tech IPOs could deliver similar gains in the years to come. But that doesn’t mean you should blindly buy them.

The IPO Market Rewards Patient Investors

Sure, some IPOs storm out of the gate… delivering big gains to investors who bought in on Day 1. But most hyped-up IPOs follow a predictable pattern.

They decline shortly after going public. In other words, you’re usually been better off waiting to buy IPOs. In fact, every single IPO I mentioned from the 2016–2017 IPO boom eventually went “on sale,” meaning you could have picked up shares below their IPO closing price.

For instance, you could have bought The Trade Desk at a 24% discount to its IPO price by simply waiting two months. You could have also picked up shares of Twilio at a 19% discount to its IPO price by waiting 11 months. The same goes for Coupa, which you could have bought at a 30% discount five months after its IPO.

I have no doubt that the current crop of IPOs will also go on sale in the coming months. When that happens, these stocks will go from hyped up to hated. And that’s when you should plan to swoop in.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get our latest report where we reveal our three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Justin Spittler

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.