Why You Should Look for Stocks Climbing Out of a “Big Base”

Companies / Tech Stocks Oct 09, 2020 - 03:16 PM GMTBy: John_Mauldin

By Justin Spittler : Today I’m going to show you a trading tactic so simple, yet so reliable, it’ll allow you to predict when certain stocks will skyrocket days or even weeks in advance.

Master this tactic and it’ll feel like you’ve got a “cheat code” to the markets. Let me show you exactly how it works. In short, you want to identify stocks that are climbing out of a “base.”

A stock forms a base when it trades within a narrow price range for a period of time. In other words, the stock isn’t crashing, and it’s not zooming higher (yet).

It’s essentially trading “sideways.” Now, many people disregard sideways price action.

They think it’s “no man’s land.” A place where money just sits stagnant. They’re only focused on charts that showcase big moves to the upside or downside. This is a big, costly mistake.

You Should Learn To Love Sideways Price Action

I’m extremely interested in stocks that form “big bases.” In other words, stocks that trade sideways for a long time.

Why? A strong base often serves as a launch pad for an explosive move where a stock leaps 30–50% higher within weeks, sometimes within days.

And the more time a stock spends carving out its base, the higher the upside. I’ve found that the biggest moves come right as a stock starts climbing out of a strong base.

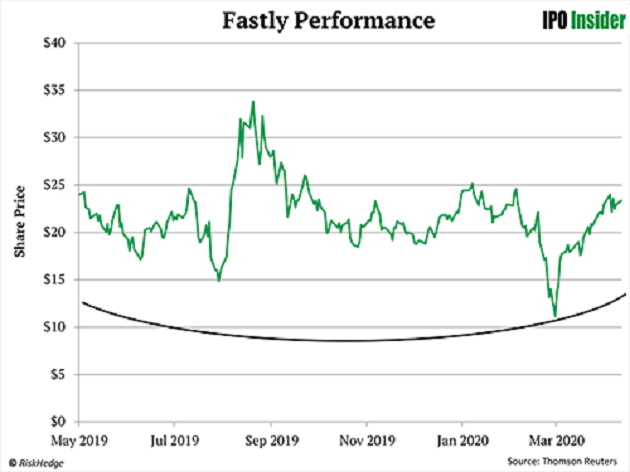

Earlier this year, this exact setup presented itself. You’re looking at a chart we showed to our premium subscribers in an urgent alert on April 27.

Fastly (FSLY) is an internet infrastructure company and “edge computing” pioneer. Many of the world’s biggest, most disruptive companies use Fastly to rapidly and securely deliver digital content to users around the world.

Not only was it at the forefront of one of our favorite trends, its chart told us that after years of sideways price action it was time to pull the trigger.

You can see Fastly was “carving out a base” for 12 months before starting its climb higher. As we told our subscribers, this action suggested Fastly “could be in the early innings of a major move higher.”

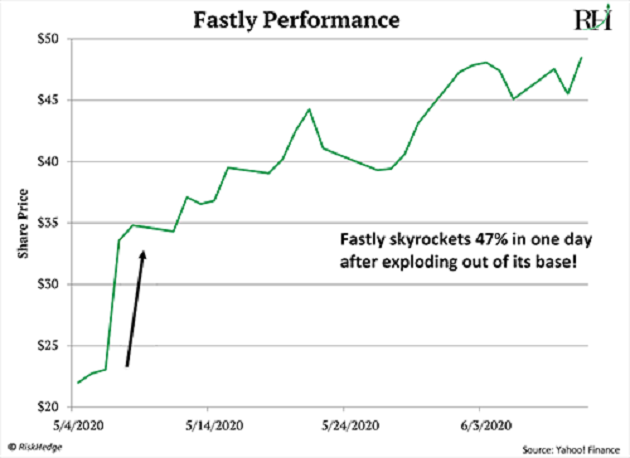

And that’s exactly what happened. Less than 2 weeks later, Fastly erupted: soaring 47% in just one day.

Take a look:

Now, collecting 47% gains in one day is not typical. But it is possible if you hunt for stocks that’ve carved out strong bases. And as you can see, Fastly didn’t stop there.

It kept roaring higher. After a year of “sitting on the launchpad,” Fastly took off with unstoppable force.

If You Want To Find The Next Big Winner, I Recommend Using This Reliable Tool

Look for a world-class stock like Fastly that’s carving out a long-term base. And pounce when the stock has successfully climbed out of that base. It’s that simple.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get our latest report where we reveal our three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Justin Spittler

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.