Q4 Market Forecast: How to Invest in a World Awash in Debt

Stock-Markets / Financial Markets 2020 Oct 09, 2020 - 04:34 PM GMTBy: The_Gold_Report

In a world buffeted by political and social "noise," sector expert Michael Ballanger outlines his strategy for maximizing the worth of his portfolio. Before I wade into my Q4 strategy analysis, I have to tell you that prior to last Tuesday's "debate," I was leaning toward a "neutral" investment strategy largely based upon the 2016 outcome where heavily favored Hillary Clinton was upset by the Trump Train at the last hour, and in direct opposition to what every poll was predicting. I have a theory about the 2016 election and just exactly why the pollsters got it so completely wrong. I will explain.

I majored in marketing and finance from 1976's ninth-ranked undergraduate business school in the United States, Saint Louis University, a Jesuit institution of immense reputation and stature. In the marketing courses, they taught us that surveys are only relevant when they have a representative sample size. If you are asking a group of Canadians their opinion of Budweiser beer, you will get a skewed result. If you ask a group of Japanese whether they like "fish and chips," you will get a skewed result. If, in October 2016, you could not find a group of Americans living in the Ozarks or the Louisiana bayou or the Montana wilderness, you would never have obtained a representative sample of the pulse of the 2016 election. And that was where the pollsters went wonky. They chose to speak to metrosexual millennials with the colored glasses and Starbucks lattes rather than the guy in the F150 with the Confederate flag draped in the back window and two shotguns in the rack.

Last summer, in Tobermory, Ontario, I was having lunch with my friend Tomas, a German now living in Canada and an extremely gifted thinker and engineer. As he forced himself to take yet another sip of what was advertised as "German beer" (he said the only thing "German" about the beer was the flag on the bottle), I decided to engage him on the topic of U.S. politics, knowing full well that he has, in his business, several U.S. plants to manage and a number of U.S. clients to service.

In his wonderful German accent, he took the bait and was quick to advise me that "Donalt Tromph vill vin by a londschlide. He vill kigg arsche." I smiled and quickly added, "Only if he can keep the black and female vote at home on Nov. 3." Think about it.

I lived in the USA for the better part of six years, in one of the greatest cities in the world and after I abandoned the idea of being an NHL hockey player, I kept in touch with many of my American-born classmates. I have always found it useful to poll this highly diverse group of Yanks because they hail from all over the country and they are a mixture of left- and right-thinking citizens, all college-educated, and all quite aware of the problems besetting the American Dream. Unfortunately, there is wide disagreement among them as to the solutions to the many structural ailments that are ripping the fabric away from American life—and therein lies the problem.

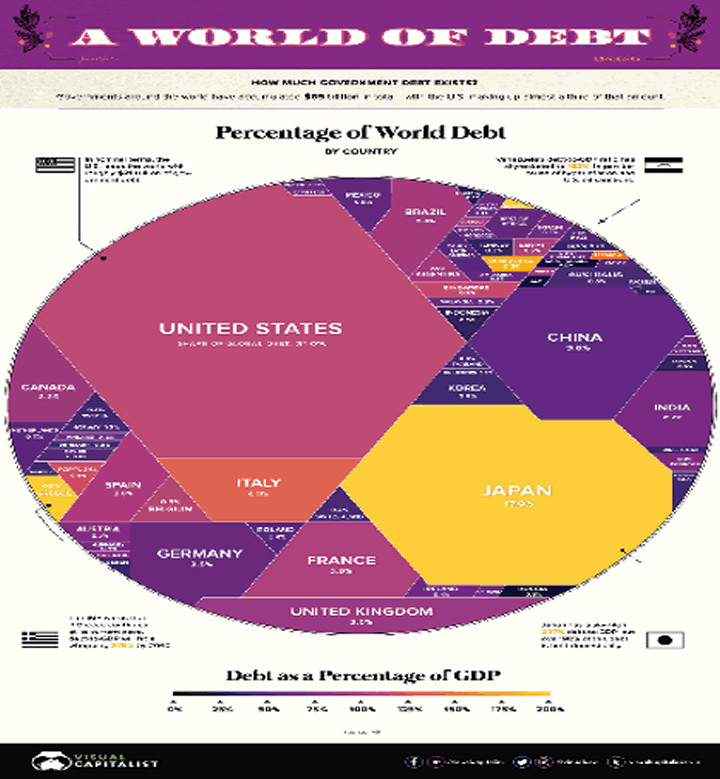

In the last quarter of 2019, I put forth the opinion that the major problem plaguing the global economy was not Chinese trade nor European banks nor American imperialism but rather one glaringly obvious collective problem shared by almost every nation on the planet: Debt.

Long before this epidemic of influenza spread across the mainstream landscape, fed and fanned by political leaders and the ratings-starved news media, the banker-owned Fed was already pouring gasoline on the fire with their Q4/2019 REPO actions, which saw billions upon billions of dollars handed out like confetti at a wedding to the primary dealers in order to avoid what Fed chairman Powell referred to as "liquidity issues." That shift in Fed policy was, in my opinion, the first ugly emergence of the debt monster, and it was only in February 2020 that those in power executed the ultimate "carpe diem," after learning of the Wuhan outbreak. This created a "false flag" event, a "feint," a clever, panic-driven "diversion" designed to frighten and distract the public.

The outcome? Well, Joseph Goebbels (former Nazi Minister of Propaganda) is looking down (or up) at "Operation COVID-19" with a big smile on his face, because this campaign worked like a charm.

So, just when "liquidity issues" are plaguing the primary dealer network, the Fed suddenly sees through the mayhem and decides that it is "insolvency issues" that are on the fiscal horizon. Just like clockwork, and in the name of "saving the average American," they take away his job, print a few trillion in phony money, hand most of it to large corporations and the banks on the guise that they will recall workers back, and throw a few measly shekels into bank accounts of "average Americans." All the while, the Fed is goosing the stock markets and feeding the media the absurd notion of a "V-shaped recovery" just around the corner.

Overnight, I heard the news that Donald Trump and his wife have tested positive for the virus, and the major averages are expected to be off 1.5–2.25% when they open. Gold had given up all of Thursday's gains and was sitting at US$1,895/ounce when the news hit; it reversed and was back through $1,920 by 3 a.m. EST.

This is symptomatic of the mood of the populace these days, as no one can put forth anything that lasts for more than a nanosecond sound byte. Gold, silver, stocks and bonds are all going to be whipped around like unbridled fire hoses until well after the U.S. elections, so managing one's portfolio is going to be problematic unless one can grasp a lifeline on the "bigger picture" and cling to it as a critical lifeline. All of these headline "events," since Q4/2019, represent noise designed to divert us from the highly successful "crisis investing" bias that has currency destruction as its primary driver and preservation of capital as its primary objective.

I think that the insurmountable levels of debt in existence the world over (but significantly in the U.S. and terminally in Canada) vastly outweigh the outcome of any election or emergence of any sort of "fiscal messiah" claiming to have the answers. Reversing seventy-five years of uncontested debt creation through monetization and deception; through intervention, interference and manipulation; through criminal acts (JP Morgan) that have taken billions of dollars from the trading accounts of law-abiding citizens, is going be impossible. It will not happen. All we, as rational men and women, can hope to achieve is the retention of our standards of living by protecting the purchasing power of our wealth.

I continue to hold forth that wealth retention in an era of unprecedented monetary debasement is best achieved through overweight positions in precious metals and the listed companies that produce, develop and explore for them. The 1970s model is the one most closely aligned with today's crisis, with the one difference being that even by 1979, with gold at $800 per ounce, the U.S. was still a creditor nation (the world's largest) versus today when she is a debtor nation (also the world's largest).

In 2020, there exists not one central banker with the vision and fortitude of a Paul Volcker, the former Fed chairman (1977–1987) who set out to control the Great Inflation of the 1970s by cutting off the flow of easy credit to the banks and brokers, driving borrowing costs through the roof and crippling the global economy in its wake.

Because there is a vacuum of grit and resolve anywhere in the political arena these days, I see no force out there able to reverse the course of debt monetization and currency debasement that will inevitably result in the total and complete destruction of the purchasing power of cash. Portfolios that are dependent on the return of the global economic status quo (60% equities/40% bonds) will be vaporized by rising input costs to manufacturers (ex-metals), which in turn leads to margin compression and disappearing profits.

The senior and junior gold producers are enjoying the best of all worlds these days, as revenues are soaring while energy prices, usually 25% of throughput costs, are in decline. In 2011, when gold last traded at US$1,920, oil was approaching US$100/barrel, with the HUI (unhedged gold index) north of 600. Today, oil is under US$38/barrel and the HUI is 329.

With the current prices for gold and silver, I see massive dividend increases on the horizon, not unlike the South African gold stocks in the last 1970s. Portfolios overweight in the developers are positioned for leverage-driven gains the likes of which we have yet to behold in recent times. A one-million-ounce deposit appropriately valued at US$40 million in 2015 is today worth more than double that, because of the reasons mentioned above.

This is why the 2020 GGMA portfolio is overweight a number of junior developers with proven resources, poised and ready to deliver updated resource estimates or preliminary economic analyses, the result of which will be sharply higher share prices and accelerated merger-and-acquisitions activity.

There are times when the best defense is not always a strong offense (think "Toronto Maple Leafs"). As we approach the elections, the end of stimulus handouts, and the sudden realization that the world is in a depression not even close to anything resembling a recovery, I am executing a strategy where the best offense is a strong defense. The defense to which I refer has "loss of purchasing power" as its enemy.

Owning precious metals in Q4/2020 is a "prevent defense" designed to prevent portfolios from being unduly buffeted by all of this "noise" to which we are constantly subjected. Stated another way, I want to add to "what is working" and avoid "what is not working," and with the GGMA portfolio up over 200% year to date, that means holding positions and adding on reactions, never easy and rarely fun.

Follow Michael Ballanger on Twitter ;@MiningJunkie.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. 2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.