Stock Market SPY Retesting Critical Resistance From Fibonacci Price Amplitude Arc

Stock-Markets / Stock Markets 2020 Oct 15, 2020 - 05:15 PM GMTBy: Chris_Vermeulen

RESEARCH HIGHLIGHTS:

- We continue to monitor the $339.50 level as a key resistance level.

- Our weekly SPY chart is showing that the Fibonacci Price Amplitude Arc resistance level is acting as a ceiling for price and a downward trend in the Momentum indicator.

- The current rally in price may simply be another Bull-Trap set up in a typical “R” price formation near our Fibonacci Price Amplitude Arc resistance level.

- A SPY breakout or rally above $339.50 pushes us closer to the all-time highs, which could then could prompt a new breakout/rally in price.

My research team and I have been watching with keen interest how the markets have continued to trend sideways since setting up a major price peak on September 2, 2020. We’ve continued to suggest general market weakness in the US major indexes was likely to take place after nearly all of the US major indexes rallied above the February 2020 price highs. Our bigger concern was that a “Bull Trap” was setting up just 60+ days before the US elections.

Recently, we authored a series of new research articles about sector rotation and how we believe global investors are shifting assets away from risk and into undervalued value sectors. You can read these articles here:

October 7, 2020: STICK WITH THE WINNERS LIKE CLEAN ENERGY

October 8, 2020: COVID-19 HAS PUSHED VARIOUS SECTORS INTO POSITIVE RECOVERY TRENDS

My research team believes the final months of 2020 will be a challenge for all traders/investors as volatility continues to stay nearly 2x to 3x higher than normal and as global investors continue to transition from high-flying sectors over the past 12+ months into undervalued sectors that appear to be breaking into a new upward trend. We believe certain sectors, like housing, freight, and heavy equipment, as well as certain retail segments, could continue to do moderately well throughout the Christmas season. Yet we also believe this transition away from risk may prompt some big downward price trend surprises over the next 60+ days – so traders need to stay keenly aware of risks and cautious of broad market rotations.

FIBONACCI PRICE AMPLITUDE ARC CEILING BACK IN PLAY

Today, we are focusing our research on the SPY chart and how our Fibonacci Price Amplitude Arc from a projected target point many months into the future continues to play a role in creating resistance for the SPY and major US markets. We’ve mentioned the $339.50 level on the SPY as a key level to watch over the past 30+ days and we’ve authored numerous articles about the key developments and setup from a Technical Analysis standpoint. One of the most informative research posts recently was our detailed article on September 6, 2020, entitled BIG TECHNICAL PRICE SWINGS PENDING ON SP500, which suggested a broad market decline was setting up.

We believe the current price setup in the SPY is similar to the early September peak price action and may prompt another downside price move after briefly testing out these recent high price levels. In other words, the current rally in price may simply be another Bull-Trap set up in a typical “R” price formation near our Fibonacci Price Amplitude Arc resistance level and traders need to stay extra cautious at this time.

Yes, a breakout trend/rally above this level that pushes back to near the all-time highs could prompt a new breakout/rally in price – but we’re not there yet. We believe the indecision and uncertainty related to the US elections will continue to keep the US markets in a mode of paralysis over the next 3+ weeks (or longer). Don’t expect much of a price trend over the next three to four weeks and stay very cautious of risks as news, tweets or other items could become major drivers of price rotation over the next 30 to 60+ days.

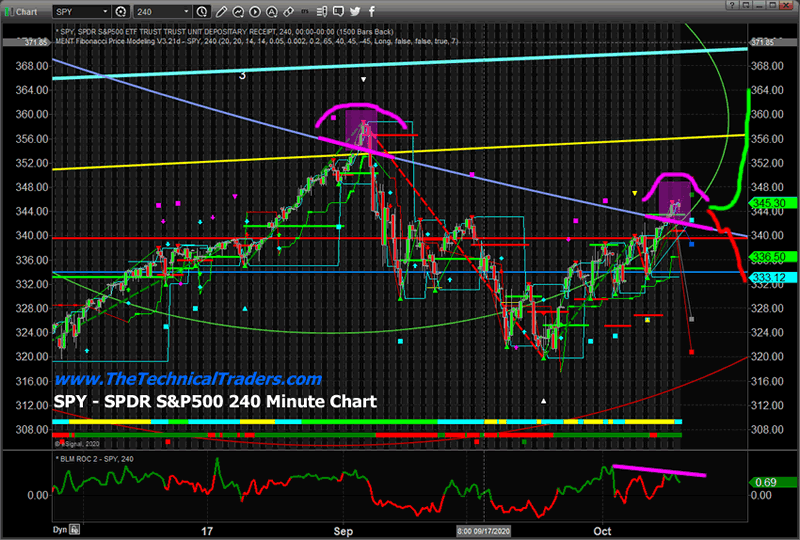

Notice the two MAGENTA highlighted areas on the SPY 240-minute chart below. These are the areas above the Fibonacci Price Amplitude Arc that present Bull Trap setups. We have a moderate technical divergence in our Momentum indicator and we believe the current price setup is, again, at a make-or-break setup.

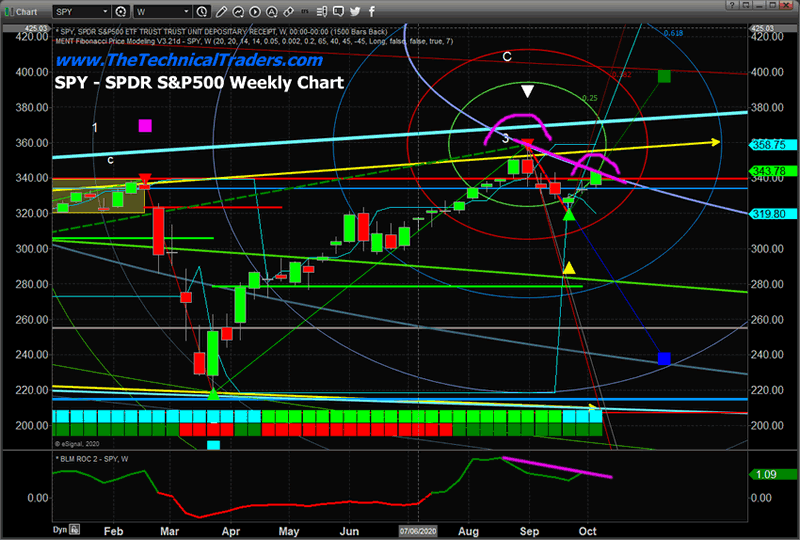

This SPY Weekly chart, below, highlights the same setup over a more condensed chart. We can still clearly see the Fibonacci Price Amplitude Arc resistance level acting as a ceiling for price. We can also see the two recent peaks that align with this Fibonacci Price Amplitude Arc. We also have a downward trend in the Momentum indicator near the bottom of the chart. If price fails to hold above the Fibonacci Price Amplitude Arc (with any indecision or uncertainty over the next few weeks), we believe the downside price risk is rather substantial. A breakdown in price at this point could prompt a move below $315 on the SPY – possibly targeting the $280 level again.

Any failure in price to continue to rally will quickly become evident as price should setup a rollover peak very close to the $340 to $350 price level on the SPY. Again, we are nearing a make-or-break price level on the SPY – skilled traders need to be cautious right now.

Jumping into any long-side trades at this time could represent a very real 11%+ downside risk factor. Jumping into any inverse trades could represent a very real 6% to 8% risk. With volatility still 2xto 3x+ the normal price range and price hovering near critical resistance just weeks before the US elections, taking big trades banking on big trends in this market is like taking a Dingy out in a Hurricane. Best to understand the risks and prepare for stormy weather to ride out the volatility and risks.

Targeted trades in the most opportune sectors with moderate levels of risk are the only real opportunities in our opinion. Swing traders should stay cautious as unknown risks still persist near this critical resistance level and a number of unknowns continue to lurk just below the surface.

f you want to survive the trading over a long period of time, then you learn fairly quickly how important it is to protect against risk and to properly size your trades. Subscribers of my Active ETF Swing Trading Newsletter can ride my coattails as I navigate these financial markets and build wealth. My research and trading team are here to help you find better trades and navigate these incredibly crazy market trends.

While most of us have active trading accounts, what is even more important are our long-term investment and retirement accounts. Why? Because they are, in most cases, our largest store of wealth other than our homes, and if they are not protected during the next bear market, you could lose 25-50% or more of your net worth. The good news is we can preserve and even grow our long-term capital when things get ugly (likely soon) and I will show you how. We’ve recently issued a Long-term Investment Signal for subscribers of our Technical Investor newsletter. Be sure to become a member of my Passive Long-Term ETF Investing Signals.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.