High-Profile Billionaire Gives Urgent Message to Stock Investors

Stock-Markets / Stock Markets 2020 Oct 21, 2020 - 02:23 PM GMTBy: EWI

In a deflationary depression, the prices of most financial assets crater, including stocks.

One well-known billionaire says it's time to shift into cash.

Here's an excerpt from a Sept. 22 CNBC article:

Billionaire media mogul Barry Diller on Tuesday urged investors to maintain sizable cash positions following the stock market's robust rally from coronavirus-induced lows in late March.

"Personally, and professionally, every nickel you can, keep it ... wherever it's banked," the chairman of both Expedia and digital media group IAC said ... "I think the market right now is a great speculation, I would stay home."

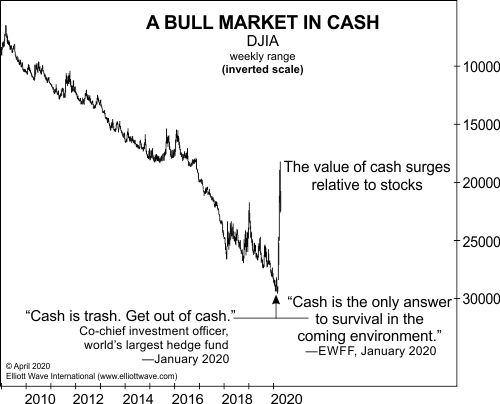

This calls to mind a chart and commentary from the April 2020 Elliott Wave Financial Forecast, a monthly publication which provides analysis of major U.S. financial markets:

In January, EWFF opened the year with a forecast titled, "2020 Foresight: Financial Assets and the Coming Return to Planet Earth." The centerpiece in our "return" scenario was a dissertation on the renewed value of cash. "In the 2020s, a countervailing public passion for cash will grab hold." Conquer the Crash anticipated this development by showing two charts of inverted stock averages in bear market periods. The point is that equities are the opposite of cash; risk-assets that require the surrender of cash. The relative value of cash will necessarily zoom higher when stocks plunge. The chart inverts the Dow's recent plunge to show the liftoff for a new bull market in cash, as discussed here in January. ... In a section on "The Wonder of Cash," CTC explained, "Owning an array of investments is financial suicide during deflation. They all go down, and the logistics of getting out of them can be a nightmare." It's not too late, but it's getting close, as CTC stated that the time to move into cash is before a sustained deflation emerges: "Then when the stock market reaches bottom, you can buy incredibly cheap shares that almost no one else can afford because they lost it all when their stocks collapsed." Also, be sure and check with CTC when it comes to the right forms of cash and cash equivalents. Not all of them will do. Chapter 15 covers the waterfront on that topic.

Also, read the special free report "What You Need to Know Now About Protecting Yourself from Deflation."

This article was syndicated by Elliott Wave International and was originally published under the headline . EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.