A Golden Election Promise

Commodities / Gold & Silver 2020 Nov 04, 2020 - 04:40 PM GMTBy: The_Gold_Report

Peter Krauth explains why he believes gold will be the biggest winner in the election.

There's no shortage of prognostications or conjecture about the U.S. election.

Of course, everyone has an opinion.

Some like red, some like blue, some like neither.

Last week's volatility in stocks, bonds, currencies and commodities is a clear signal that markets are uneasy. They hate uncertainty.

If the election's outcome is less than clear, then volatility will be around for a while, and probably even intensify.

A lot of the forecasting is about what will happen to gold. One thing I know for sure is, no matter who takes election victory, gold will come out of it the biggest winner.

In the meantime, we're likely to hear a lot of noise.

I suggest you ignore most of it, and focus on the prize: soaring gold prices.

Near-Term Gold Pressure

Gold is already up 25% year-to-date. But that doesn't mean there's no gas left in its tank.

Here are the main drivers influencing the gold price.

I see two temporary headwinds for gold. The first is central banks.

Bloomberg reported recently that "central banks became gold sellers for the first time since 2010, as some producing nations exploited near-record prices to soften the blow from the coronavirus pandemic."

The World Gold Council (WGC) said Q3 saw central banks (CBs) become net sellers of 12.1 tons versus last year's net buying of 141.9 tons. Russia was a standout, with its first net sales in 13 years as oil prices remain low. With gold prices high, some CBs are selling to raise cash.

Bloomberg also said year-over-year gold supply is down 3%. Meanwhile, CB purchases are forecast to bounce back next year.

A second headwind for gold could be volatility. It's possible we might see a strong market selloff if investors panic from an uncertain election outcome. I would expect that to be nothing more than temporary weakness.

Still, I see overall strong market winds at gold's back.

Support for Higher Gold

Legendary investor Stanley Druckenmiller told viewers of the Robin Hood Investors Conference, "We have borrowed so much that I'm skeptical that three to five years out that equities will give us any kind of return." He does however see inflation above 4% and gold prices higher.

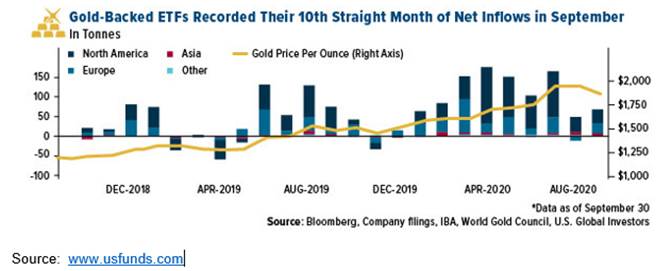

Meanwhile, the WGC says gold ETFs reached a record high 3,880 tonnes in Q3, acquiring another 272.5 tonnes.

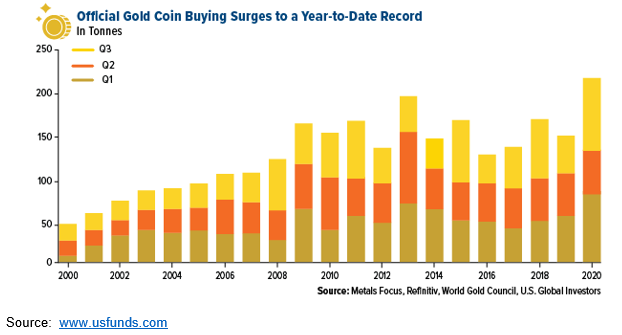

What's more, physical gold buying has just reached an all-time high.

The WGC highlights gold bar and coin buying jumped an astounding 49% year-over-year, reaching 222.1 tonnes through the end of Q3. Don't forget, this is with near-record sustained high gold prices…globally.

Much of this is being propelled by low rates and government spending.

Trump has proposed a $1 trillion infrastructure plan, while presidential candidate Biden is proposing a $2 trillion green energy and infrastructure plan should he win.

That doesn't even account for Covid-19 stimulus spending: a global phenomenon.

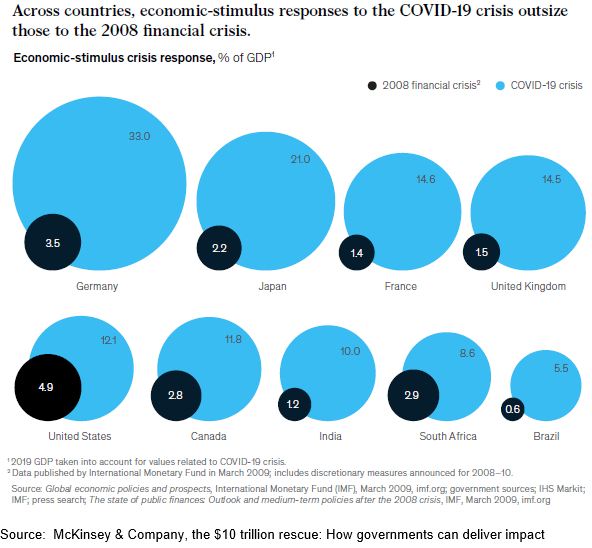

In June, McKinsey & Company stated, "Governments' economic responses to the crisis is unprecedented, too: $10 trillion announced just in the first two months, which is three times more than the response to the 2008–09 financial crisis.

It's not a stretch to conclude that spending, deficits and debt are heading in one direction: higher.

Which is why it's easy to see why gold is set to follow.

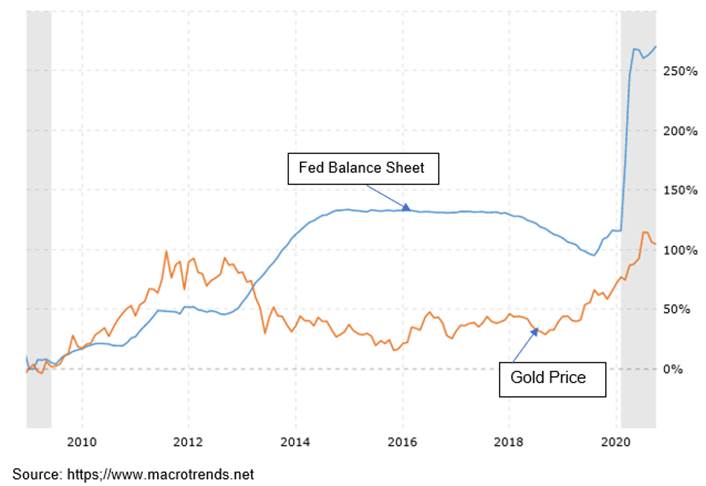

Here's a look at the monthly percentage growth of the Fed's balance sheet versus the gold price (gold in orange, Fed balance sheet in blue).

While this chart is pretty much self-explanatory, I will say that gold has a lot of catching up to do.

I'm cautiously optimistic in the near term. But if markets sell off hard, investors will look to raise cash. Be ready for gold and gold stocks to follow, at least initially, as investors sell to meet margin calls. I'd expect a quick recovery though, as wise money steps in on the opportunity to buy the dip.

My bottom line is this:

A whole lot of promises have been made by both sides in this election. In order to get our votes, politicians try to bribe us with our own money.

In the end, you need to ask yourself who really has your greatest interest at heart?

I'm most willing to bet on the promise of gold.

And I think we'll see a new record high before the year is out.

--Peter Krauth

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in energy, metals and mining stocks. He has been editor of a widely circulated resource newsletter, and contributed numerous articles to Kitco.com, BNN Bloomberg and the Financial Post. Krauth holds a Master of Business Administration from McGill University and is headquartered in resource-rich Canada.

Disclosure: 1) Peter Krauth: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.