Americans Are Buying Homes Sight Unseen: Here’s Why

Housing-Market / US Housing Nov 09, 2020 - 01:06 PM GMTBy: Stephen_McBride

Lester Knispel bought the $1.5 million white-columned house on the second fairway. His Porsche is now parked in the garage. And family pictures hang in the living room.

But Lester and his wife have never set foot inside their new country club home! They live in California, and didn’t want to visit Florida during the lockdowns.

So instead they toured the five-bedroom mansion virtually, bought it, and then shipped the car and furniture soon after. “I never thought I’d buy something like this, sight unseen” Knispel told the Wall Street Journal.

In 2013, One Silicon Valley Startup Had a Weird Idea

What if you could buy or sell your home on a smartphone app? Opendoor is an internet “realtor” that will buy your house sight unseen. No open houses, negotiation, or waiting months for a buyer to come up with the money. Type your address into Opendoor’s website, submit a few photos, and it will make you a cash offer in a couple of days.

The idea of buying or selling a house online is “weird.” Sell your house to an internet realtor? Are you out of your mind? But thousands of Americans love Opendoor. It bought and sold 20,000 homes online last year alone.

And internet realtors are making real inroads in big US cities. Last year, these disruptors snapped up more than 5% of houses in Atlanta, Phoenix, and Las Vegas.

“iBuying” Is the Mother of All Disruptions

Real estate is one of America’s biggest, most lucrative markets. Roughly five million homes were sold last year, totaling $1.6 trillion in value. But did you know less than 1% of transactions happen online?

Buying and selling homes is America’s largest undisrupted market. Today, you can do just about anything on your smartphone. But as I wrote last year, middlemen still dominate the real estate market.

If you’ve ever bought or sold a house, you know realtors take a fat slice for themselves. If the same agent is working for both sides on a $500,000 deal, you have to cut them a $30,000 check!

Then you have mortgage brokers, title insurers, surveyors, and lawyers to pay too! And getting slammed with fees is the “easy” part. You have to negotiate offers and tend to repairs. You have to host open houses with strangers traipsing through your home. And if things don’t go smoothly, prepare for shouting matches with incompetent realtors.

Selling a home is the largest transaction in most folks’ lives. It’s also the most painful, making it ripe for disruption. An Opendoor survey found one in four Americans would rather get a root canal than go through the process of selling their home!

What if You Could Make Home Buying Stress-Free?

How much do you think that service would be worth? This is what Opendoor has invented with iBuying. And it’s one of the greatest disruptions I’ve ever seen. And I’m convinced it will transform the $1.6 trillion/year real estate market.

As I mentioned, the disruptor basically allows you to buy and sell a house with a few clicks of your smartphone. It handles all the renovations. It lets you pick a closing date. So you don’t have to shack up in your mother-in-law’s house for a month while you wait on your new home.

And Opendoor will wire the cash into your bank account in as little as three days. Compare that to the traditional route, which averages two months from listing to closing. Take Miriam Glover, for example. The writer recently sold her Dallas-Fort Worth home to Opendoor.

Getting her house ready to sell and dealing with strangers walking through her property gave her pause. And she didn’t want the hassle of getting it in “list ready” condition. So she contacted Opendoor. They asked her to send along photos and videos of the house. She sold her home just three hours after the assessment was completed! It’s no surprise a homeowner requests an Opendoor offer every 60 seconds.

Remember, $1.6 Trillion Worth of Homes Change Hands Each Year

Americans bought and sold five million homes last year. Yet iBuyers like Opendoor accounted for less than 1% of deals. Opendoor’s process is clearly better than the traditional route. I first wrote about the disruptor of real estate last year, and judging by the replies I got, readers are already fed up with realtors…

RiskHedge reader Tim told me: “The last five property deals have been realtor-less on my side. I offered to have them help me for a small cut and they refused. So they are cutting their own throats.” And Terry said: “You ask if I would ever use a real estate agent to sell my home and my answer is NO! We sold three houses and not one was sold with the help of a realtor.”

I’m convinced millions of Americans will soon ditch the old home-selling process. Opendoor will do to real estate what Uber did to taxis. My research suggests iBuying could grab at least 20% of US housing over the coming decade. That’s a 40X surge from today’s levels. So iBuyers have years of rapid growth ahead.

Even traditional real estate firms are latching onto this disruption. Realtor.com recently signed a partnership with Opendoor. When homeowners visit its new "seller marketplace," they can request an offer from Opendoor instead of listing on the open market.

Here Are Three Ways You Can Profit From This Disruption

Opendoor pioneered iBuying. And until recently, regular folks couldn’t buy shares in the private company. But Opendoor (IPOB) recently went public through a “reverse merger.” The disruptor is valued at just $4.8 billion today. This will be one of those stocks we look back at in 10 years and think: “I can’t believe I missed buying Opendoor at those prices.”

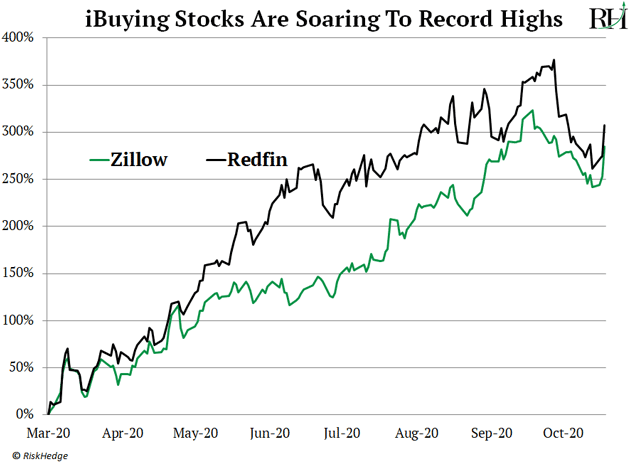

Longtime RiskHedge readers know Zillow (Z) and Redfin (RDFN) jumped into the iBuying business last year. And both stocks have handed investors 280%+ gains since March:

In short, we’ve only scratched the surface of this disruption. These iBuying stocks will transform how we buy and sell homes over the next decade. My analysis suggests all three will head much higher in the coming years.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2020 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.