Apple M1 SOC Chip Another Nail in Intel's Coffin - Top AI Tech Stocks

Companies / Apple Dec 28, 2020 - 11:50 AM GMTBy: Nadeem_Walayat

This is a continuation of my in-depth analysis into the buying levels for the Top 10 AI stocks to ride the electron mega-trend the whole of which was first made available to Patrons who support my work so immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month.

- US Presidential Election 2020 Forecast Review

- Seeing Stock Market New Highs Through the Prism of AI

- Stock Market Dow Quick Take

- AI Stocks Buying Levels and EC ratio Explained

- Top 10 AI Stocks individual analysis i.e. for Google, Amazon, Apple etc.

- AI Stocks Buying Levels Q4 2020

- The Next IMMINENT Global Catastrophe After Coronavirus

4. Apple $117

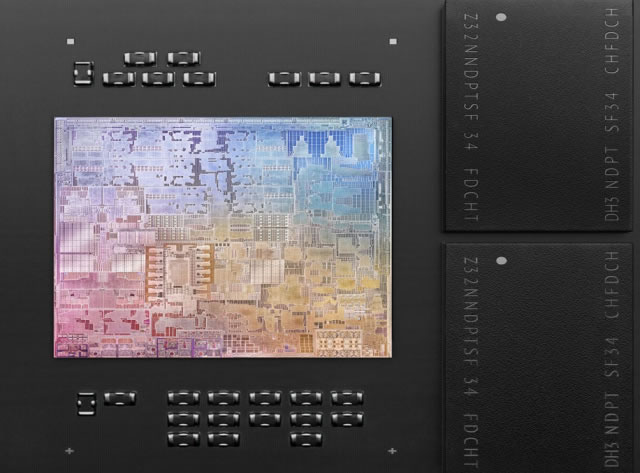

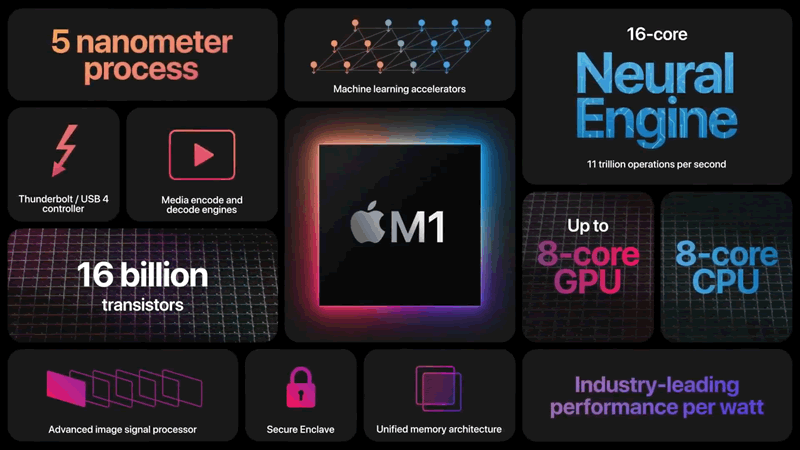

Apples EC has rocketed higher to 76 up from 55. which on face value makes Apple an expensive stock to buy right now. However, when one actually looks under the hood at what's going on at Apple then one finds the reason why Apple has been bid up to such lofty levels, where it's current price even after the recent correction is more than double where the stock was trading during March. The answer lies in Apple's 2 year transition away from using former best buddy Intel's CPUs which has started off with a BANG following the launch of the the M1 Mac Book laptops just a few days ago. what's the M1? It's Apple ditching intel for it's ALL in one chip that includes a 8 core CPU, 8 core GPU, 16 core neural engine and memory all on one SOC die that is basically a souped up version of the A14 chips found in Pads and iphones.

What does this mean? Well it means that Apple has actually innovated for a change rather than bamboozling it's followers with marketing hype, though there's still plenty of marketing hype coming out of Apple. Nevertheless the M1 results in a huge performance increase due to reduction in latency between components such as the CPU, GPU and Memory as these are now all burnt onto the same 5 nanometre M1 chip. In terms of benchmarks Apples M1 mac book performance depending on what test one runs ranges from a boost of between 30% to 100% over the preceding intel based Mac Books whilst at the same time delivering a whopping 50% increase in battery life! So contrary to much pre launch skepticism out there that the first generation of M1 Mac books would fail to deliver due to being Apple silicon's first generation devices, which instead were expected to lay the ground work for the real innovations in later generations of Apple processors, instead Apple HAS delivered and further driven a nail in Intel's coffin, as Apple Mac computers to be launched during 2021 will be based on the same M1 technology and are thus likely to deliver similar performance increases over the use of separate components i.e. Intel CPU, Nvidia / AMD GPU's and memory which are now all on one APPLE M1 chip.

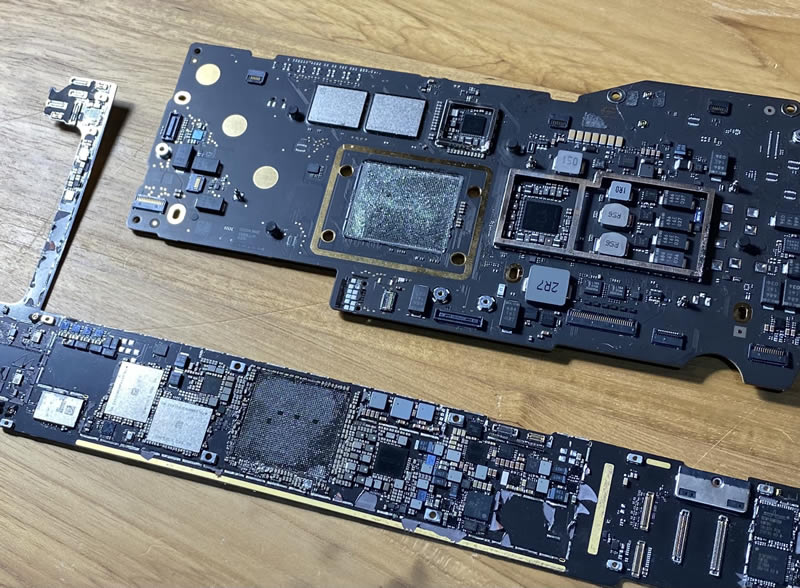

Furthermore there is huge reduction in costs of manufacture as illustrated when one dissembles a M1 Mac book pro that bolls down to 2 small PCBs, though on the downside Apple has completed erased the ability of Users to upgrade anything on their systems, as there are NO expansion ports! So choose your specs wisely as you cannot add to anything later!

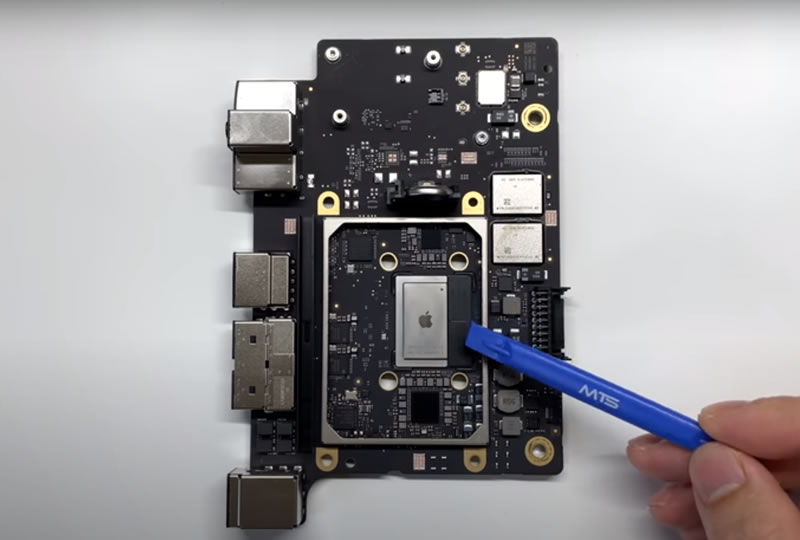

And here's what's inside an M1 Mac mini computer that costs $700.

Even more sparsely populated with again absolutely nothing that's remotely upgradeable, effectively a ipad in a small computer case.

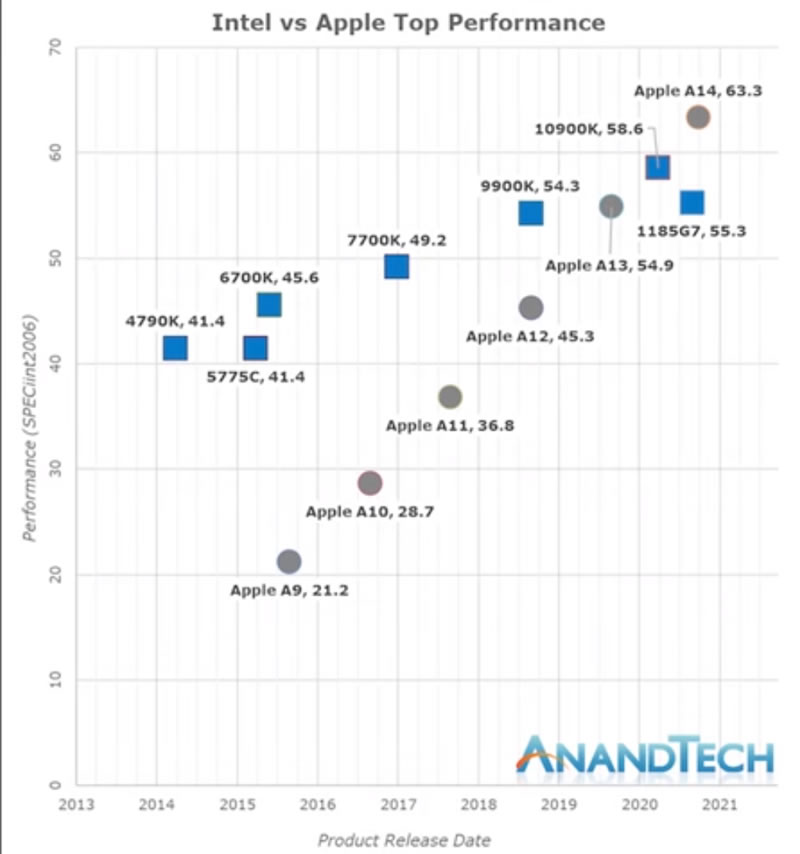

How did Apple achieve this apparent performance miracle? well the trend was is in motion for over a decade where it all boils down to the failure of Intel to innovate which has allowed others such as Apple to both catch up and now PASS Intel in terms of processing power of mobile chips compared to Intel's CPUs as the following graph illustrates. Though in reality it would be better to label the graph Intel vs Apple (ARM).

Take another look at the above graph, from 2015 to 2020 Intel processors have improved by about 40% in performance, whilst Apple processors have improved by 200% in performance. However, even that does not tell the whole picture for instance the 10900k out of the box consumes 125 watts of power, whilst the better performing Apple A14 consumes just 5 watts of power hence Intel requires being plugged into a mains socket with a lot of cooling to dissipate the heat given off whilst the Apple works in small mobile devices working off batteries all without any active cooling.

So basically Apple M1 Mac Books are now effectively large smartphone's comprising as few as possible discrete components so as to maximise efficiency and cost of production, technology that they are set to bring to their desktop Mac Pro computers during 2021 and 2022, which means to expect much more powerful Mac computers compared to what we have grown accustomed to, all whilst consuming much less power so will run quieter than Intel Macs. Though with little ability for users to upgrade so the Mac echo system won't be killing off the Windows Desktop PC's anytime soon given the flexibility that they continue to offer, that and AMD's innovations have prevented that market from dieing along with Intel. That and not wanting to be locked into the highly restricted Apple echo system that up until the release of M1 systems did not represent good value for money in terms of performance vs cost. Also that the M1 Mac books now effectively only match similarly priced Intel laptops such as the Dell XPS in terms of performance per cost which just illustrates how bad a value for money Apple hardware tends to be, despite which a large segment of the public continued to buy into Apples marketing hype, happy to get ripped off, basically paying DOUBLE for the same performance as over a Windows system, hence Apples huge profit margins and why the market is valuing Apple stock so highly.

And another reason to avoid Apple tech was brought home to iphone users during 2017 when they discovered that Apple was deliberately slowing down old phones so users would be more eager to upgrade to the newer models! In fact if I were going to use Mac O/S I would use a x86 hackintosh system. What's an hackintosh? It's basically a Windows PC that dual boots a hacked version of Mac O/S. So you get a MAC without paying more than double what a similar performing MAC would cost.

But now Apple with its M1 processor has pulled one out of the hat, and we can only eagerly await what M1x is likely to deliver to the desktop arena during 2021, for instance I can imagine Mac desktops comprising several M1x chiplets much as AMD processors comprise 8 core chiplets. It could be as simple as taking 2 M1 processors and linking them up to result in a 16 core machine, which is basically what AMD has done with it's Ryzen, Threadripper and Epyc processors. And why stop at 16 core?, 24 core, 32 core even 64 core processing monsters could just be around the corner that Apple could charge inflated prices for, which I am sure is what Apple are working on right now. For it has already been done by AMD just not in terms of the whole package of processor, gpu and memory all on one die. In comparison the most powerful desktop Mac Pro today comprises the 28 core Intel Xeon that starts at £5,500 for the 8 core machine! Opt for the 28 core Xeon and the price jumps to £12,500! Which in my opinion is total a rip off. For instance I could configure a more powerful 32 core Threadripper build for less than half the cost of a £12,500 Mac Pro. In fact the build would come in at about £5000 or at 40% of that which Apple charges for it's Mac Pro's which is why I have never owned anything with an Apple sticker on it.

Anyway that's the past the future is Apple silicon M1 and beyond 64 core Macs are definitely coming if not in 2021 then in 2022 which I am sure Apple will sell at inflated prices as Apple customers appear content to continue to get ripped off which is good for Apple stock holders.

And even worse for Intel is that NONE of this was necessary for Intel HAD the opportunity way back in 2006 to develop and supply the processors for Apple's then new smartphone's, the Iphone but turned Apple down due to forecasts of lack of volume to justify the investment and thus sowed the seeds for today's total departure from Intel due to Apple porting over their Apple / ARM / Samsung smartphone technology to laptops and during 2021 to Mac desktops, the decision for which was likely taken on launch of Intel's sky lake processors in 2015 that were just bad, full of bugs, prompting Apple engineers to conclude that they could do a better job than this crap and the rest is history, as Intel's failure to innovate has continued since resulting in Apple silicon now passing Intel processors, all whilst consuming far LESS energy due to being smartphone technology being ported over to laptops and soon desktops.

So Apple is definitely not a stock to listen to any doom merchants out there as it benefits from it's AI division delivering huge leaps in performance on developing it's M1 processor that incorporates neural engines right into every laptop and desktop that help boosts performance in machine learning tasks. Meanwhile Intel continues do die its slow death not only at the hands of AMD but now also at the hands of Apple due to FAILURE TO INNOVATE! And it is even possible that the M1 chip could mark the beginning of the demise of the x86 processors which means that AMD in the not to distant future could also be fighting for survival if Apple continues on it's current trend trajectory, something to definitely keep an eye and a reason why Apple stock is primary.

Anyway if you are thinking of buying a desktop Mac Pro then DON'T! Because the next generation will be vastly more powerful than what's being sold today with processing power of upto 64 cores!

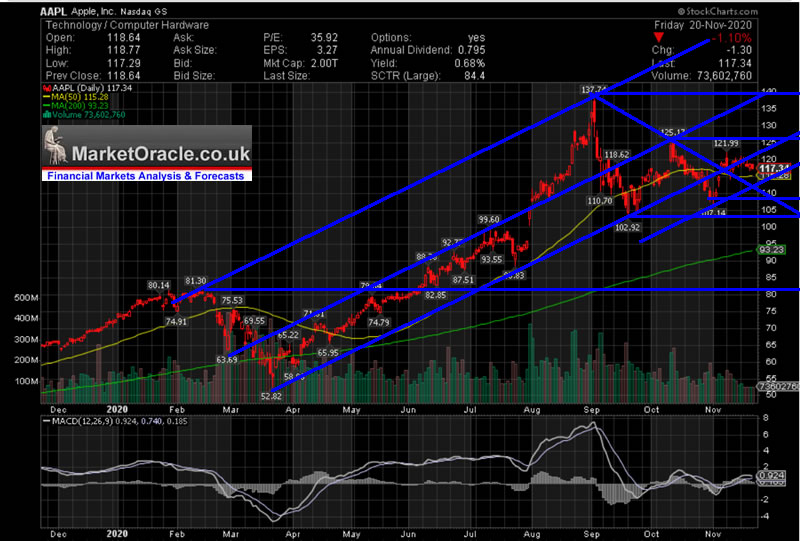

Don't be surprised that the Apple stock price has not reacted higher to the launch of the M1 Mac books, as the stock had already been bid up to a very high EC valuation of 75. In terms of the chart then we are seeing the near exact same pattern as for Microsoft and Amazon i.e. a holding pattern as the market digests the recent bull run waiting on corporate earnings to reduce valuations before the next leg higher.

.

.

The reaction from the $137 high is corrective, unwinding a heavily overbought state that looks like has just about run it's course, so just like Amazon and Microsoft the downside looks limited, perhaps eyeing no more than a move to $110, and 106 at best. Therefore the buying level for Apple is $110 before the next bull run begins though at a more measured pace then earlier this year.

Top AI Tech Stocks Buying Levels and Valuations Analysis

The rest of this analysis has first been made available to Patrons who support my work so immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

AI Stocks Portfolio Buying Levels Q4 2020 Analysis

- US Presidential Election 2020 Forecast Review

- Seeing Stock Market New Highs Through the Prism of AI

- Stock Market Dow Quick Take

- AI Stocks Buying Levels and EC ratio Explained

- Top 10 AI Stocks individual analysis i.e. for Google, Amazon, Apple etc.

- AI Stocks Buying Levels Q4 2020

- The Next IMMINENT Global Catastrophe After Coronavirus

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.