Google, Amazon, Apple... AI Stocks Buying Levels

Companies / AI Dec 31, 2020 - 04:11 PM GMTBy: Nadeem_Walayat

This is a continuation of my in-depth analysis into the buying levels for the Top 10 AI stocks to ride the electron mega-trend the whole of which was first made available to Patrons who support my work so immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month.

- US Presidential Election 2020 Forecast Review

- Seeing Stock Market New Highs Through the Prism of AI

- Stock Market Dow Quick Take

- AI Stocks Buying Levels and EC ratio Explained

- Top 10 AI Stocks individual analysis i.e. for Google, Amazon, Apple etc.

- AI Stocks Buying Levels Q4 2020

- The Next IMMINENT Global Catastrophe After Coronavirus

AI Stocks Buying Levels Q4 2020

The bottom line is that unlike what some clearly inexperienced prominent tech commentators out there are stating this is NOT A Tech BUBBLE! Stocks are trading higher due to real revenue growth, earnings and innovation that the market is discounting. The developments that are taking place in the tech world are REAL and thus the current valuations are sustainable for most of the tech giants on my AI list as we firmly remain on on upwards trend trajectory cutesy of the exponential AI mega-trend.

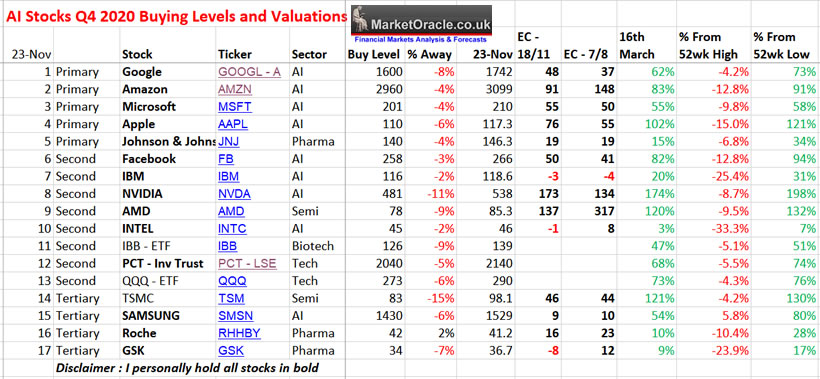

And here are the updated buying levels and EC valuations for all of the stocks on my AI stocks list.

So what am I doing during Q4?

IBM is dirt cheap, I cannot resist buying more, I am sure several years from now many people will be kicking themselves for not picking up IBM when it was trading so cheaply. Next would be to try and add some more Google and Facebook given it's continuing VR market success. And maybe pick up some Amazon if it trades below $3000.

Whilst I already have decent exposure to Apple, I would be eager to buy more on any serious sell off that takes Apple down to say $104, a low probability event at this time but something to keep an eye out for in case it happens as Apple is definitely onto a winner with it's M1 all in one RISC processors that could be the disruptive technology that even comes to dominate the Windows PC market in a few years time given the pace of innovation.

I will probably also pick up some more AMD given the moderation in its valuation.

Whilst TSM continues to present relative value on an EC 46 despite a huge run up in it's stock price, so any correction to around $87 would perk my interest to finally add some of stock in this emerging tech giant.

The whole of this analysis was first been made available to Patrons who support my work so immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

AI Stocks Portfolio Buying Levels Q4 2020 Analysis

- US Presidential Election 2020 Forecast Review

- Seeing Stock Market New Highs Through the Prism of AI

- Stock Market Dow Quick Take

- AI Stocks Buying Levels and EC ratio Explained

- Top 10 AI Stocks individual analysis i.e. for Google, Amazon, Apple etc.

- AI Stocks Buying Levels Q4 2020

- The Next IMMINENT Global Catastrophe After Coronavirus

My current analysis is focused on the prospects for the US and UK housing markets during 2021, soon to be followed by a stock market trend forecast for 2021.

In respect of which how did my forecast for 2020 fair?

31st Dec 2019 - Stock Market Trend Forecast Outlook for 2020

Dow Stock Market 2020 Outlook Forecast Conclusion

Therefore my forecast conclusion is for the Dow to target a trend to between 30,750 and 31,000 by the end of 2020. For a likely gain of 8% to 9% for the year (on the last close of 28,642).

My series of 2020 stock market analysis will seek to map out multi-month detailed trend forecasts as was the case for 2019. With the first to be completed during January, going into which my expectations are for a correction early 2020. Which given my bullish outlook implies should prove to be a buying opportunity.

Here is how the Dow trended during 2020 and where it ended the year.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.