Consumer Prices Are Not Reflecting Higher Inflation; Neither Is The CRB

Economics / Inflation Jan 05, 2021 - 02:09 PM GMTBy: Kelsey_Williams

As of November 30th, the annual inflation rate for the year 2020 is 1.17% (CPI). And it is not likely to get a whole lot worse anytime soon.

When the Federal Reserve responded to the financial crisis of 2007-08 with hugely unprecedented monetary expansion efforts, many thought that it would lead to runaway inflation and collapse of the U.S. dollar. It didn’t; and the expected higher inflation rates did not occur.

What did happen is that consumer prices remained reasonably stable and we even saw lower prices in 2009 and 2015.

Noteworthy is the fact that the CPI rate of increase has trended lower ever since the summer of 2008. In other words, since the Fed began large scale bond purchases in 2008 and engineered lower interest rates, the expectations for much higher rates of inflation have gone unfulfilled.

That seems to be the case now, as well. Even in light of huge money creation by the Fed during 2020, consumer prices are not signaling inflation to any worrisome degree, if at all.

Inflation rates have actually been trending down for more than forty years. The last double-digit rates of increase for the CPI occurred in 1979, 1980, and 1981. Also, the average annual rate of inflation has declined in every decade since the 1970s.

COMMODITY PRICES DOWN FOR 2020

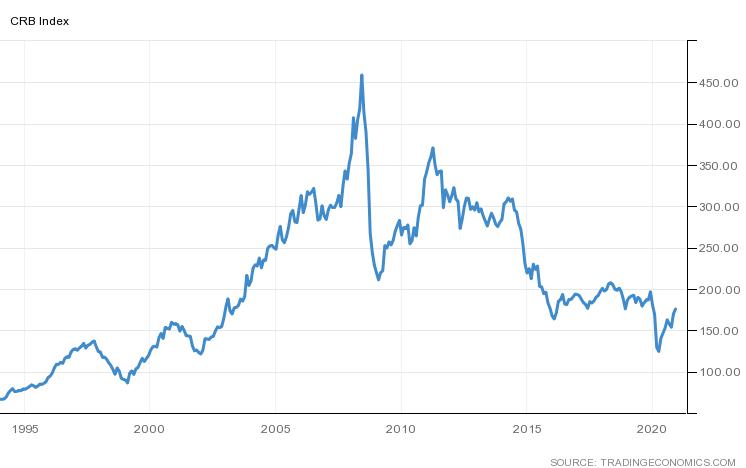

Commodity prices are a barometer for higher rates of inflation. Below is a chart of the Commodity Research Bureau Index (CRB) reflecting price action for the past twenty-five years…

After peaking in 2008, the CRB has trended down in a series of lower highs and lower lows.

Some facts for consideration:

- At its low point earlier this year in April, the CRB was down seventy-five percent from its peak in 2008.

- Even though commodity prices have increased significantly since April, the CRB is still down thirteen percent for 2020.

In general, higher prices are a reflection of the loss in purchasing power of the US dollar. The loss in purchasing power of the US dollar and the higher prices are the effects of inflation.

At this point in time, both the CPI (consumer prices) and the CRB (commodity prices) indicate that the effects of inflation are not meeting expectations. No wonder the Fed is concerned. The money drug is losing its potency.

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2021 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.