Bitcoin Price Collapses almost 20% at the start 2021

Currencies / Bitcoin Jan 07, 2021 - 03:32 PM GMTBy: Chris_Vermeulen

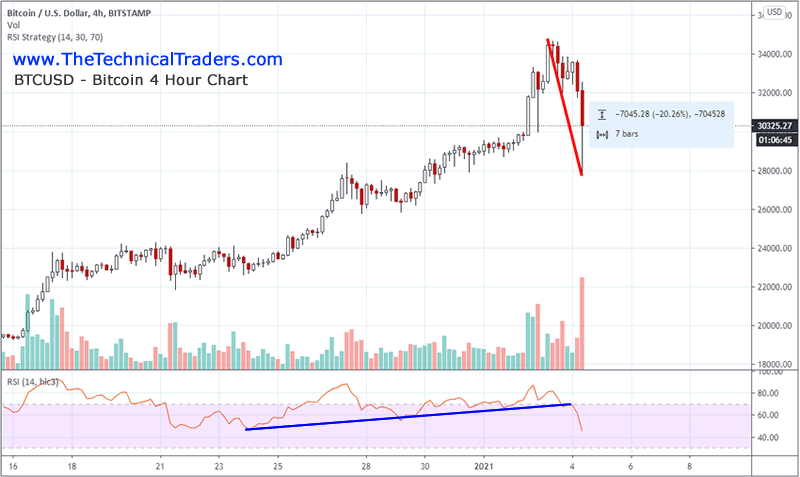

After an incredible upside price rally that took place throughout the end of 2020, the recent 20% decline in Bitcoin prices, seemingly overnight on January 4th, may have come as a shock to many Bitcoin traders. The deep low price was reached in early trading overnight on very heavy volume – reaching levels near $27,734. Compared to the high price level reached just 27 hours earlier, near $34,800, this strong price decline represents a 20% sell off (over -$7040).

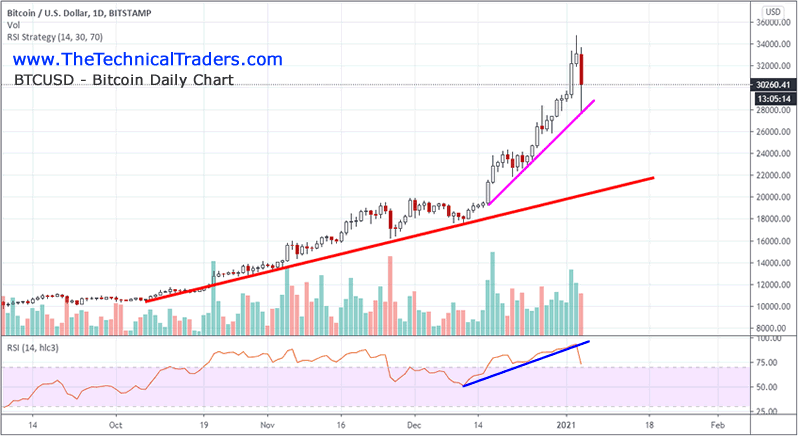

Bitcoin Daily Chart

If this is the start of a broader downtrend for Bitcoin, we’ll have to watch the MAGENTA trend level on this Daily Bitcoin chart below for an indication the upward support channel is breached. This may be a deep pullback in a stronger uptrend still. But the heavy volume and very deep decline suggest the upside parabolic price trend may have “popped” and Bitcoin may be setting up for a bigger change in trend in early 2021.

Overall, very clear support from the RED trend level on this chart would suggest that support near $21,000 may become the next target level. Traders can see the breakdown of the RSI indicator as well as the clear support channel represented by the MAGENTA trend level on this chart. We believe the MAGENTA trend level is a critical level if this upside price trend is going to continue.

Watching your Bitcoin investments collapse by -20% overnight must be a tough pill to swallow for many traders. What we find interesting about this move is that it appears to take place withing what we’ve been calling an “Excess Phase” peak. We’ve authored numerous articles over the past 60+ days suggesting the global markets have entered an “Excess Phase” (Blow-off top) type of formation related to our super-cycle and intermediate cycle research. Check out our recent research on How to Spot the End of an Excess Phase and Bitcoin – Is this the Peak?

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

If our researcher is correct, this deep downside rotation in Bitcoin will start an “Excess Phase” (Blow-off top) pattern – resulting in a steeper price decline lasting many months into the future. Eventually, price may settle back below $8500 before finding support again.

We will have to watch how this peak/rollover continues over the next few days and weeks. Excess Phase tops are fairly clear in terms of how they process. This first phase peak will settle into an upside Price Flag formation trend. When that Price Flag formation breaks, a bigger downtrend will push prices much lower – setting up a final support level, which will also be broken eventually.

If this downward trending continues in Bitcoin, this next price low will setup the Bullish Price Flag pattern of the Excess Phase. Pay attention to the setup and phases of these types of Excess Peaks. It is important that you learn to manage risks throughout these trends.

Do you want to stay ahead of these sector trends and learn which sectors are the best opportunities for your trades? Our BAN Trader trades the Best Asset Now using to consistently earn better-than-market returns. Learn how our BAN Trader solution can help you keep focused on the best trading opportunities in 2021 and beyond while helping you protect and grow your wealth. Go to www.TheTechnicalTraders.com to learn more about BAN Trader, or let me teach you how to trade this strategy yourself by watching my FREE webinar! Scroll below to register for your seat now and make 2021 your year to PROFIT!!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.