Will the Fed Support Gold Prices in 2021?

Commodities / Gold and Silver 2021 Jan 08, 2021 - 01:43 PM GMTBy: Arkadiusz_Sieron

Gold ended 2020 at $1,891, partially thanks to monetary policy easing. In 2021, the Fed may not trigger a comparable rally in gold, but it should offer gold prices some support.

Gold ended 2020 at $1,891, partially thanks to monetary policy easing. In 2021, the Fed may not trigger a comparable rally in gold, but it should offer gold prices some support.

Welcome to 2021! I hope that it will be a wonderful year for all of you; a much healthier, calmer and normal year than 2020 was. And even more profitable of course! Indeed, at least gold bulls could be satisfied with the last year, in which the price of gold jumped from $1,523 to $1,891 ( London A.M. Fix )! It means that the yellow metal gained more than 24 percent, as the chart below shows.

I know that 24 percent does not look impressive compared to Bitcoin , which gained more than 260 percent in 2020, but it’s still a great achievement relative to other assets or gold in the past. Not to mention the fact that gold’s price level looks more sustainable, while the recent parabolic rises in cryptocurrencies suggest a price bubble .

One of the reasons behind gold’s rally was the easy monetary policy adopted by the Fed (and other central banks) in a response to the pandemic and related economic crisis . In a way, the Fed reintroduced the quantitative easing first implemented in the aftermath of the Great Recession . So, gold’s bullish move shouldn’t be surprising.

However, there are also some important differences in the monetary policy that followed the global financial crisis and the coronavirus epidemic . First, when Lehman Brothers went bankrupt, the Fed went big. But when COVID-19 infections spread widely through America, the Fed went not only big, but also fast!

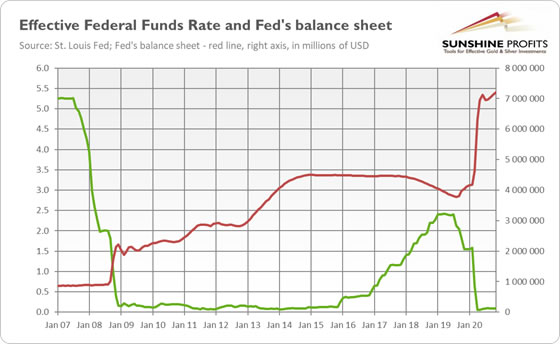

Just look at the chart below. As you can see, it took just about two months for the U.S. central bank to slash the federal funds rate to zero in the spring of 2020, while it took over a year during the Great Recession.

Moreover, from February to November, i.e., in just nine months, the Fed expanded its balance sheet by about $3 trillion, while a decade ago, such an increase took over six years!

Implications for Gold in 2021

What does the difference in the Fed’s stance imply for the price of gold in 2021? Well, on one hand, because the Fed acted aggressively, there is less room for further monetary policy easing . In the aftermath of the Great Recession, the Fed gradually fired from increasingly powerful weaponry, announcing new rounds of asset purchases from 2007 to 2013, while in a response to the coronavirus, the Fed has fired a bazooka at the outset. This decreases the odds for further monetary policy easing, pushing market expectations towards normalization. You see, when you are at the bottom, the only possible move is up.

This is my biggest worry for the gold market in 2021: that monetary policy has already become so dovish, that now it can be only hawkish – at least on a relative basis. The real interest rates are so low that – given the prospects of economic recovery on a horizon – they can only go up, especially if inflation does not increase.

On the other hand, inflation could really rise in 2021. Additionally, the fact that the Fed went both big and fast means that the U.S. central bank became more dovish than in the past , which should be positive for the yellow metal. Moreover, a decade ago the central banks at least pretended that they would like to tighten their stance and normalize monetary policy. They even said that quantitative easing would be reversed, and the Fed’s balance sheet would return to its pre-recession level.

Now, the illusions have dissipated. The central banks will buy assets for years to come, if not indefinitely, and there will be no taper tantrum . The eventual exit from the current easy monetary stance will be ultra-slow and gentle. The Fed has a clear dovish bias, so the interest rates may go down further – after all, given the debt trap , the central banks could be forced to cap the bond yields , which should support gold prices.

Therefore, in 2020, the Fed no longer only intervened on a large scale as it did a decade ago, but it also acted quickly. The change of strategy from go big to go big and fast can be positive for gold prices, but only when the market participants do not believe that the Fed is out of ammunition and only when they expect the normalization of interest rates. Although some investors expect an interest rate hike this year, I believe that the Fed will remain dovish and successfully manage market expectations in order to suppress market interest rates. So, although without the next crisis (such as a debt crisis ) or inflation, the price of gold may not rally substantively, it should be supported by the Fed in 2021 .

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.