Financial Market Forecasts 2021: Navigation in Uncharted Waters

Stock-Markets / Financial Markets 2021 Jan 10, 2021 - 06:26 PM GMTBy: The_Gold_Report

Sector expert Michael Ballanger lays out the foundation for his investment strategy in the new year, with uranium and copper augmenting his focus on the precious metals.

As I sat down in mid-December to formulate the draft outline for my 2021 Forecast Issue, I was immediately engulfed with a feeling of impending dread, not by way of dissatisfaction with the investments currently being held in my portfolio and trading accounts, but by being confronted with such a vast array of possible outcomes in the upcoming year 2021. Adding insult to injury, it is also the uncertainty of outcomes that places forecasts directly in the crosshairs of failure and embarrassment, resulting in fewer and less happy subscribers.

In contrast, during the same period one year ago, I knew that the single greatest issue facing us was managing the rapidly approaching debt monster, which allowed me to assume that markets would not look kindly upon the U.S. Fed chairman Jerome Powell and his sudden about-face in monetary policy. When the REPO fiasco began in Q3/2019, it was as plain as the nose on his face that Powell looked into the crystal ball and was horrified with what he saw. His vain (and lame) attempt to "normalize" the Fed balance sheet earlier that year had laid to bare a pitifully fragile debt structure teetering on the brink of implosion. He and his global central bank brethren sprang to action, flooding the world with wave after wave of counterfeit cash otherwise known as "liquidity."

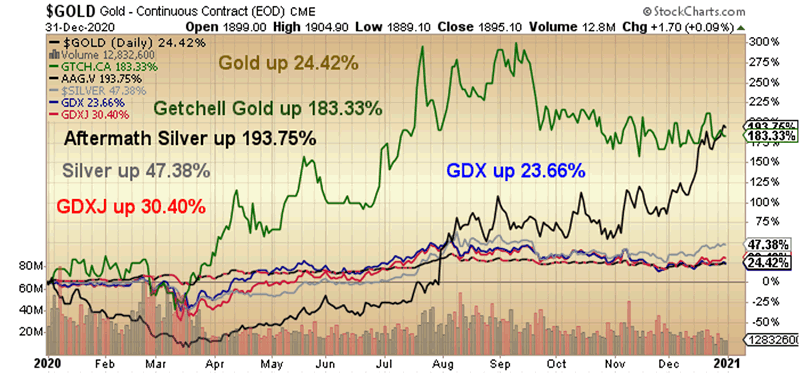

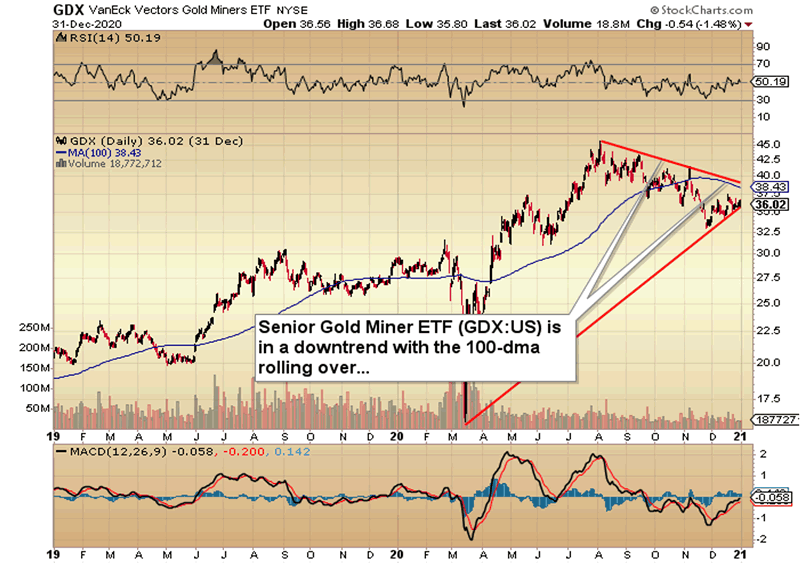

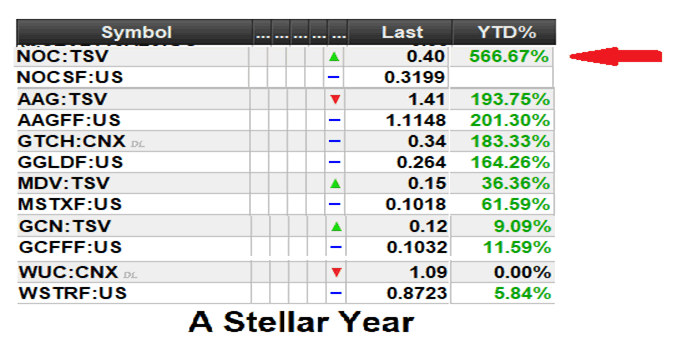

As a strategist, it was an easy call to construct a portfolio of gold and silver and their corporate offspring (gold and silver miners), with the result being a range of year-to-date returns swinging from GDX:US (Senior Gold Miner ETF) up 27.36% to Getchell Gold Corp. (GTCH:CSE) up 195.83% and Norseman Silver Ltd. (NOC:TSX.V) up 400% (as of Dec. 27, 2020).

However, sitting in my office overlooking the Kawartha swamp, I find myself without a chart, no GPS, and night clouds blocking the stars, rendering the vessel's sextant impotent. Between the pandemic and the absurdity of bumbling bureaucratic responses, the global currency system has been turned upside down by the simultaneous pressing of panic buttons in treasury department boardrooms, central bank think sessions and government policy politburos.

Alas, despite being bereft of navigational apparatus, there remains a certain consistency in the global economic "condition." Not only has the debt monster remained a factor, but it has also since grown into a leviathan of epic proportion and threat, and what makes it so lethal is that those who contributed to its obesity are the very ones telling us that it no longer matters. "Modern Monetary Theory" allows government employees to receive weekly paychecks while small business owners are shuttering not only their operations but, sadly and outrageously, their lives.

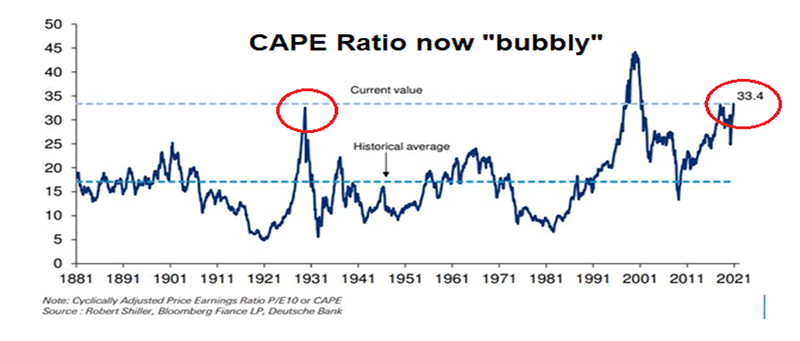

If the basis for investment strategy in 2020 was debt, then the explosion in its size and universal acceptance has now become my primary theme for 2021. With the cyclically adjusted price to earnings ratio (or CAPE, as it is known) now higher than the 1929 peak, it has become a matter of public policy to ensure that citizens are educated to the wonders of central bank charity.

In a manner not unlike the famous "Emperor's New Clothes" literary folktale, there can never be a young lad pointing to a naked monarch lest the entire financial system unravel. With interventions rampant across all asset classes regardless of borders or nationalities, the citizenry is now being schooled in the art of Ponzi-scheme management by way of daily doses of propagandist doctrine crafted by Wall Street for the benefit of Wall Street, to the detriment of retirees and savers the world over.

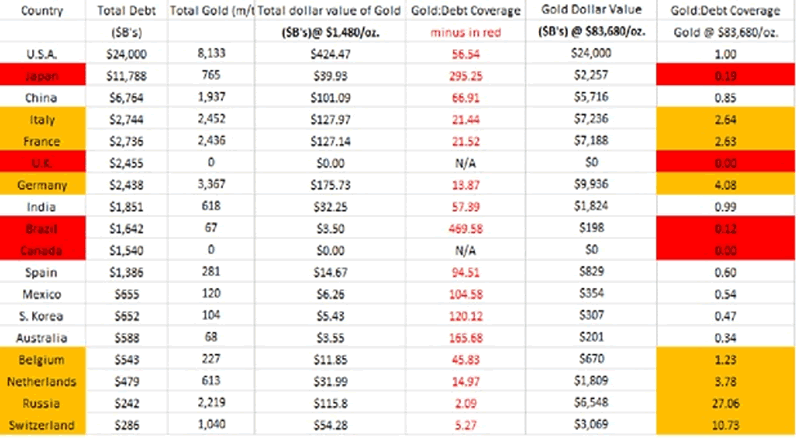

In the 2020 Forecast Issue, I posted this chart of the ratio of national debt to gold reserves among the top holders of central bank gold. While I would have loved to provide all of you with an updated version, I cannot, because there are no longer any reliable sources for the data available last year. For example, Canada, whose central bank sold all of its gold decades ago, has a debt level that has grown by an estimated ten times the US$1.5 trillion it sported in 2019.

The U.S. was pegged at US$25 trillion, but their revised number is estimated to be $35–45 trillion and that is before the release of the stimulus package in 2021. Europe and Asia are no better. To say that governments the world over are insolvent is an understatement, but the real question that remains to be answered is: Will it matter?

There are cases in history where serial debasers of domestic currencies assumed the practice of convincing their citizens that it "did not matter," and they would be Rome circa the invasion of the Barbarians, Weimar Germany 1921–1923, Zimbabwe 1980–2000, and Venezuela 2000–2020. Inflation rates in Venezuela approached 300,000% in 2019 and things are no better today.

These are historical events that occurred because the people in charge of the issuance of credit and currency sacrificed the integrity of their currencies' purchasing power in return for the adulation of the electorate. In other words, in every instance, they opted for votes over fiscal prudence. In the case of Canada and the U.S., where 10% of the citizens control 90% of the assets, reflating the asset bubble in 2020 with phony stimulus money has further impoverished the 90%, now without jobs and in lockdown, while further enriching the 10% whose stock portfolios and multiple properties continue to hit new highs.

Given the ferocity of debasement spurred on by the fear-mongering media, government officials are now scrambling to appease the 90% as visions of guillotines in public assemblages dance in their heads.

One of the interesting side effects of the pandemic is how it gave the police and the National Guard an excuse to descend upon public protests, like Black Lives Matter and antifa, and implement legalized disbursement trumping First Amendment rights in the name of "public safety." I wrote in 2020 that the surge in public protest actually had nothing to do with racial injustice or left versus right politics; it was solidly grounded in the astronomical rise in wealth inequality as wealth redistribution becomes "the nobler cause" rather than "theft," which is far more accurate.

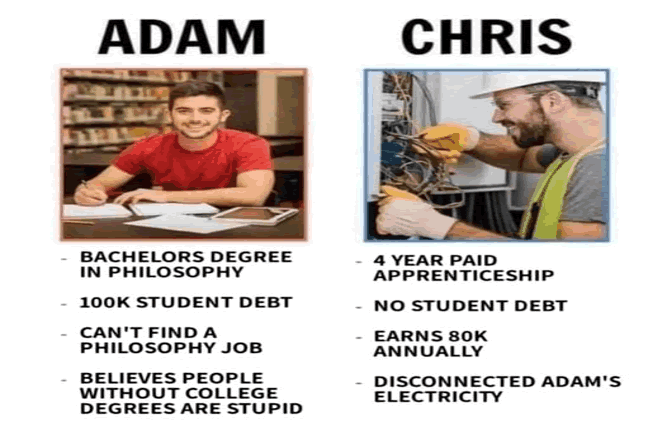

For me, this is one of the major themes for 2021: Having your wealth close by is far more soothing than having to log into a website owned and operated by a stranger to see how many digital coins I hold or how many shares of the latest Robinhood deal have traded. Call me old-fashioned or call me clueless, but there is something infinitely satisfying about opening the safe and counting silver and gold coins and bars while the Smith & Wesson stands next to the wine rack, ready, willing, and able to dissuade some unemployed philosophy graduate from "redistributing" my hard-earned wealth to his (or her) pocket.

The graphic shown above perfectly describes my thought process when it comes to how I view my fellow citizens of more recent birth and graduation dates. The problem with "entitlement thinking" is that one winds up totally unprepared for life's curveballs when they arrive. As for this new generation of day traders and Robinhooders and electric vehicle worshippers, they may be the new target market for the financial planning industry, but something is amiss.

I called my online discount broker yesterday over a problem with a DRS deposit and after being on hold for two hours (not an exaggeration), I finally got through to a "customer service representative." After being told that he could not help me, I asked him, "Why the two-hour wait?" to which he responded, "Market conditions are driving thousands of young people to open accounts with us."

The law of unintended consequences dominates whenever one tries to divert the flow of a river or a stream, because it only works until it overflows its banks and continues in the direction of least resistance, with gravity in full control. Similarly, trying to keep stock markets elevated in order to appease the masses only accentuates the magnitude of damage once the bubble bursts. Trying to suppress gold and silver prices in order to create optics that defy this massive currency debasement can only result in bad things happening, as in the period after the March Covid Crash, when gold rocketed to all-time highs against the U.S. currency. To learn that brokerage accounts are being opened in such volumes due to "market conditions" underscores the existence of the "bubble" that is so clearly illustrated by the CAPE ratio shown below.

Investing in 2021

As I move into the New Year, I will continue to favor companies that have gold and silver resources in place, thus creating optionality on the prices in both direction and amplitude. We watched in 2020 as projects that were deemed "marginal" at US$1,200 gold suddenly became Tier 1 assets at US$1,800 gold. Even greater impact will be felt in the silver developers due to the impeccable chart formation that now favors silver over gold.

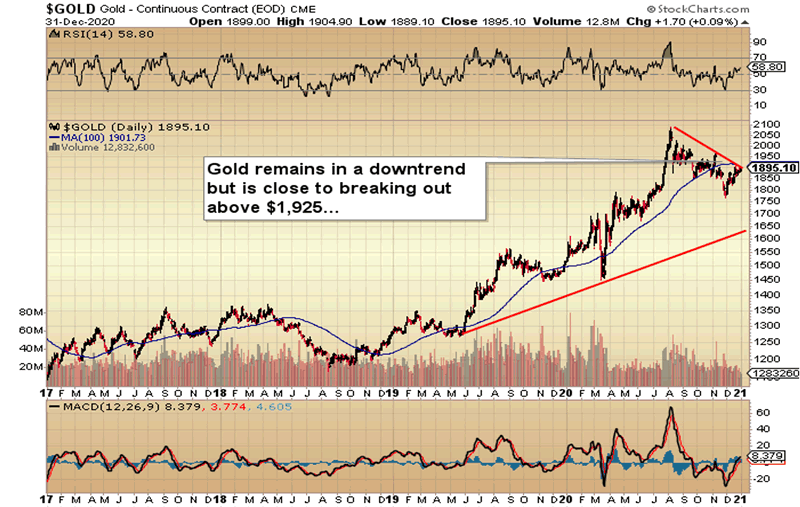

Gold: (US$1,895.10): Gold is in a long-term, multiyear bull market that began in December 2015 and should continue through 2023, albeit with multiple corrections along the way. At the forefront of your investment strategy is the conviction that there is going to be a U.S. dollar gold price reset, designed to bolster the collateral value of the 8,134 metric tonnes believed to exist in the U.S. treasury.

All of the chart formations on the planet will be meaningless if we get another "Gold Reserve Act" like the one passed on Jan. 30, 1934, whereby Franklin Roosevelt signed into law (after it was passed in Congress) a unilateral change in the dollar-denominated price of gold. The 69.33% increase took the price from US$20.67 to $35 where it remained until 1971, when Nixon ended the convertibility of dollars to gold, giving rise to the Great Bull Market of the 1970s and the crippling stagflation that plagued that period.

I have shown subscribers on numerous occasions how 8,134 metric tonnes could be used to collateralize the U.S. national debt, but at $1,886 per ounce, it has a dollar value of approximately $540 billion. As a percentage of the post-Covid national debt (estimated to be approaching $45 trillion in 2021), the value of the gold held by the U.S. is 1.21%, which does not qualify as adequate collateral for such a gargantuan debt structure.

However, if you increase the price of gold by 8.26 times, the value of the gold rises to 10% of $45 trillion, which then may qualify as "adequate collateral." Incidentally, that would infer a gold price of $15,578 per ounce. Just as no one can even imagine that happening, no one thought it possible in 1934 for the gold price to rise 69.33% with the stroke of an executive order pen.

Silver (US$26.03): Unlike gold, silver broke out of the four-month correction on Dec. 16 and now looks poised for a test of the 2020 highs around US$30/ounce. The silver stocks, particularly the juniors, are rapidly approaching their 2020 peaks, thus confirming the action in the March futures. 2021 could be the year that the gold-to-silver ratio (GSR) gets down to the May 2011 lows, around 42 from the current level of 72.

The superlative action in silver here in December was best explained by a colleague whose is my age but whose son is well-versed in the mindsets of the Millennials and the Gen-Xers. It seems that they view silver as a modern-day elixir, very pro-technology, very pro-environmental and basically "cooler" than gold. They are steadfast in their unshakeable belief that Bitcoin has seized the throne of "value-protector" from gold but, surprisingly, not silver. Bitcoin can never replace silver for its tech-friendly attributes, and the result is a tsunami of newer, younger investors clamouring to build portfolios stuffed with both Bitcoin and silver.

Now, make no mistake—purists like your author cannot even tiptoe into that cesspool of debate because, well, I am a dinosaur with Jurassic biases and Pleistocene thought processes. The grey hair in my beard would turn back to strawberry blond in a Mesozoic minute if I were forced to debunk the notion that gold's 5,000-year utility of immunity to currency destruction has today somehow ended.

However, as a shareholder of silver developers, it is incumbent upon me to put aside my biases and focus on the possible impact of millions of new, social-media-driven investors swarming down upon the global supply of silver and of the companies that explore for, develop and mine it. It embraces a new paradigm of strategic thinking and a timely unshackling of ideological bonds.

Uranium (US$29.90): The big surprise in the final stretches of 2020 was the explosion in the uranium stocks. With the price still unable to scale the US$30/lb. level, 90% of the uranium developers that trade on the North American exchanges cannot make a plug nickel of profit from their mining operations. However, like 2018, when the uranium cheerleaders were trotting out charts of new reactor construction and mine closures around the world, it turned out to be a stock play rather than a commodity or energy play, because by mid-2019, the prices of all of the major players had settled back down to earth once again, confirming that the rumors of uranium's untimely death were, in fact, true.

After a bear market that began in 2008, there has been a 95% reduction in the number of uranium names in twelve years, giving credence to the notion that maybe this time it truly is different. I remain intrigued and alert.

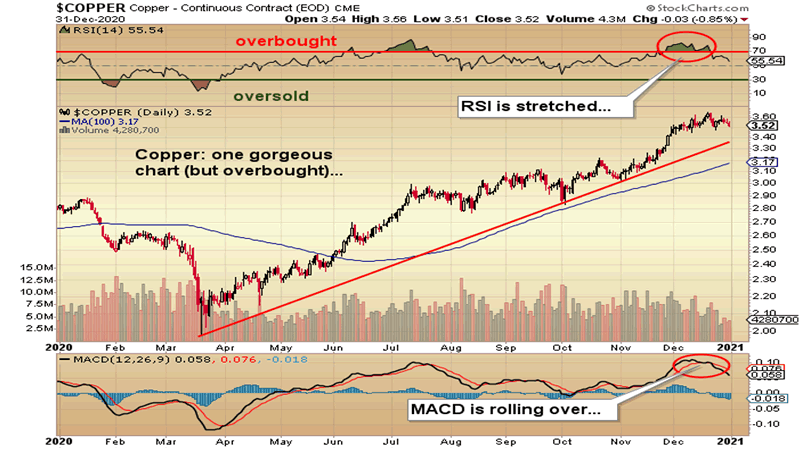

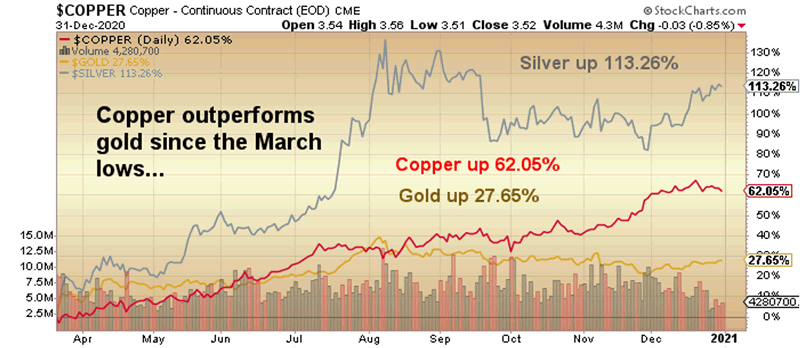

Copper (US$3.65/lb.): In past bull markets, copper has been anything but a "sexy metal;" it almost always finds its way into macroeconomic debates rather than the focus of staking rushes or area plays. However, copper has quietly moved in stealth-like fashion from the COVID Crash March lows under US$2.00/lb. to the best weekly close in years at US$3.64/lb., marking a 67.2% advance and soundly thrashing gold, whose 27.29% move pales by comparison.

While currently seriously overbought, the charts shown below reveal a vastly different narrative than the "subdued inflation" meme being trotted out by Jerome Powell and his central bank inflation collaborators. To be sure, the weak U.S. dollar is the culprit behind it, but if you listen to the copper bulls, electric vehicle production is adding significant demand-pull pressures on pricing, and as I mentioned earlier regarding this new wave of investors dominating the blogosphere and twitterverse, if they believe that copper is an eco-friendly commodity, they will gravitate toward it and any junior developers and explorers with a good story and social media presence.

I draw your attention to Dr. Copper (called so because it is said to be the one commodity with a PhD in economics) because my two premier holdings (Getchell Gold Corp. and Norseman Silver) are both exploring properties that have significant potential for copper deposits. Now, before the precious metals devotees go running from the room, it should be remembered that in Rouyn, Quebec, the Horne Mine was a copper mining operation that had gold as a byproduct. Over its life, in addition to recovering 1.13 million tonnes of copper, the mine produced 260 tonnes (11.6 million ounces) of gold, making it one of the biggest gold producers in Canadian history.

Copper-gold porphyry deposits are not uncommon in Nevada nor British Columbia, and due to their scale, they are prized possessions. For this reason, it is important to keep a close watch over copper prices and the upcoming exploration programs for our two top juniors.

Senior Gold Miners ETF (GDX:US) (US$36.58): Due to the boring nature of this chart, I am standing aside but prefer Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) as a stand-alone play.

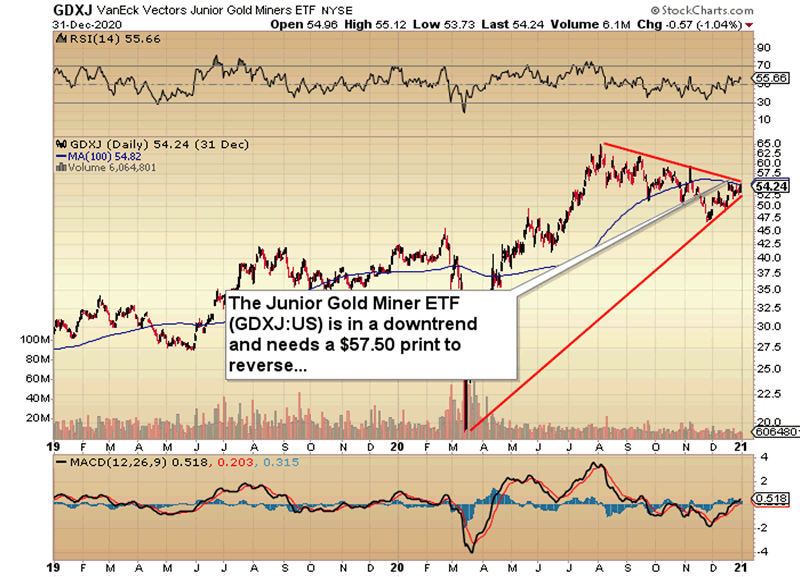

Junior Miner ETF (GDXJ:US) (US$54.42): The junior gold miners have just experienced a complete capitulation blow-off in November, which I identified as a bottom on Nov. 30 and initiated purchases of Barrick Gold and Eldorado Gold Corp. (ELD:TSX; EGO:NYSE). Although the GDXJ has a better set-up than GDX, November's wretched performance was classically the newbie late-comers to the precious metals party dumping positions that they bought in July-August purely on momentum, and whether or not they have been switching to crypto, it is going to take a while for them to place their charred fingers back in the space.

Around mid-July, I began to reduce exposure to the senior and intermediate gold miners, and since the GDXJ no longer owns the micro-cap developer/explorers, I determined that these "little guys" were going to be very safe harbors in the event of a precious metals hurricane in the second half of the year (which there was). After eliminating both GDX and GDXJ from the GGMA 2020 Portfolio, I moved to overweight positions in gold and silver micro-cap developer/ explorers, where I hid from November's gold and silver exchange-traded fund (ETF) bloodbath. I am able to head into 2021 with the two largest holdings closing out the year up 183% and 400% year-to-date (YTD) and which comprise over 62% of the portfolio. Comparing those returns to GDX (up 24.93% YTD) and GDXJ (up 28.77% YTD), the performance numbers certainly validated my move to the developer/explorer group and explain the 200%-plus return on investment (ROI) for the GGMA 2020 Portfolio.

Two recent additions to the portfolio were Barrick and Eldorado, both purchased on the exact day they bottomed (Nov. 30), which now represent laser-beam substitutes for the Senior and Junior Gold ETFs. I elected to avoid the risk of tax-loss selling and portfolio rebalancing, which would be more pronounced in the ETFs than in the two names I selected, but once December is over, the ETFs will undoubtedly rally.

Looking back to the year 2020, I had some good calls, and I had some not-so-good calls. Calling the arrival of the bear market in late February turned out to be spot-on, but for the wrong reason—I did not believe that the pandemic would throw the politicians into panic mode, which threw investors into panic mode, resulting in every central bank on the planet going into panic mode.

I called the bottom in gold and silver to the exact day (March 16) and in oil (April 22), but I missed the technology rally and I missed Bitcoin, two misses that I will continue to make as long as I am breathing. I should have avoided the volatility trade (UVXY:US) and the SPY short (SDS:US), but who would have thought back in July that the Dow Jones, the S&P 500, and the NASDAQ would see all-time highs with a U.S. and global economy in lockdown?

The upcoming year will be dominated by the impact of the vaccines upon the global population, but more importantly how these central planner politicians react. Despite an immune system that has worked pretty much without fail for several thousand years, past pandemics came and went without legislated lockdowns and economic madness.

However, the dominant theme in 2021 will continue to be debt, with the addition of another term for consideration—insolvency. Most markets around the world have been fanned and fueled by liquidity injections from both central banks (monetary) and government treasuries (fiscal), so markets have fully discounted a positive outcome for the vaccine and political responses. With stocks sporting valuations higher then 1929, I believe that they are priced for totalperfection, leaving them extremely vulnerable to disappointment.

The offset to that is the obsession carried by central banks toward stock prices; in the minds of the spigot-controllers, there can be no more corrections, and that is why shorting markets when the liquidity valves are set at "open" is a flawed strategy. You want to stay with the "short cash; long everything it can buy" strategy until there is rioting in the streets over food or gas prices. It is then, and only then, that monetary policy will turn hostile, and if the Fed is in the mood to tighten after twelve years of outrageously easy money, then you have to run for the hills, because cash will once again be king. For the near term though, the Fed has said they are not going to do anything hostile until 2023, and until the evidence proves otherwise, the status quo remains in place.

Specific to the performance of our junior developers and explorers will be execution. Management has to execute all of the steps required to add value, and if 2020 is any barometer for 2021 expectations, we should be in great shape.

Subscribers are now in possession of the GGM Advisory 2021 Forecast Issue, which includes another seventeen pages of commentary on the companies I own. If you wish to become a subscriber, direct message me on Twitter @MiningJunkie or email me at miningjunkie216@outlook.com.

Follow Michael Ballanger on Twitter ;@MiningJunkie.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Aftermath Silver Ltd., Great Bear Resources, Western Uranium, Stakeholder Gold, Getchell Gold. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. My firm no longer does consulting work for Stakeholder Gold.. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Great Bear Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium and Vanadium and Aftermath. Please click here for more information. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports (including members of their household) own securities of Getchell Gold, Western Uranium and Stakeholder Gold and Aftermath, companies mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.