Are Covid Lockdowns Bullish or Bearish for Stocks? FTSE 100 in Focus

Stock-Markets / Stock Market 2021 Jan 13, 2021 - 04:25 PM GMTBy: EWI

"The market has a law of its own. It is not propelled by the external causality..."

Elliott Wave International has long held -- and proven -- that events outside of the market do not determine the long-term trend of prices. In the short term, news and events can, and often do, contribute to market volatility -- although, not always, and not always "logically." But then the long-term trend resumes.

We've shown countless examples of that on these pages -- and here's one of the latest: the lockdowns related to covid. One might conclude that investors would view the business interruptions resulting from a lockdown as a sign that stock prices would decline. Hence, a selloff would occur with each lockdown announcement.

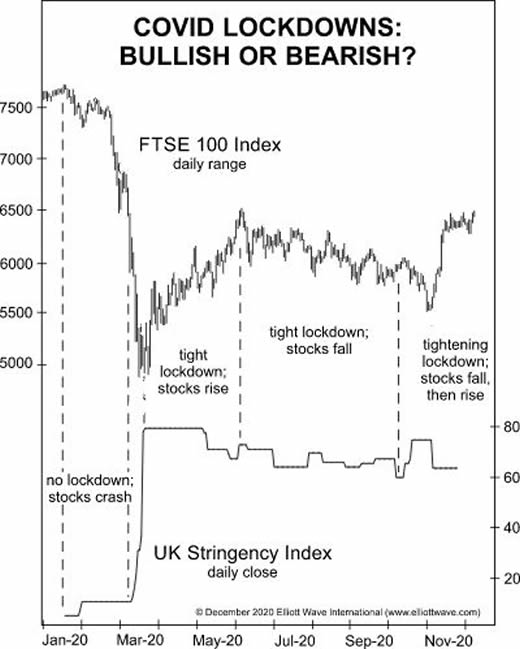

However, the evidence shows no correlation between the behavior of the market and lockdowns.

Here's a chart and commentary from the December Global Market Perspective, an Elliott Wave International monthly publication which covers 50-plus markets worldwide:

Notice the non-relationship between the FTSE 100 and the UK Stringency Index, which records the number and strictness of the British government's policies in fighting coronavirus. Stocks crashed from February to March of this year -- with almost no restrictions in place -- and then rallied from March through May during Britain's tightest lockdown to date. Shares gradually declined alongside the government's receding restrictions from June through early October. And as lockdowns tightened in early October, the FTSE 100 initially fell and then rallied. In other words, perfect foreknowledge of the largest, most extensive societal lockdown in modern history (and perhaps in all of human history) would have provided no useful information whatsoever for investors to use to trade stocks.

As Elliott Wave International has reiterated many times, financial markets often move ahead of the news. They are not driven by the news; the mainstream simply uses the news to rationalize what the markets have already done.

Yes, there are indeed trading days when stock markets rise when the news is "good." Yet, there are many times when the news is "good" and stocks fall, and vice versa.

As the Wall Street classic book, Elliott Wave Principle: Key to Market Behavior, by Frost & Prechter, says:

Sometimes the market appears to reflect outside conditions and events, but at other times it is entirely detached from what most people assume are causal conditions. The reason is that the market has a law of its own. It is not propelled by the external causality to which one becomes accustomed in the everyday experiences of life. The path of prices is not a product of news. ...

The market's progression unfolds in waves. Waves are patterns of directional movement.

Would you like to read the entire online version of the book for free?

You can do so if you're a Club EWI member. If you're not, signup is easy and free. Club EWI members enjoy unlimited and free access to a wealth of Elliott wave educational resources.

Sign up now and start tapping into the insights of Elliott Wave Principle: Key to Market Behavior -- 100% free.

Simply follow this link now: Elliott Wave Principle: Key to Market Behavior.

This article was syndicated by Elliott Wave International and was originally published under the headline Are Covid Lockdowns Bullish or Bearish for Stocks? FTSE 100 in Focus.. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.