Gold Price Big Picture Trend Forecast 2021

Commodities / Gold and Silver 2021 Jan 13, 2021 - 04:44 PM GMTBy: Ken_Ticehurst

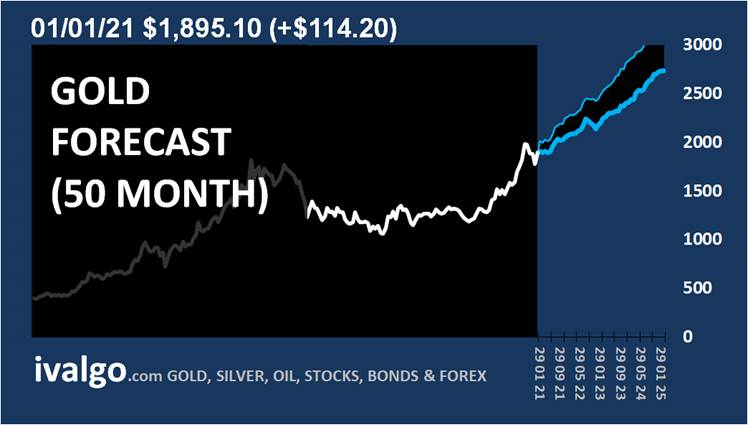

Below is our long term gold forecast, it continues to be bullish on a monthly basis, despite the turbulence of 2020 gold has performed well and a pause for a few months is entirely reasonable given the speed of its initial acceleration.

As you can see from our monthly chart, gold is clearly at significant levels - hovering around the 2011 highs, the underlying structure of the market is still very positive (big blue line) and the bull signal (small blue line) which turned positive in March 2018, still remains bullish. We think a monthly close above $2000 in the next few months would be a significant moment.

From the lows of late 2018 gold has quietly performed well relative to the S&P 500, we have included below our weekly and monthly GOLD/SPX ratio forecasts, you can see on a monthly basis that gold is cheap relative to the SPX and on a weekly basis we are approaching the long term floor. We will be looking for this ratio to begin to turn during 2021.

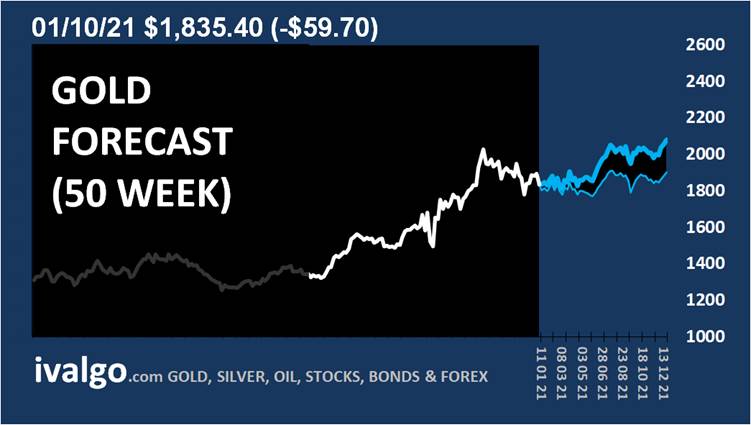

Gold sold off again this week indicating it wants to consolidate for a while longer, this shouldn’t worry longer term bulls, a few more weeks and months hovering around these levels or even a little lower whilst frustrating will be forgotten when the next bull leg is underway.

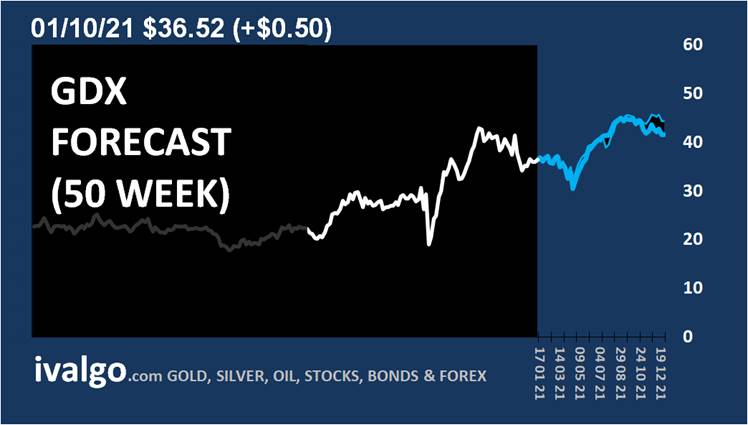

The miners surpisingly outperformed gold last week with GDX and GDXj both remaining neutral to mildly bullish.

GOLD continues to be bullish on a MONTHLY basis.

GOLD is bearish on a weekly basis

GOLD/SPX remains bearish on a monthly basis

GOLD/SPX remains bearish on a weekly basis

GDX has moved to neural on a weekly basis.

VanEck Vectors Gold Miners ETF (GDX)

GDXJ has turned mildly bullish on a weekly basis.

VanEck Vectors Junior Gold Miners ETF (GDXJ)

Ken Ticehurst

Founder www.Ivalgo.com

Ken Ticehurst is the publisher of forecasts for a wide range of markets at www.Ivalgo.com he has a BSC (Hons.) in Industrial Design and decades of experience as a data analyst. Having used technical analysis during over ten years of trading, he became frustrated with how backward looking it is and set about creating a logical mathematical approach to analysing future prices.

Copyright 2021, Ken Ticehurst. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.