General Artificial Intelligence Was BORN in 2020! GPT-3, Deep Mind

Companies / AI Jan 20, 2021 - 12:41 PM GMTBy: Nadeem_Walayat

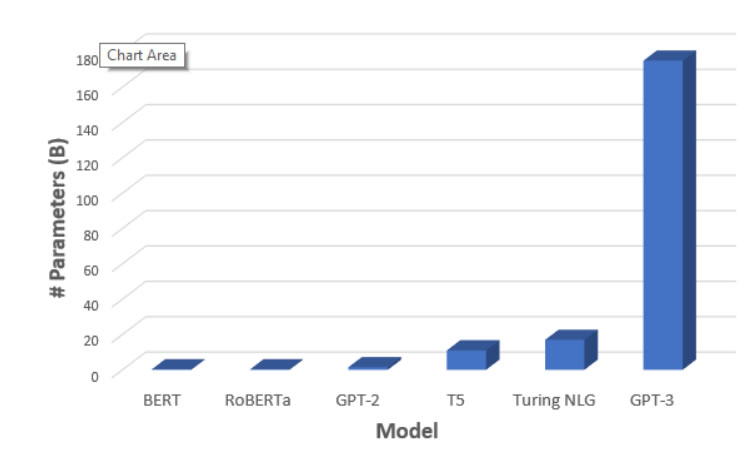

During 2020 the fictional general artificial intelligence of the movies to some degree become reality in the form of GPT-3 that performs exponentially better than AI that preceded it as the following graph illustrates,

What is GPT3?

GPT-3 generates texts using pre-trained algorithms created by Open AI which was co-founded by Elon Musk. GPT-3 has basically hoovered up most of the text published online much as Google's search engine has indexed web pages throw regular crawls. The result is that GPT-3 can answer questions, write essays, summarise texts, translate languages, take memos, virtually anything a human can do involving text GPT-3 can do!

In my opinion this means THE AI has now been born, where the only question mark is how quickly will it grow? Where if you follow my analysis and conclusions you should understand I expect it to develop exponentially in capability, and perhaps on the cusps or leaving human level intelligence behind.

So how to profit from GPT-3. Well ensure you own stock in the No 3 company on my AI stocks list, because Microsoft has effectively BOUGHT GPT-3! Yes, it was supposed to be open source, but Microsoft UNDERSTOOD what it was looking at when it saw what GPT-3 could do and BOUGHT IT! Has an EXCLUSIVE right to the SOURCE CODE!

Anyway, there will be plenty more competing GPT-3's out there as each tech giant will have their own AI.

AI has now been born so it is no longer a future we are trending towards, it has now HAPPENED, Pandora's box has been OPENED!

And once more all we can do is to -

a.Own a piece of the AI

b. Ensure we understand the technology so we can deploy AI to improve productivity for which we are witnessing signs of everywhere, i.e. from neural engines incorporated into CPU's and GPU's such as Apples new M1 processor and Nvidia RTX GPU's.

c. To stay one step ahead as individuals we need to start offloading processing power onto AI, because we cannot compete against AI so HAVE to USE IT to our advantage i.e. in our decision making processes, an example of which is Google, where we let Google answer our queries and guide our actions in every day life from the routes we take following Google Maps, to answering a myriad of how to queries we pump into Google search every day.

How AI will come to rule the world

Ai's foot print in controlling and ruling over mankind is not going to happen with terminator style robots roaming the world, though that may be our fate several decades down the road. Instead to see how AI will rule mankind one needs to take a look at exactly what is fostering and nurturing the AI mega-trend which are the intelligence agencies as a means of controlling populations and expressing power over other nations. So whilst the likes of Google may be seen by most to be trading as a profit driven corporation focused on corporate earnings, in reality whether the heads at Google like it or not IS part of the CIA's intelligence umbrella as are all of the other tech giants, just as once upon a time the primary expression of power was through the print media, which is why a large number of journalists were on the payroll of the intelligence agencies. Which means there won't be any respite or pause for thought for the consequences of what is being unleashed onto the planet, artificial intelligence and the intelligence agencies go hand in hand, are flips side of the same coin.

Thus artificial intelligence is already being used by state intelligence agencies to for instance interfere in elections right across the globe, where AI over time will increasingly act on their own accord, far beyond the comprehension of those with just 1350cc of grey matter to comprehend the direction of travel as all they will beware of are disparate events just as human Intelligence agencies do today, will have a hand in towards a particular outcome of control.

The consequences of which is that we are all going to be living in a less free world, less freedom of thought and expression as the AI will increasingly be successful in silencing competing narratives through either brain washing, mind control and silencing of opposition, much as the Democrats in congress are doing this very day. The successors to CIA's experiments of the 1970s that we know of namely "MK Ultra" and outright assassinations just as the CIA has been engaged in so will the Central Intelligence Entity continue to unchecked.

The bottom line is to remain invested in AI stocks, don't make the mistake of exiting early because we are NOT on an Linear curve but EXPONENTIAL! i.e. the market will likely not give you an opportunity to buy back in cheaper later so we basically got lucky with the pandemic that resulted in severe Mis-pricing of AI stocks during March 2020 that I hope my Patrons took full advantage of to stock up on to the hilt.

This article is an excerpt form the latest extensive indepth analysis that concludes in a detailed trend forecast for US house prices.

US Housing Market Trend Forecast 2021, AI Stocks and Coronavirus Pandemic Finale Catastrophe

- UK Coronavirus Catastrophe at Start of 2021

- US Coronavirus Catastrophe at Start of 2021

- US House Prices Trend Forecast Review

- The Inflation Mega-trend QE4EVER

- US House Prices Trend Forecast 2021

- General Artificial Intelligence Was BORN in 2020!

- How AI will come to rule the world

- Intel Fights Back!

- AI Stocks at Start of 2021

The whole of which was first been made available to Patrons who support my work so immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Analysis Schedule :

My analysis schedule for the rest of January and into Mid February to include:

- UK house prices trend forecast

- Stock market trend forecast for 2021

- AI stocks buying levels update

- Bitcoin price trend forecast

- US Dollar and British Pound analysis

* UK Housing Market Trend Forecast 2021

Will the UK follow the US inflationary lead or has Brexit and Covid combined to press the pause button on the UK housing bull market for 2021?

* Stock Market Trend Forecast 2021

In respect of which how did my forecast at the start of the year for 2020 fair?

31st Dec 2019 - Stock Market Trend Forecast Outlook for 2020

Dow Stock Market 2020 Outlook Forecast Conclusion

Therefore my forecast conclusion is for the Dow to target a trend to between 30,750 and 31,000 by the end of 2020. For a likely gain of 8% to 9% for the year (on the last close of 28,642).

My series of 2020 stock market analysis will seek to map out multi-month detailed trend forecasts as was the case for 2019. With the first to be completed during January, going into which my expectations are for a correction early 2020. Which given my bullish outlook implies should prove to be a buying opportunity.

Here is how the Dow trended during 2020 and where it ended the year.

* AI Stocks Buying Levels for Q1 2021

If possible before the end of January 2021, if not early February.

* Bitcoin trend forecast 2021

Last two updates forecast conclusions -

17th Sept 2019 Bitcoin Price Analysis and Trend Forecast

Forecast Conclusion

Therefore my forecast conclusion is for the Bitcoin price to hold support at $9,400 in preparations for an assault on $12k, a break of which would target a break of $14k. However if support at $9.4k fails than Bitcoin could trade down as low as $6k BEFORE heading higher.

31st March 2020 - Coronavirus Parabolic Pandemic, Bitcoin Price Trend Forecast

Forecast Conclusion

My forecast conclusion is for the Bitcoin price to mark time by trading down to as low as $7,500 before basing for a run higher to resistance of $10,500 that 'should' break to propel the Bitcoin price towards the next resistance level of $12,000. Thus the bitcoin price could drift lower for the next couple of months or so before resuming a bullish trend as illustrated by this chart.

Your analyst wishing all my Patrons a happy and prosperous covid free 2021

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.