Bitcoin and Precious Metals may be disconnecting trends

Currencies / Bitcoin Feb 04, 2021 - 04:35 PM GMTBy: Chris_Vermeulen

In the recent past, quite a bit of attention was focused on Bitcoin throughout the October 2020 to January 2021 rally phase. It was an incredible rally of over 400% and many analysts had highlighted the alignment of Bitcoin to Precious Metals prior to the breakout rally in Bitcoin. The renewed interest in Cryptos in October broke this alignment as Cryptos rallied while Precious Metals stayed mostly flat to negative.

My research team and I have written on How To Spot The End Of An Excess Phase (Part I and Part II)near the end of November 2020, which spotlighted Bitcoin. We have further identified a broad market cycle phase which has shifted from Appreciation to Depreciation, taking place in late 2018/early 2019, and believed the rally in Bitcoin was driven by this excess phase enthusiasm.

The Reddit group that has disrupted trading over the past few months has opened fresh wounds across many hedge funds and ETFs. The weighting of technology-heavy ETFs has shifted and capital is shifting away from risks much faster than anyone expected. This #WallStreetBets Reddit group has shown the strength and fortitude to continue to execute their group buying across various heavily shorted symbols and rumour is that they are targeting Silver.

Shifting Capital May Increase Volatility Of Trends In Bitcoin/Metals

The process of reducing liquidity in the markets, buy Buying and HOLDING shares, while levering positions with Call Options has created a short-squeeze of epic proportions – we’ve only seen this a few times in history. What it means for traders is that the next few weeks could be very volatile and dangerous and/or opportunistic.

If capital moves away from Cryptos as this Reddit plan is executed, a breakdown of the support channel is very likely – targeting $25,000 or lower. Additionally, precious metals, particularly Silver and Silver-related shares, are likely to experience a potentially epic short-squeeze event. This event may send Silver skyrocketing above $45 a share very quickly.

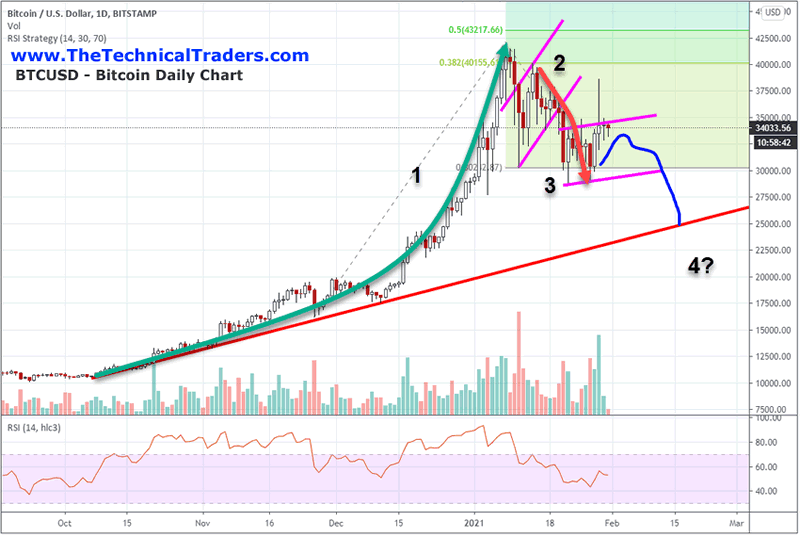

This Daily Bitcoin chart highlights the current Excess Phase process (currently trending in Phase #3 waiting for the breakdown in trend to complete Phase #4). This breakdown event will likely prompt Bitcoin traders to wait for a new bottom to set up in the future and possibly use their capital to move into the Reddit-focused short-squeeze plays.

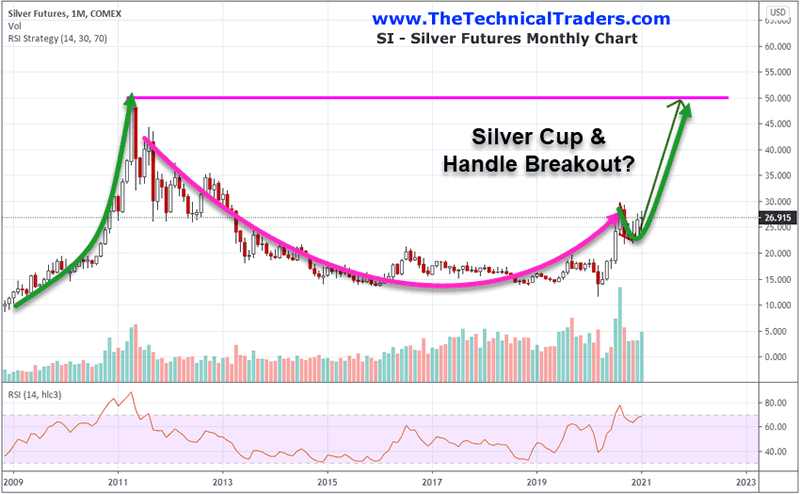

Silver May Rally Above $45 Very Quickly – Possibly Targeting $85+ On A Breakout

Additionally, the following Monthly Silver Futures chart highlights the extended Cup-n-Handle setup that appears to suggest a move to $45 (or higher) is very likely. As the Reddit group targets SLV, AG, and SILJ, it is very likely that spot prices will climb rapidly as metals investors buy as much physical metal as possible. This is a “shotgun” style of a short-squeeze. It will likely result in the entire precious metals sector moving higher in some form whereas the leading ETFs, Miners, and Spot will drive the trends.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

The disconnect happens when Bitcoin stalls/breaks down and precious metals rally. Traders are very likely to take their Bitcoin gains and shift into precious metals as this breakout trend extends. If you were lucky enough to have physical Silver or Gold already, sit back and enjoy the ride. If not, you will likely join the hundreds of thousands of Reddit and other traders that attempt to jump into this new Silver trend on Monday.

The one thing everyone needs to consider as these events play out is Liquidity. The process being executed by the Reddit group attempts to limit liquidity for short-sellers. This process creates a potential “gamma squeeze” – where prices climb incredibly fast as short-sellers are forced to take any ASK to get out of their shorts.

If this were to happen in Silver, or any other symbols, we may see very strange prices levels reached over the next few weeks+. Remember the Flash-Crash and how that played out? This is the same type of event except it traps the shorts forcing prices to skyrocket instead of collapsing.

Major sectors, ETFs and hundreds of stock symbols may get shoved around over the next few days/weeks. This means we’ll likely see increased volatility. Over time, things will settle down and we’ll be able to adjust to new trend/trade setups. Right now, we need to prepare for a very volatile period in the markets with the potential for a flash-crash or flash-rally taking place.

I publish these articles and research posts to teach our readers the importance of using efficient trading strategies to grow their wealth, achieve financial goals and have more free time. 2021 is going to be full of great trading opportunities for those who know how to take advantage of sector rotations, relative strength, and momentum. Quite literally, hundreds of these setups and trades will be generated over the next 3 to 6 months for those subscribers using the BAN strategy. Sign up now and I will teach you how to create and trade your own hotlist in my FREE (less than) one-hour tutorial on the Best Asset Now.

For those that don’t have the time to research and create their own BAN Hotlist, you can get my Hotlist, daily technical analysis and research, as well as my trade alerts, all delivered to your inbox every day with the BAN Trader Pro newsletter service. Don’t let these great trading and investment opportunities come to pass without you taking your piece of the pie!

Happy Trading!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.