UK Current State of the CCP Coronavirus Pandemic

Politics / Coronavirus 2021 Feb 12, 2021 - 12:47 PM GMTBy: Nadeem_Walayat

Remember the big picture folks of a trend towards a full spectrum war against the emerging Chinese Empire as per my series of in-depth analysis of December 20216 towards which the Chinese prematurely unleashing a bio weapon due to incompetence is just one facet of this full spectrum war against this emerging totalitarian empire that in less than a decade will could to be come to seen as Nazi Germany when enacting their own versions of the final solutions on populations and lands they seek to conquer i.e. bordering Asian nations, Australia and large chunks of Africa in addition to wiping out conquered peoples such as the Uighurs that now reside within China's borders.

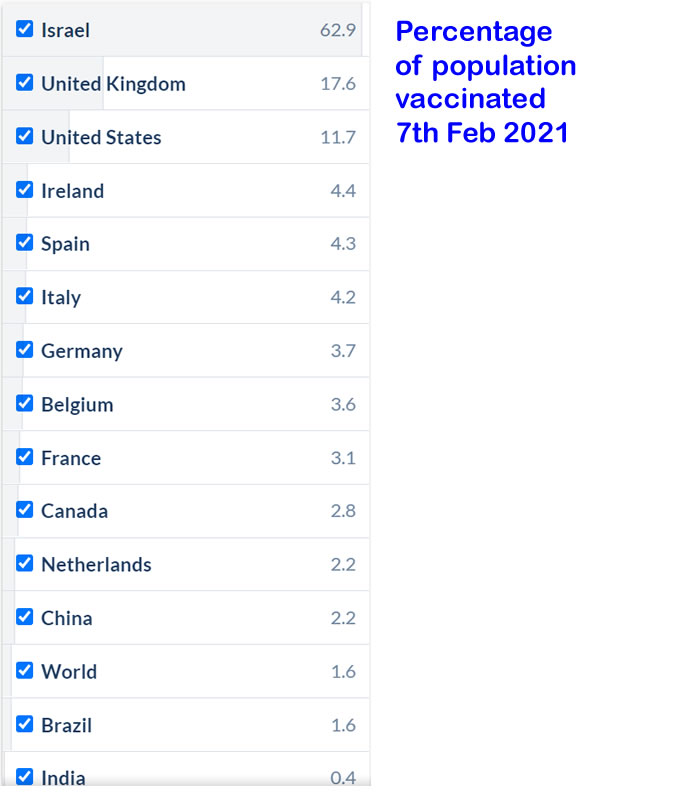

Regardless of the impact of emerging new strains of the coronavirus that are less susceptible to the vaccines the way out of the rolling pandemic economic lockdown's clearly lies in vaccinating populations to an extent that it induces herd immunity so that the pandemic is largely brought to an abrupt end, unable to spread beyond small clusters, usually as a consequence of travelers from abroad that and infections less likely to cause hospitalisation and deaths. In which respect the UK for a change LEADS the Western World with the Brexit mindset Prime Minister acting independently to the EU and the UK having pharmaceutical research infrastructure that gave Britain an advantage which has led to the UK having vaccinated more people than the whole of the EU! That unfortunately has triggered anger and rage in the inept and incompetent EU institutions which the UK has sought to escape from.

The EU has implemented export controls out of the EU which means Pfizer vaccines could be stopped from reaching Britain thus acting to delay second doses as an incompetent EU attempted to play the blame game, blaming everyone but themselves. What this means is that the drug companies will be less willing to deal with the EU, who rather than looking in the mirror at their own incompetence have been more than willing to play the smoke and mirrors game in attempts to hide the magnitude of their failure as my following video illustrated:

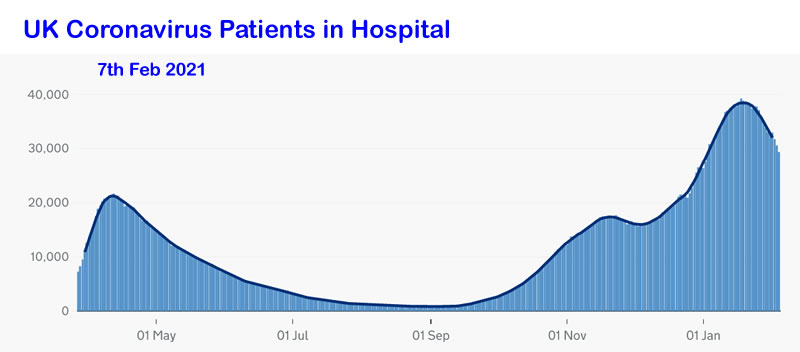

One of the key metrics for when the economically crippling lockdown's will end is the number of patients in hospital and of course the number of people dying which is a function of health systems that have hit capacity hence many people who could be saved die.

In terms of number of patients in hospital the UK is still at the critical levels with 33,000 patients in hospital set against 21,700 during the first wave April peak.

So the UK has a long way to go to reach any semblance of normality, perhaps when the number of covid patients in hospital falls to under 10,000 then the government can consider relaxing restrictions by opening schools and gradually other venues, which is likely still some 6 weeks away, so Mid to late March.

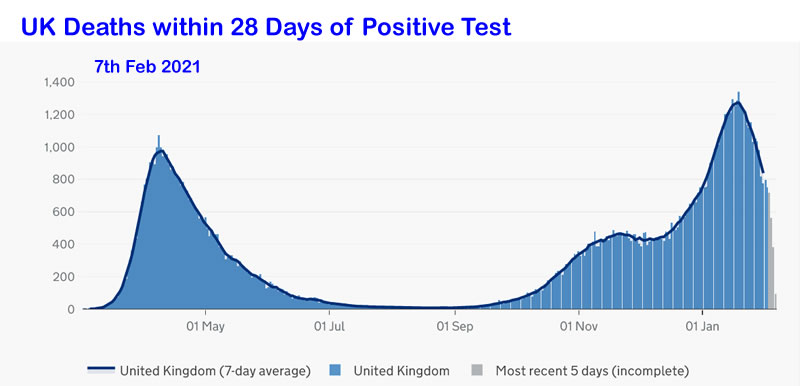

UK deaths now total 113,000 though of course this is an under estimation of actual deaths that probably exceeds 150,000. Nevertheless it is the daily metric we have to gauge the pandemic which several weeks ago I expected to total 150,000 before the end of this year.

The deaths trend is similar to the hospitalisations trend which thus also points towards likely relaxation from sometime after Mid March when the number of deaths should have fallen to below 100 per day. Where the key difference between today and the first wave has been the UK's surprisingly success programme for vaccinations as the UK looks set to achieve it's 15 million vaccinations target by Mid Feb and at this rate could have vaccinated 30 million, or about half the population by the end of March which suggests a swift bounce back from the pandemic economic depression from April onwards is highly probably, a summer post pandemic economic boom!

Covid-20 - The South African Strain

Whilst the London strain that has rightly gleaned much media attention since it emerged some 4 months ago, nevertheless does respond to covid-19 antibodies and vaccines. South Africa, the cradle of humanity where homo sapiens likely first emerged some 400,000 years ago looks set to deliver mankind a major blow during 2021. Basically covid-19 anti-bodies and therefore vaccines based on an immune response have little or no effect on this new strain which therefore should be named Covid 20.

A trial conducted in South Africa involving 2000 people by Wits VIDA Research resulted in 42 covid cases of which 39 were SA variant, 20 in the Placebo group (2.3%), 19 in the vaccine group (2.5%). Resulting in 10% Vaccine efficacy to the SA variant, against expected 60% 1st dose efficacy against covid-19.

So it looks like the Astrazenica type of vaccines only offer limited protection to the SA strain prompting the SA government to suspend their vaccination programme before it even began. However on the bright side AstraZenica have already begun developing a SA variant vaccine that they aim to start delivering in quantity from September onwards. So whilst the Covid-20 SA virus will be disruptive, However it will be nowhere near on the scale that of the Covid-19 Chinese virus given that governments are actually starting to do what they should have done a year ago! i.e. isolating travelers from infected areas, a reminder that they NEVER did that for chinese travelers, encouraged by the World Health Organisation not to prevent travelers from China spreading the virus across the world due the fact that China would cut funding to the WHO if they recommended such actions and hence chinese travelers sowed the seeds for the Catastrophe that took place during 2020 as I warned at the time on the 2nd of Feb 2020.

At the end of the day the message should be clear in that we need to live in a zero covid world like New Zealand where the number of cases needs to be ZERO so that the virus cannot mutate. In the meantime the markets like bad news such as this because it means the printing press will continue to run at full throttle.

The rest of this extensive analysis that concludes in detailed stock market trend forecast for 2021 has first been made available to Patrons who support my work so immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Dow Stock Market Trend Forecast 2021

- UK Coronavirus Pandemic Current State

- US Coronavirus Pandemic Current State

- Stock Market Forecasts and Analysis Review of 2020

- The Stock Market Big Picture

- Post Covid Economic Boom

- GAMESTOP MANIA BUBBLE BURSTS

- FED Balance Sheet

- Dow Short-term Analysis

- Dow Long-term Trend Analysis

- ELLIOTT WAVES

- SEASONAL ANALYSIS / Presidential Cycle

- Stocks Bear Market / Crash Indicator (CI18)

- Dow Stock Market 2020 Outlook Forecast Conclusion

My forthcoming schedule for analysis includes:

- AI stocks buying levels update

- UK house prices trend forecast

- Stock market trend forecast for 2021

- Bitcoin price trend forecast

- US Dollar and British Pound analysis

By Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.