US Coronavirus Pandemic Current State

Politics / Pandemic Feb 12, 2021 - 02:02 PM GMTBy: Nadeem_Walayat

Remember the big picture folks of a trend towards a full spectrum war against the emerging Chinese Empire as per my series of in-depth analysis of December 20216 towards which the Chinese prematurely unleashing a bio weapon due to incompetence is just one facet of this full spectrum war against this emerging totalitarian empire that in less than a decade will could to be come to seen as Nazi Germany when enacting their own versions of the final solutions on populations and lands they seek to conquer i.e. bordering Asian nations, Australia and large chunks of Africa in addition to wiping out conquered peoples such as the Uighurs that now reside within China's borders.

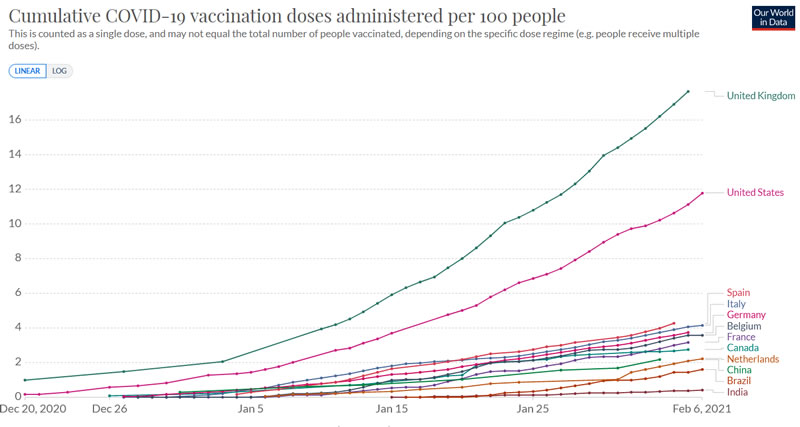

Unfortunately for the US the key problem is that like much of the rest of the western world faces the time bomb of having to ride the crest of the London strain and then all of the other strains that can so easily make their way into highly fluid US population centres, which given the huge pool of infected acts as incubators for many home grown strains. Which means the US NEEDS to be AHEAD of the UK in terms of vaccinations so as to stifle the viruses opportunity to mutate.

Still after a slow start the US is stating to accelerate it's vaccinations programme after Biden took office and made it his number one priority.

In terms of vaccinations the US is about 2 weeks behind the UK, which on face value may not sound like much but given that the US is increasingly going to see the London strain become dominant or a derivative of it then in reality the US needs to be a couple of weeks ahead of the UK. Which means there is a good chance that the US going to continues experience severe pandemic pain over the next couple of months. Though of course things could be worse i.e. Europe which is even further behind the curve in terms of vaccinations hence engaged in a Vaccines war with the UK.

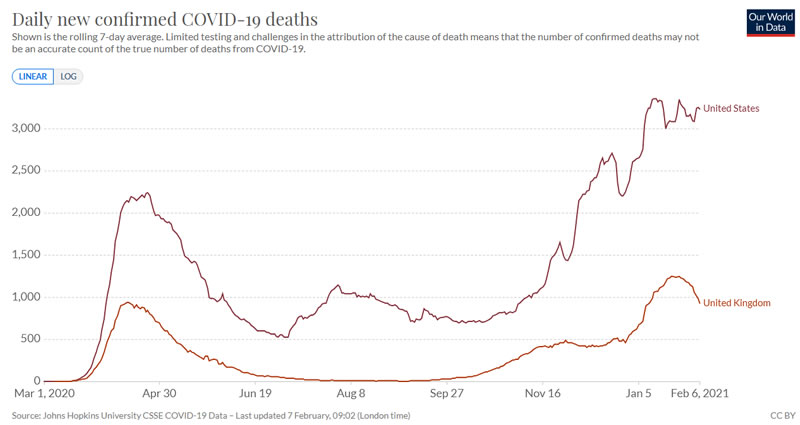

The failure of the US to act in terms of vaccinations means the US deaths per day are flat lining rather than declining as is the case for the UK which confirms to expect the stubbornly high number of daily deaths to continue for some weeks despite advances in treatments.

In total 465,000 americans have now died at the hands of the chinese virus, therefore unfortunately the US continues to trend towards a target of 750,000 covid-19 deaths by the end of 2021.

In terms of economic impact this looks set to act as a drag on the US economy for the whole of Q1 though is being off set by Biden's first stimulus money printing run of $1.8 trillion with plenty more inflationary stimulus money printing to come during the year.

The bottom line is that end is in sight, in 2 to 3 months time we should all be mostly living in a post pandemic lockdown's world of sorts, UNLESS.......

Covid-20 - The South African Strain

Whilst the London strain that has rightly gleaned much media attention since it emerged some 4 months ago, nevertheless does respond to covid-19 antibodies and vaccines. South Africa, the cradle of humanity where homo sapiens likely first emerged some 400,000 years ago looks set to deliver mankind a major blow during 2021. Basically covid-19 anti-bodies and therefore vaccines based on an immune response have little or no effect on this new strain which therefore should be named Covid 20.

A trial conducted in South Africa involving 2000 people by Wits VIDA Research resulted in 42 covid cases of which 39 were SA variant, 20 in the Placebo group (2.3%), 19 in the vaccine group (2.5%). Resulting in 10% Vaccine efficacy to the SA variant, against expected 60% 1st dose efficacy against covid-19.

So it looks like the Astrazenica type of vaccines only offer limited protection to the SA strain prompting the SA government to suspend their vaccination programme before it even began. However on the bright side AstraZenica have already begun developing a SA variant vaccine that they aim to start delivering in quantity from September onwards. So whilst the Covid-20 SA virus will be disruptive, However it will be nowhere near on the scale that of the Covid-19 Chinese virus given that governments are actually starting to do what they should have done a year ago! i.e. isolating travelers from infected areas, a reminder that they NEVER did that for chinese travelers, encouraged by the World Health Organisation not to prevent travelers from China spreading the virus across the world due the fact that China would cut funding to the WHO if they recommended such actions and hence chinese travelers sowed the seeds for the Catastrophe that took place during 2020 as I warned at the time on the 2nd of Feb 2020.

At the end of the day the message should be clear in that we need to live in a zero covid world like New Zealand where the number of cases needs to be ZERO so that the virus cannot mutate. In the meantime the markets like bad news such as this because it means the printing press will continue to run at full throttle.

The rest of this extensive analysis that concludes in detailed stock market trend forecast for 2021 has first been made available to Patrons who support my work so immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Dow Stock Market Trend Forecast 2021

- UK Coronavirus Pandemic Current State

- US Coronavirus Pandemic Current State

- Stock Market Forecasts and Analysis Review of 2020

- The Stock Market Big Picture

- Post Covid Economic Boom

- GAMESTOP MANIA BUBBLE BURSTS

- FED Balance Sheet

- Dow Short-term Analysis

- Dow Long-term Trend Analysis

- ELLIOTT WAVES

- SEASONAL ANALYSIS / Presidential Cycle

- Stocks Bear Market / Crash Indicator (CI18)

- Dow Stock Market 2020 Outlook Forecast Conclusion

My forthcoming schedule for analysis includes:

- AI stocks buying levels update

- UK house prices trend forecast

- Stock market trend forecast for 2021

- Bitcoin price trend forecast

- US Dollar and British Pound analysis

By Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.