US Economic Data Tempers Expectations on the Stock Market

Stock-Markets / Stock Market 2021 Feb 13, 2021 - 03:36 PM GMTBy: Boris_Dzhingarov

Snapshot of the US Economy: Movers and Shakers

The performance of the US economy at any point in time is predicated on a series of economic indicators. Several important metrics must be assessed to gain a better understanding of US equities markets, and the economy at large.

Chief among them are the GDP growth rate, the unemployment rate, non-farm payrolls, the inflation rate, and interest rate. As it stands, theGDP growth rate is currently at 4%, the unemployment rate is at 6.3%, NFP data is at 49, and the January 2021 inflation rate remains unchanged at 1.4% (same as December 2020).

Source: StockCharts NASDAQ

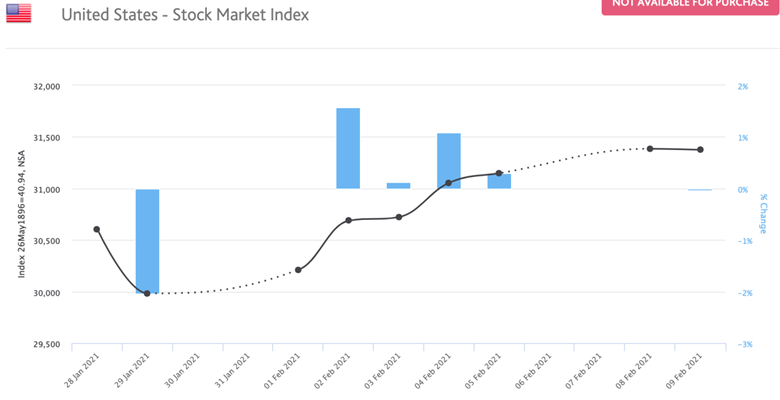

From a macroeconomic perspective, these numbers are important insofar as they affect speculative sentiment on the financial markets. Recently, Treasury yields dipped, following the January inflation reading of 1.4%. In the absence of inflationary movements, economists caution that aggregate spending is insufficient and economic activity is slumbering.True to form, short-term economic growth remains anemic, raising concerns that we may not be out of the woods just yet. The unchanged CPI (consumer price index) reading had a contractionary effect on markets, curtailing growth expectations, after successive weeks of strong gains.

Will Stimulus Cause Inflationary Pressures?

Multiple back-to-back stimulus packages have been unleashed into the US economy, notably the $2 trillion first stimulus, followed by the $900 billion second package during the Trump administration.Under President Biden, more stimulus is expected. A figure of $1.9 trillion is expected in coming months. With so much cash flooding the markets, analysts caution of inflationary pressures.

If prices start rising, this is likely to take place over a prolonged spell, during H1 2021 and well beyond. Despite pullbacks in certain industries, growth stocks abound. Multiple asset classes have benefited, including commodities like platinum. This precious metal surged in recent days, hitting a 6-year high, as tight supplies threaten the market.

Some of the hardest-hit sectors of the US stock market to date include materials, energy, and financials. Yet in spite of this, there are stocks reporting strong gains on the NYSE, NASDAQ, S&P 500, and other indices.

According to CSI Market, the best performing stocks in mid-February include a combination of tech stocks, pharmaceuticals, and financials. For retail traders, budget conscious trades are often at the forefront of decision-making processes.

Casual traders are encouraged to take a look at these penny stocks, including Greene Concepts Inc. (OTCPK: INKW),Blue Diamond Ventures, Inc. (OTCPK: BLDV), Cytodyn Inc. (OTCQB: CYDY), and Alternet Systems Inc. (OTCPK: ALYI). Each of these stocks has experienced a breakout in recent weeks, and has captured the attention of traders at online brokerages. A combination of increased volatility and speculative sentiment has helped to propel these stocks.

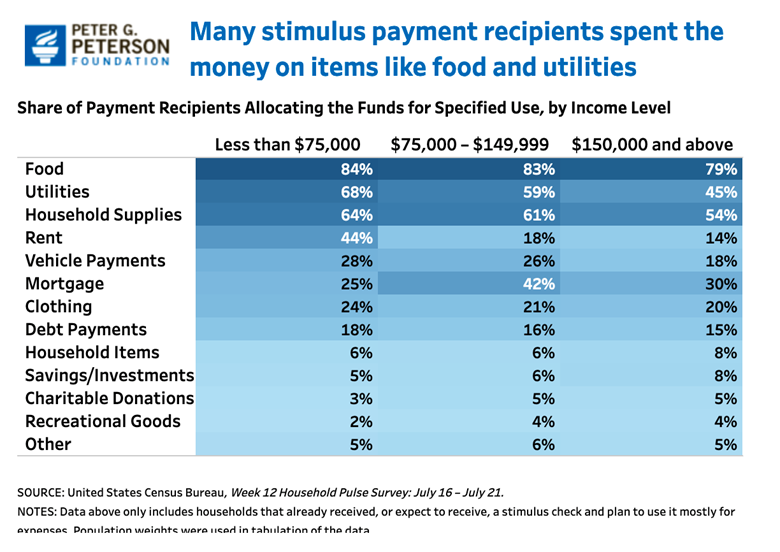

How Are Americans Spending Their Stimulus Checks?

Source: Peter G. Peterson Foundation

As the saying goes, ‘A rising tide lifts all boats’, and a great big deluge of cash is expected to hit the markets. If President Biden gets his way, with help from the House and the Senate, Americans will be issued a new round of stimulus checks valued at $1400.

According to the Peterson Foundation (October 2020), Americans spent their first stimulus checks on the following expenses: 80% of households earning less than $75K year spent their money on expenses, while 55% of households earning $150K+ spent their money on expenses, the rest went towards savings and debt reduction.

By far the biggest benefactors of stimulus checks for low-income earners are food, utilities, household supplies, rent, vehicle payments, and mortgage.For high-incomeearners, the numbers drop slightly for food, but substantially for utilities, and household supplies.

The Federal Reserve Bank has opted for an accommodative monetary policy well into the future. One of the key indicators of this is inflation targeting. The metric envisaged by the Fed was 2%, with accommodation for 2% + inflation moving forward.

Despite its Size Stimulus Only Part of a Long-Term Recovery

Source: Moody’s Analytics United States Stock Market Index

Accommodative monetary policies such as bond purchases, and stimulus measures serve to flood the US economy with money which is designed to encourage aggregate spending and growth. This is precisely the reason why stock markets have boomed. When Treasury yields start rising, capital may shift from stocks to bonds, thereby dampening the runaway activity in the markets.

From a macroeconomic perspective, the stimulus checks had a modest impact on the US economy. And, it was concentrated in a few specific industries. These include household supplies, food, utilities, mortgages, rent, credit card repayments, et al. Low income earners are less likely to plough their funds into the stock markets – that remains the purview of higher income traders and recreational traders with excess funds available.

According to Self.Inc, a small portion of stimulus checks on average have found their way into stocks/investments ($76.82), and cryptocurrency ($7.26), but the lion’s share was allocated towards an emergency fund ($250.73), debt ($227.48) groceries/food ($136.20), and mortgage/rent ($272.60).

Social trading platforms have reported a strong uptick in activity during 2020, thanks largely to the democratisation of trading activity, and the ease of access into financial markets nowadays. It is largely thanks to media hype about GME and other stocks that more people are taking to the financial markets in expectation of gains.

By Boris Dzhingarov

© 2021 Copyright Boris Dzhingarov - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.