How to Protect Your Positions From A Stock Market Sell-Off Using Options

Stock-Markets / Options & Warrants Feb 24, 2021 - 02:34 PM GMTBy: Chris_Vermeulen

Today we are going to explore how you can use options to hedge against a sudden market reversal. As you know I am going to be launching a new options service with an options specialist, Neil Szczepanski, shortly so you should start seeing more and more research on options from us.

The first question we need to answer is will there be a market sell-off? If we first look at the S&P chart below, we can see that we have had an incredible run. In order to determine if this trend is weakening, we need to look at what is happening with key sectors and sector rotation. Since the beginning of 2021, we have seen a rotation into commodity sectors which is typical of a late-cycle surge. This might give us a hint that higher volatility projections might be realized.

What do I mean by volatility projections? I look at the VVIX which is the volatility of the volatility index. I know it can be tough to understand but the VVIX is the projected rise and fall in the VIX. In laymen’s terms, if the VVIX is rising then the projected market sentiment is that the VIX will rise. If the VIX rises, then that means there is growing fear in the market. When the VIX hits certain levels we have seen broad market sell-offs because of heightened fear.

If we look at the VVIX chart below we can see it is clearly on the rise and anything over 120 means it is higher than historical averages.

With all this said, the charts don’t show us that the market will collapse, and they certainly don’t tell us when. Nobody knows that, and if they tell you they know then they are not being truthful. We do know however that the overall market sentiment is that the market is going to change direction given the softening of the SPX and VVIX charts.

Again, we can’t predict when the decline will start but we all know it will have to happen at some point. I always tell traders when I coach them that we should always strive to put us in the best positions to take advantage – or protect – from market rotations. If we have the odds in our favor, then over time we will win. So, given all the experts in the market right now think there will be a correction soon is information we should take into consideration. I always trade what is in front of me but I also keep an eye on where we might go and prepare with hedges.

Sign up now to receive information on the launch of the Technical Traders’ options trading courses and newsletter!

In this article, I’m going to give a good example of how to hedge your open positions either in stock or options. I usually look at my portfolio delta and determine if it is positive or negative. If it is positive and I see there is a possible storm brewing like we see here, then I will adjust. Most people will adjust by getting out of positions but I usually do things a little differently:

- I play the VIX. What do I mean by that? I find a way to get long in the VIX, either by buying options or putting on options spreads. I usually never hold these for long periods of time but if I do I find ways to keep them on without time premium decay costing me.

- I will put on short positions in the SPY or QQQ. I do this by buying put options or putting on put options spreads.

Playing the VIX

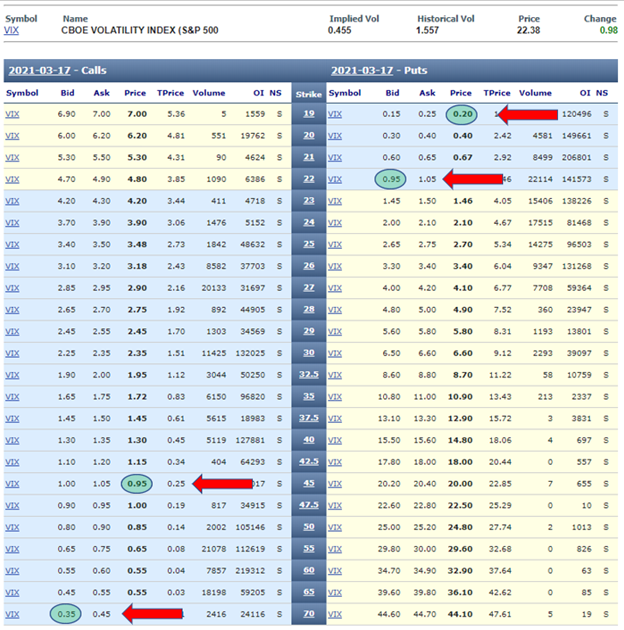

For the VIX I like to sell VIX options to buy VIX options. What does this mean? First I will buy a VIX call option credit spread and then sell a VIX put option credit spread. Secondly, I will buy puts on each. See the below chart that outlines how you would open these positions:

In this scenario the trade would look like this:

***** TRADE DETAIL *****

Complexity: ADVANCED

To: OPEN

Symbol: VIX

Strategy: Custom Bullish Spread

BUY: 17 MAR $19 PUT – $0.20 DEBIT

SELL: 17 MAR $22 PUT – $0.95 CREDIT

BUY: 17 MAR $45 CALL – $0.95 DEBIT

SELL: 17 MAR $70 CALL – $0.35 CREDIT

TOTAL = $0.15 CREDIT

The above trade is four-leg spread with two debits and two credits. In this particular trade, we are essentially hedging for free, or in this case a small credit of $15/position (which is one contract for each of the four legs). I love getting paid to protect my long positions! This would be huge in protecting positions we put on with our BAN Trader Pro service.

We can expand this hedge by simply buying more contracts, and we can keep this hedge on all year simply by rolling over the contracts. If the VIX were to suddenly rise as we saw in March of 2020 during the market panic and sell-off, we would have about $2,400/position as profit. If the market continued to rise and there was no correction and the VIX were to go down to 15 we could lose up to about $370. If the market went sideways and the VIX stayed exactly the same we would realize the small gain of $15.

As you can see, you can use options in a creative way to hedge your positions, and if you are good, not even have to pay for the protection. In my trading portfolio I usually keep one of these on at all times because as we all know, no one knows when the market could correct.

For the second trade, we are shorting the indexes, i.e. buying puts to play the market going down. These will go up with the market goes down and hopefully offset some of the losses on bullish or positive delta positions. These generally are a better way to hedge because you can keep your long positions intact and don’t have to spend the time to get out of them (along with the numerous commissions that go along with it). This is really easy to do but most new retail traders don’t know how to play the market to the downside, which is critical to survive as a trader.

Putting these positions on will hedge your overall portfolio delta. What I mean by this is these positions are negative delta. A negative delta will offset your positive delta. A negative delta is profitable when the market is decreasing. You can put these options positions on or take them off very easily. You can do it intra-day, hold for a pre-defined period of time, or keep rolling them forward. The flexibility of these hedging strategies makes them very attractive.

Remember hedges are not meant to make money, but generally meant to limit your losses. I put these on and if they make money it is generally a bad thing because it means my long positions are failing or getting stopped out. At least I did not lose as much as I could have given my options hedge which rises in value as my stock or ETF falls in value. If the market falls harder than the stops on my long I may even avoid losses altogether.

If I lose on these options trades, then that means my bullish positions I was hedging are doing well and overall I am up more than the cost of my hedged option positions. So, as we see from the above that if you are worried about a market correction it is not always necessary to panic and close your positions if you have a proper hedge in place.

Join Neil and me as we launch our new Options Trading Signals newsletter and trade alert service soon! You can sign up for our launch special at www.thetechnicaltraders.com/options-trading.

All my best,Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.