Gold Continues Declines on Bond Yield Jitters

Commodities / Gold and Silver 2021 Mar 07, 2021 - 01:50 PM GMTBy: Arkadiusz_Sieron

The economy seems to be recovering, while bond yields are increasing again, sending gold prices down.

The economy seems to be recovering, while bond yields are increasing again, sending gold prices down.

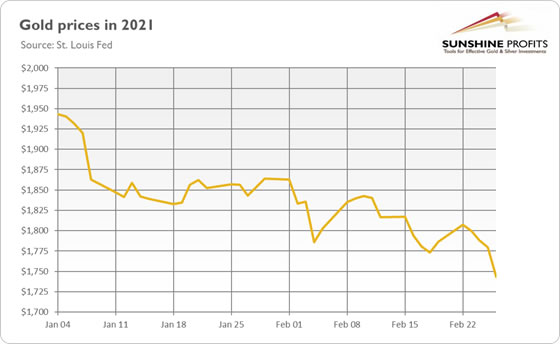

Not good. Gold bulls can be truly upset. The yellow metal continued its bearish trend last week. As the chart below shows, the price of gold has declined from $1,807 on Monday (Feb. 22) to $1,743 on Friday (Feb. 26).

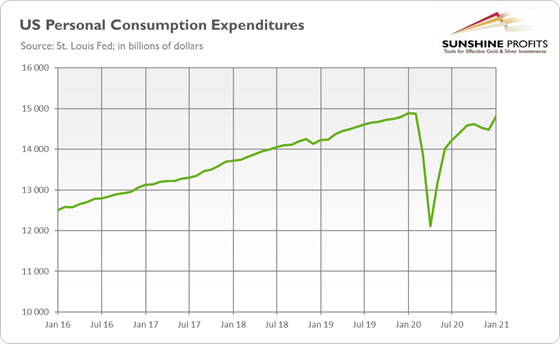

What happened? Well, last week was full of positive economic news. In particular, personal income surged by 10 percent in January, compared to only 0.6-percent rise in the previous month. Meanwhile, consumer spending increased 2.4 percent, following a 0.4-percent decline in December. This means that, on an absolute basis, personal consumption expenditures have almost returned to the pre- pandemic level, as the chart below shows.

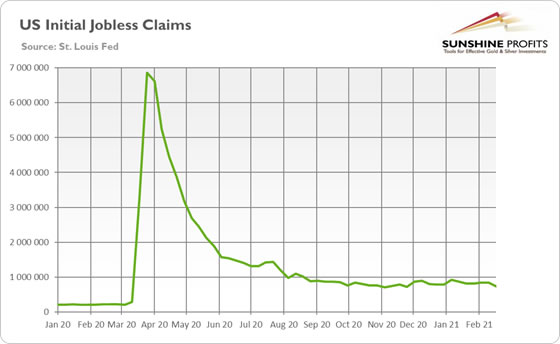

Additionally, durable goods orders jumped by 3.4 percent in January versus a 1.2-percent increase one month earlier. Moreover, initial jobless claims declined from 841,000 to 730,000 in the week ending February 20, as the chart below shows. It means that the economic situation is improving, partially thanks to the December fiscal stimulus.

And, on Saturday (Feb. 27), the House of Representatives passed Biden’s $1.9 trillion stimulus package. Although the bill has yet to be approved by the Senate, the move by the House brings us one step closer to its implementation. Although the additional fiscal stimulus may overheat the economy and turn out to be positive for gold prices in the long-term, the strengthened prospects of higher government expenditures can revive the optimism in the financial markets, negatively affecting the safe-haven assets such as gold .

Finally, on Saturday, the FDA authorized Johnson & Johnson’s vaccine against COVID-19. This decision expands the availability of vaccines, which brings us closer to the end of the epidemic in the U.S. and offers hope for a faster economic recovery. The new vaccine is highly effective (it provides 85-percent protection against severe COVID-19 28 days after vaccination) and most importantly, requires only one dose, which facilitates efficient distribution. So, the approval of another vaccine is rather bad news for gold and could add to the metal’s problems in the near future.

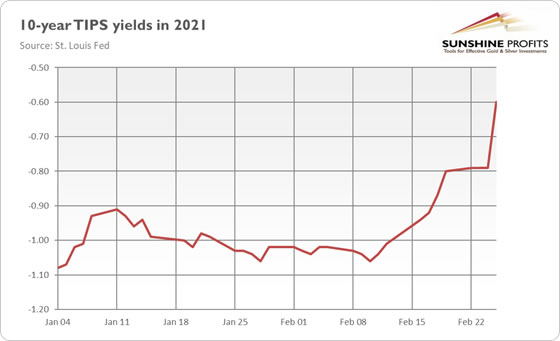

However, the most important development from the last week was the jump in the bond yields . As the chart below shows, after a short stabilization in the first half of the week, the yields on the 10-year Treasuries indexed by inflation rose from -0.79 to -0.60 percent on Thursday (Feb. 25). This surge in the real interest rates is negative for the price of gold.

Implications for Gold

What does this all mean for the price of gold? Well, the increase in the bond yields is clearly bad for the yellow metal. Although they have partially risen to strengthened inflation expectations, the real interest rates have also soared. It means that investors expect wider fiscal deficits and expanding vaccination to accelerate inflation only partially, but in a large part, it will speed up real economic growth. This is a huge problem for gold, as real interest rates are a key driver of gold prices.

An additional issue is that the expectations of higher economic growth and inflation create accompanying expectations for the Fed to tighten its monetary policy and hike the federal funds rate , which exerts downward pressure on gold prices.

This is what we were afraid of at the beginning of the year. We noted that the real interest rates were so low that the next move could be up. Importantly, there is further room for upward trajectory, as the real interest rates are still importantly below the pre-pandemic level.

However, we wouldn’t bet on the return to the levels seen last year. After all, interest rates didn’t return to the pre-crisis level after the Great Recession , so it’s unlikely that they will do it now. Additionally, investors should remember that the U.S. government is now so heavily indebted that if Treasury yields continue to increase, the Fed would have to intervene. A failure to do so would mean that the interest expenses would grow too much, creating serious problems for the Treasury. So, the current bearish trend in gold may not last forever – although it may still take some time.

Thank you for reading today’s free analysis. We hope you enjoyed it. If so, we would like to invite you to sign up for our free gold newsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all our premium gold services, including our Gold & Silver Trading Alerts. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.