Stock Market Enough Consolidation Already!

Stock-Markets / Stock Market 2021 May 02, 2021 - 12:13 PM GMTBy: Monica_Kingsley

Stocks are readying another push higher, and not just on the heels of the still accomodative Fed. The Fed won‘t simply remove the punch bowl, let alone discuss removing it, and will keep repeating the transitory inflation mantra ad nauseam. The ingredients are in place for a continued upswing in stocks and commodities.

Look for nominal yields to continue rising, and my hunch is that won‘t be enough to turn the dollar around. We‘re about to experience continuously rising inflation expectations, rising nominal yields, and declining dollar:

(…) When even Larry Summers starts talking the dangers of an inflationary wave, things are really likely getting serious down the road.

(…) we‘re in the decade of precious metals and commodities super bull runs – and these are well underway. The debasement of fiat currencies against real assets is set to continue, and will accelerate given the unprecedented fiscal and monetary support already and ahead – sorry dollar bulls, the greenback declines are resuming – just look at the yen and yields nodding to the metals upswing.

And the emerging markets are embracing the unfolding currency moves – they are rising with more vigor than the Russell 2000 lately. Little wonder for they are farther from their prior highs than the smallcaps. When it comes to S&P 500 sectors, yesterday brought us a rare rotation out of tech while the heavyweights still eked out minor gains – and that rotation is as telling a sign of a risk on sentiment returning as much as the credit market performance is.

The key more in the gold sector was in the miners, whose continued resilience is a good omen. In other words, what a recovery from the daily setback I covered amply between the regular trading sessions on Tuesday and Wednesday. Enriching the examination with copper and yen performance, let alone real yields, leads to a universally bullish verdict on the precious metals upcoming price path.

What‘s not to love about this reflation before inflation starts to bite noticeably more? Forget about those pesky commodities and my incessant bullish calls within the sector too…

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook

Stocks are merely gathering strength before another upswing. Enough consolidation already, seems to be the rallying cry here.

Credit Markets

A strong sign of risk-on returning here – high yield corporate bonds (HYG ETF) clearly outperformed investment grade ones (LQD ETF), and these mirrorer the long-dated Treasuries performance.

Technology and Financials

Another proof of risk-on is in both the technology performance disregarding $NYFANG holding ground, and in the Dow Jones Industrial Average weakness. Value stocks and cyclicals such as financials (XLF ETF) are having a field day, and as will be apparent from today‘s oil analysis, energy (XLE ETF) is a great pick as well.

Gold, Silver and Miners

Gold caught a bid, and refused to decline intraday, but the miners scored gains – that‘s as bullish as it gets. It might seem disappointing in light of nominal yields not going anywhere, but only until you examine the great copper performance.

Gold‘s volume hints at accumulation within this flag-approximating consolidation, where the next upswing would be ushered in by the miners. Note how silver gave up prior day‘s gains, and remains ready to join strongly next.

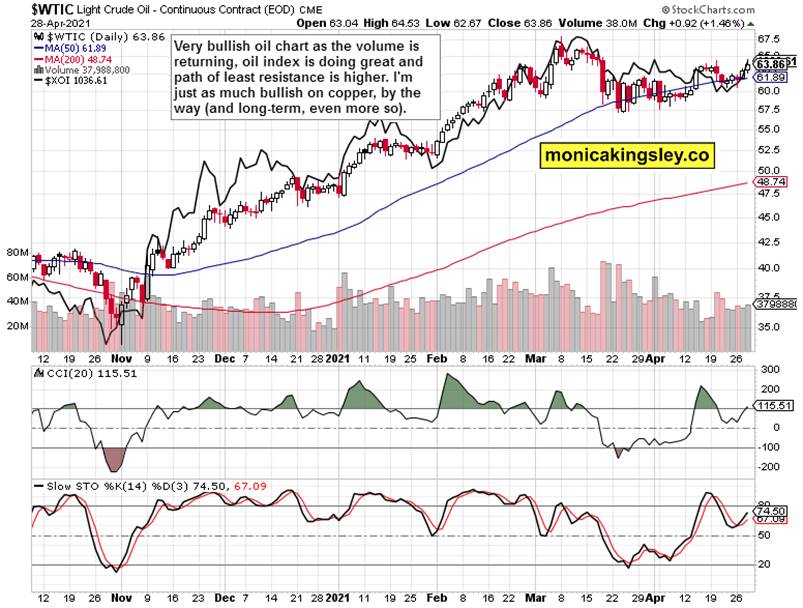

Crude Oil

Oil is in an upswing mode, and the bullish spirits are confirmed by the oil sector ($XOI) moves. The multiweek consolidation is in its closing stages.

Summary

The S&P 500 keeps pushing for new all time highs, and remain well positioned to close there any day now, especially since the credit markets favor risk on, and the defensives underperformance concurs.

Gold and miners are ready for another upswing, and the commodities performance, inflation expectations and nominal yields trajectory favor that. The inability of the sellers to push prices below $1,760 speaks volumes.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.