Gold Can’t Wait to Fall – Even Without USDX’s Help

Commodities / Gold and Silver 2021 May 04, 2021 - 01:18 PM GMTBy: P_Radomski_CFA

Gold started its decline without anyone’s assistance. And when the USDX takes off, that downhill tumble can only increase.

The USDX declines and the precious metals sit by idly, twiddling their thumbs. If they had the strength that’s being talked about, they should be soaring by now, or getting ready to. So, what’s their problem?

In the previous days, I discussed the signals coming from the precious metals market or for the precious metals market, as they kept on emerging, and we just received yet another round of indications. And yes, they also confirm the bearish outlook for the following weeks - or a few months.

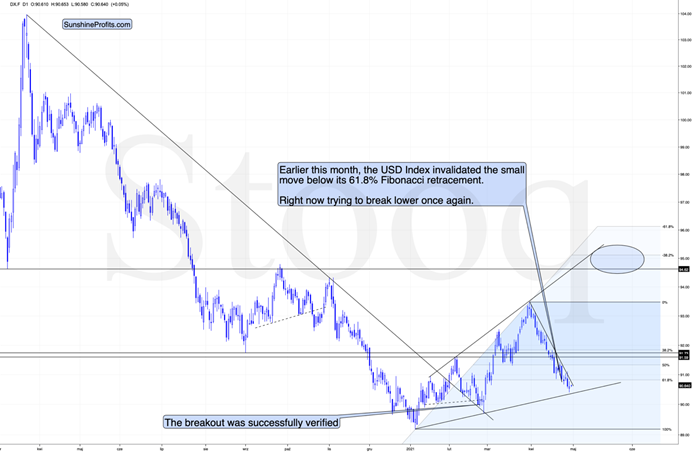

Let’s start by looking at the USD Index.

On the above chart you can see that this week, the USD Index broke to new monthly lows. And you can also see that gold didn’t move to a new monthly high. In fact, it was not even close to doing so – it just closed the day below $1,770. This is a clearly bearish sign for gold.

And what about the USD Index?

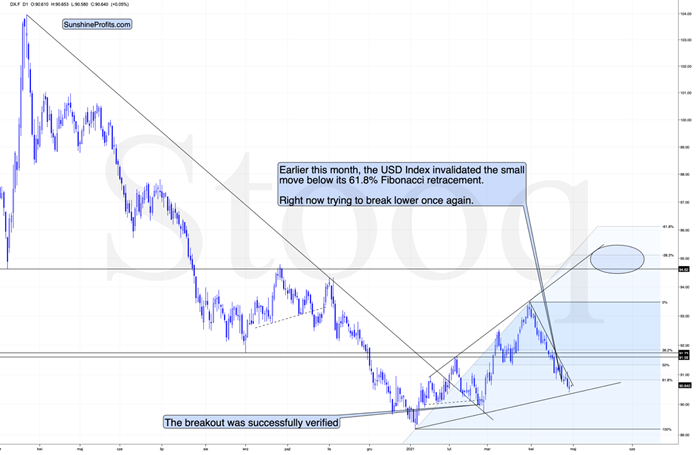

It’s making a second attempt to break below its 61.8% Fibonacci retracement level. Will it be successful? It might be, but… Another support level is just around the corner. Perhaps the proximity to the rising support line based on the January and February lows was actually enough to trigger the rebound yesterday. In this case, the bottom in the USDX is already in. But, we’ll know with much greater certainty when the USDX finally breaks above the declining resistance line and then confirms this breakout.

On the above 4-hour USD Index chart we see that the previous short-term breakout was invalidated, which triggered a substantial sell-off, but… Whatever was likely to happen based on this invalidation seems to have already happened. And it seems that we’re about to see another attempt to break higher. Will the USD Index be successful this time? That’s quite likely, but that’s not the most important thing from the precious metals investors’ and traders’ point of view.

PMs Play the Fiddle While USDX Burns

The key thing is that during the recent declines in the USDX (and during the move to new highs in case of the general stock market), gold , silver, and mining stocks didn’t soar. They “should have” if the situation was normal or bullish. They declined instead, which means it’s highly likely that even if the USD Index doesn’t break out now (but a bit later), the decline in the PMs will not be avoided but only delayed.

In fact, to be more precise, it’s unlikely to be delayed as well – what might be delayed is the increase in the pace at which gold, silver, and miners are about to slide. After all, gold and gold stocks are already moving lower (while silver is trading sideways).

By the way, silver’s lack of movement recently is perfectly normal in the early stage of a decline – the white metal tends to catch up big-time in the final part of a given move.

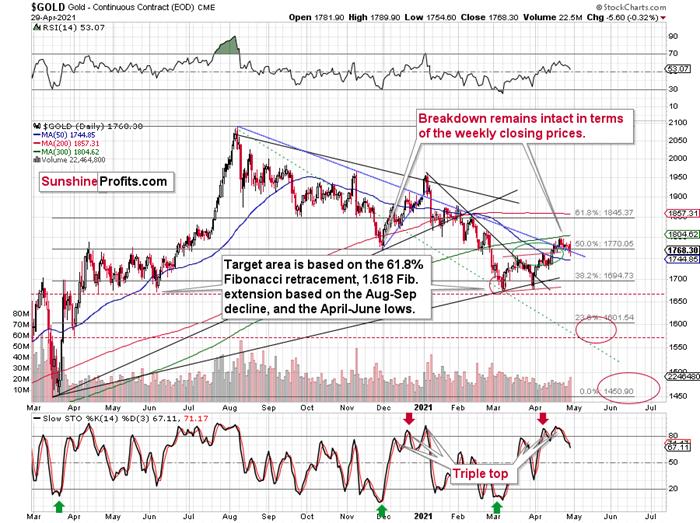

On the above gold chart, you can clearly see how gold moved back up to its rising short-term resistance line this week, and – instead of invalidating the breakdown – it bounced from it and declined once again. This is what verifications of breakdowns look like.

Also, let’s keep in mind that the situation now seems to be a mirror image of what we saw in April – June 2020, and at the same time it’s somewhat similar to what we saw at the beginning of the year. You can see the former (the rectangles are identical) on the above chart, and you can see the similarity to the early January action below.

Just as was the case in early January, we first saw a pause – a rebound – and the decline continued only thereafter. It seems that the Jan. 7, 2021 price action is quite similar to what we saw yesterday (Apr. 29). Moreover, please note that both happened just above the declining blue support line. It was the final pause before the move higher was invalidated.

Having said the above, let’s move to gold stocks:

Miners: GDX and GDXJ ETFs

In yesterday’s analysis, I described the GDX’s previous performance in the following way:

Gold stocks’ intraday recovery that we saw yesterday may seem profound, but not if we consider what happened in the USD Index and the general stock market. The former declined substantially while the latter was close to its all-time highs. This is a combination of factors that “should have” made gold miners move to new highs – and a daily gain of less than half percent is a sign of weakness, not strength.

In today’s pre-market trading the S&P 500 futures moved to new highs, and gold miners showed gains in the London trading, but they are nothing to write home about – and more importantly, nothing that would change the bearish forecast for gold I described more broadly previously .

The bearish interpretation of the previous “strength” turned out to have been correct – the GDX ETF declined yesterday.

The decline was even more visible and important in the case of the GDXJ ETF, where we have trading positions.

This ETF for junior gold and silver miners ( gold miners have much bigger weight in it, though) moved and closed back below its March 2021 highs.

Consequently, we have a situation in which:

- The USD Index is about to reverse and rally.

- Gold signals that it just can’t wait for the USD Index to rally, and it’s already declining (the pace at which it declines is likely to greatly increase once the USD Index takes off).

- Gold miners behave relatively normally, which in this case means that they are declining more than gold does (GLD just closed 1.14% below the highest daily close of April, while the GDX just closed 5.59% below the highest daily close of April). Besides, their recent move back to the May 2020 highs and the subsequent decline further increases the odds that the decline is going to shape the right shoulder of a huge head and shoulders formation with extremely bearish implications (once completed).

- GDXJ is underperforming GDX just as I’ve been expecting it to. While GDX declined by 5.59% so far (in terms of the closing prices), GDXJ declined by 5.67%. This might seem an unimportant level of underperformance, but the perspective changes once one realizes that GDXJ is more correlated with the general stock market than GDX is. Consequently, GDXJ should be showing strength here, and it isn’t. If stocks don’t decline, GDXJ is likely to underperform by just a bit, but when (not if) stocks slide, GDXJ is likely to plunge visibly more than GDX.

The above combination tells me that we are very well positioned in case of our short position in the GDXJ.

Besides, as an analytical cherry on the bearish GDXJ cake, please note that we just saw a sell signal from the MACD indicator (lower part of the chart) while it was visibly above 0, and after a relatively big short-term rally. We saw this kind of performance only several times in the previous year, and it meant declines in almost all cases. We saw it only once before this year – in early January, and a sizable decline followed.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the target for gold that could be reached in the next few weeks. If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.