Stock Market Transportation Index Continues To Grind Higher

Stock-Markets / Stock Market 2021 May 07, 2021 - 03:28 PM GMTBy: Chris_Vermeulen

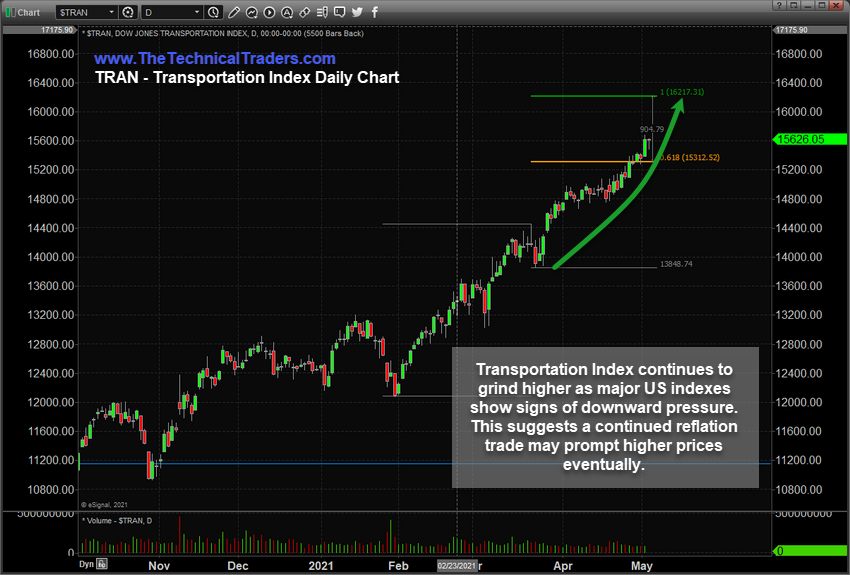

If the face of last week’s sideways price action and almost in a rebellious manner today (May 4, 2021), the Transportation Index is moving higher while the US major indexes are all broadly lower. VIX has shot up over 20 again (over +13% higher) and the NASDAQ is off by more than 300 points (-2.75%) as I write this article. Yet, the Transportation Index is bucking the trends and trading higher.

What Does It Mean When The Transportation Index Bucks The Major Index Trends?

My team and I have often highlighted the Transportation Index in our past research article. The reason we watch this index so closely is that it tends to lead market trends by at least 30 to 60 days. In short, the Transportation Index is a measure of future expectations related to freight, shipping, transportation, and the movement of goods and commodities across the US and across the globe.

When an economy contracts, the Transportation Index will likely follow major indexes lower as future expectations related to economic activity contract. When a recession or deep price correction happens, the Transportation Index usually moves sharply lower as the sudden shock of an unexpected economic contagion vastly alters future economic expectations. But generally, the Transportation Index tends to front-run economic expectations.

The fact that the US major indexes are all broadly lower while the Transportation Index is moderately higher (and really running counter to the bearish trending) today suggests this price decline is a technical pullback in price – not a broad market contagion event. As we interpret this early stage price rotation, we have to call it as we see it right now – Crude Oil is higher, the Transportation Index is higher, and the US Dollar rebounded higher yesterday. Until we see confirmation within all three of these components related to a change in price trend, we believe the current move is a technical pullback of the bullish price trend, meaning the markets just got ahead of themselves recently and this is a common pullback.

We are fairly early into this pullback and things may change if it progresses downward over the next few days/weeks. But right now the strength in the Transportation Index, the US Dollar, and Crude Oil are suggesting the markets are expecting a continued reflation trade (upward trending) to continue at some point in the near future. If the Transportation Index were to fall below $14,800 on a deep price decline, then we would immediately become very concerned that a broad market bearish price trend has set up, possibly setting off a very deep price correction.

As I highlighted in yesterday’s research article, precious metals will likely continue to rally in a moderate upside price trend because both Gold and Silver have recently started a new Advancing Cycle Phase. This start of a new Cycle Phase may be prompting some early rotation in the US major indexes right now and we’ll just have to watch and see how this proposed technical pullback plays out over the next few days/weeks.

Watch previous Pivot Low levels for support in the markets. We are seeing some increased volatility and when markets break previous “stand-out” pivot lows, that’s when we want to prepare for the potential of a deeper downside price trend. The basis of Fibonacci Price Theory is that price is always seeking new highs and new lows – thus, the breach of a major “stand-out” pivot low could be interpreted as a major breakdown in price trending.

As we’ve been suggesting for many months, the next few years are going to be full of incredible opportunities for traders and investors. Smart traders will quickly identify these phases of the market and will understand how to position themselves to take advantage of this next phase. You can learn more about how I identify and trade Gold, Silver, and the markets by watching my FREE step-by-step guide to finding and trading the best sectors.

For those who believe in the power of trading on relative strength, market cycles, and momentum but don’t have the time to do the research every day then my BAN Trader Pro newsletter service does all the work for you with daily market reports, research, and trade alerts. More frequent or experienced traders have been killing it trading options, ETFs, and stocks using my BAN Hotlist ranking the hottest ETFs, which is updated daily for my premium subscribers.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.