Gold Watch Out as Price May Be Staging New Momentum Base In Preparation For A Big Move Upwards

Commodities / Gold and Silver 2021 May 18, 2021 - 01:41 PM GMTBy: Chris_Vermeulen

Although Gold has continued to drift downward after reaching a peak near $2089.20 in early August 2020, our Custom Gold Inverse Trending Index suggests this weakness has actually built a very strong momentum base – preparing for a big move higher.

The relationship of Gold to the US Dollar is a fairly widely known correlation. When the US Dollar is weaker, Gold tends to rally. When the US Dollar is stronger, Gold tends to be weaker. Yet the combination of EURUSD and JPYUSD (plotted in INVERSE) in combination to the trend of the US Dollar related to Gold is difficult to ignore. Let’s explore this unique correlation a bit deeper.

Exploring Currency/Gold Correlations – Are We Starting A New 7 Year Gold Rally?

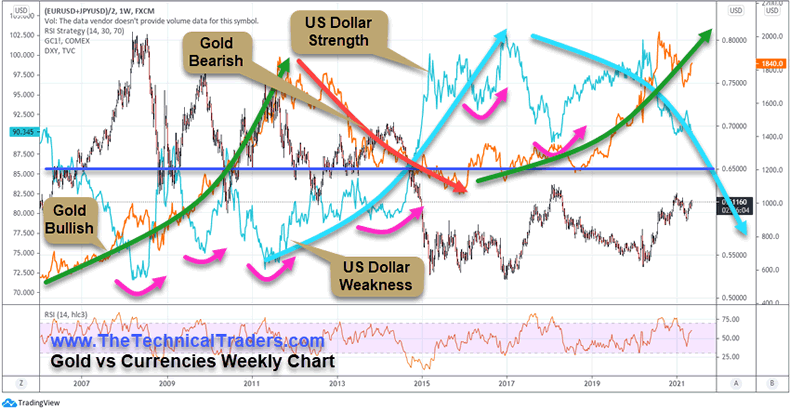

The Weekly Gold vs Currencies Chart, below, may seem a bit complicated, so let me try to explain what I’m trying to illustrate. First, the CYAN colored line is the US Dollar Index. What I want to share with you is the US Dollar enters periods of strength or weakness for extended periods of time. You can see the US Dollar Index weakening near the left edge of this chart near 2006-07, then strengthening again after a moderate bottom near 2013~14, then starting to weaken again after the recent peak in March 2020. These roughly 7-year cycles act as major US Dollar Index bias trends. We are current within a weakening US Dollar Index bias based on our research.

Second, the 85 to 86 level on the US Dollar appears to be a moderately critical support level. When the US Dollar falls below this level, entering a period of broad overall weakness, Gold tends to react to US Dollar strength more aggressively than when the US Dollar stays above the 85~86 level. A good example of this can be seen by the 2019 to 2020 rally in Gold while the US Dollar Index traded moderately higher while above the 86 level.

Next, when the EURUSD and JPYUSD move into a position of strength compared to the US Dollar, Gold tends to trend generally higher as the US Dollar weakness is persistent in driving traders/investors into safe-havens. The 0.65 level, the BLUE line, on this chart highlights the combined threshold for the US Dollar Index and the EURUSD/JPYUSD trend bias.

Lastly, we want to highlight how Gold reacted to US Dollar bottoming rotations in different bias trends. We’ve highlighted a number of US Dollar bottoms with MAGENTA arcing arrows. Notice how stronger upside moves in the US Dollar Index while trading below the 85~86 level prompted fairly deep downside price trends in Gold. You can see this happen over and over again in 2008, 2010, and 2011. Now, compare the US Dollar rallies/bottoms in 2014, 2016, and 2018 to how Gold reacted while the US Dollar Index had transitioned into a bullish bias (moving above the 85~86 level, or trending towards this bias).

The deep low in the US Dollar Index in 2011 prompted a very big change of trend for Gold – prompting a -20% decline followed by a deeper -38% decline before starting to bottom in 2015. The US Dollar bottom in 2015 prompted another-20% decline in Gold prices, yet the transition of the US Dollar moving to levels above 85~86 while the EURUSD/JPYUSD fell below 0.65 prompted a shift in how Gold started reacting to US Dollar weakness. The US Dollar bottom in 2016 actually prompted some moderate strength in upside trending in Gold and continued a new bullish bias for Gold over the past 6+ years.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

Now, with Gold rallying off the current US Dollar weakness while trading quite strongly above $1800, we are starting to see a transitional shift in the US Dollar Index and the EURUSD/JPYUSD correlation. Just like in 2006-07, if the US Dollar continues to weaken and trail below the 85~86 level, the current bullish trending in Gold will likely continue to strengthen. At that time, reactions to US Dollar bottoms may prompt some Gold volatility and rotation, yet the bias of the trending appears to be starting a new 7-year bullish Gold trending phase (just like what happened between 2007 and 2014). All we need to see happen is for the US Dollar to continue to weaken to levels below 85~86 (or continue to drift lower) while the EURUSD/JPYUSD correlation continues to strengthen.

Comparing Inverse EURUSD/JPYUSD to Gold Trends

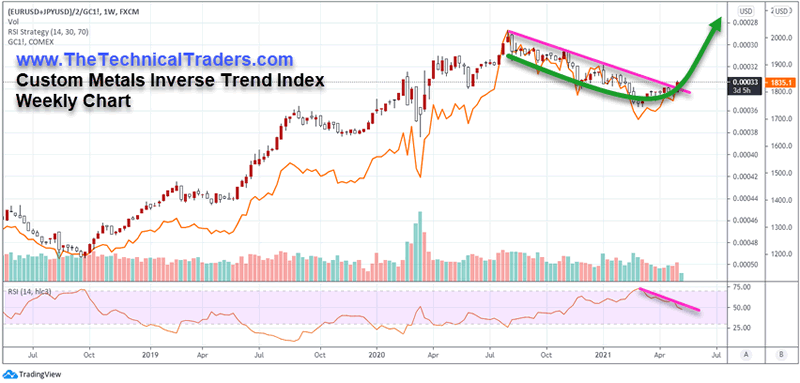

Our research team decided to try to use the EURUSD/JPYUSD correlation and attempt to align it to the price of Gold. In order to do this, because of the inverse price relationship between the two, we had to invert the EURUSD/JPYUSD price structure.

The Japanese Candlesticks on the chart, below, are reflective of our EURUSD/JPYUSD correlation to Gold. The GOLD line on the chart, below, is the real Gold Futures price level.

We are starting to see an upward price correlation between these two symbols as well as a potential technical correlation setting up over the next few weeks. If the US Dollar continues to weaken, pushing the EURUSD/JPYUSD higher, we’ll likely see an RSI bullish breakout confirm the price trigger that has just broken the downward price channel on this chart (the MAGENTA line).

It appears the recent weakness in Gold translates into the building of a new momentum base for precious metals near $1700. Are you ready for what may come next?

Although it may be difficult for you to see and understand these broad market bias phases and cycle trends, there are two key elements I hope you to conclude from our research:

- It appears a, roughly, 7-year currency/gold cycle phase takes place where the US Dollar becomes decidedly weaker while the EURUSD/JPYUSD becomes decidedly stronger – then these two switch directions/strengths. When the US Dollar is weaker throughout this 7 year cycle phase, Gold tends to become a bit more reactive to US Dollar strength, yet Gold continues to trend higher showing a very defined bullish trend bias.

- The transitional process of this cycle phase appears to be shifting into US Dollar weakness right now. The recent downward price trend in Gold appears to be a new Momentum Base in price near, or above $1700. If our research is correct and the proposed current transition takes place in the near future (the new cycle phase), we may see Gold enter a very defined bullish trend bias lasting more than 4~5+ years.

If you believe in the power of trading on relative strength, market cycles, and momentum but don’t have the time to do the research every day then my BAN Trader Pro newsletter service does all the work for you with daily pre-market reports, proprietary research, and trade alerts. More frequent or experienced traders have been killing it trading options, ETFs, and stocks using my BAN Hotlist ranking the hottest ETFs, which is updated daily for my premium subscribers. Sign up today!

In Part II of this article, I will explore longer term charts and how this currency correlation may be confirming a big upward price trend in Gold and what it means for traders/investors. I will also explore how this new potential rally phase in gold translated into proper positioning of assets and preparations for broad market volatility.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.