Stock Market: 4 Tips for Investing in Gold

Commodities / Gold and Silver 2021 Jun 06, 2021 - 04:59 PM GMTBy: Mark_Adan

Investment involves taking a risk. It involves putting your money on something with the hope that it will increase in value. Therefore, it will be difficult for you to participate in the investment if you are not a risk-taker. Anything can happen at any time, and you might end up incurring losses or profits. For someone who only had hopes of making a profit, the losses may discourage him/her.

Investing in gold can be the best decision to make if you want to diversify your investment. Gold is always considered the safest asset because it does not depreciate. It means that its prices keep increasing with time. Therefore, you are sure of making a profit when you invest in it. Below are some of the tips for investing in gold.

- Do not Choose Gold ETF Product Manager Based on Low Fees Alone

Choosing something based on its price is always dangerous and can make you choose the wrong product. The price of a product can easily lure you into considering price rather than quality. In the end, you incur significant losses that can easily discourage you from any form of investment.

The safest way to invest in gold is to take your time to monitor the fund or product manager for a few years before you purchase their product. It will help you know the performance of the fund manager. It will also help you have a clear idea of how well the manager will manage your account. Otherwise, you may invest in something that will only lead you to losses.

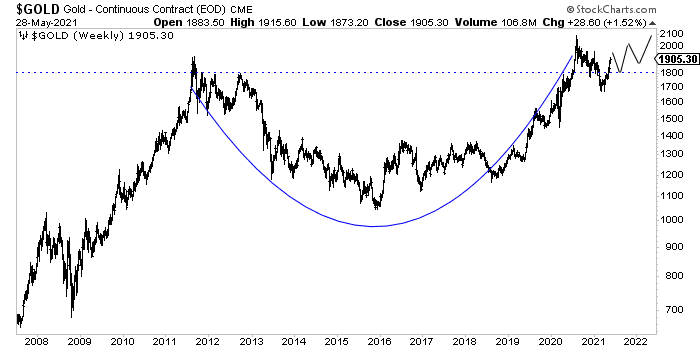

- Keep an Eye on the Gold Price Trends

Every business or investment is started to make a profit. It, therefore, means you will buy at a low price and sell at a higher price than the purchase price. It is, therefore, important to always keep an eye on the price trend. It will help you approximate the amount of profit you can make out of the investment.

Failing to consider the price trend may make you incur gross losses.

- Do not Make too Heavy or Long-Term Investments in Gold.

Investment involves taking a risk, and therefore it is wise to invest in it bit by bit rather than putting heavy investment at once. It will reduce your chances of getting double losses in case it occurs. Long-term investment can also interfere with the price trend, making you fail to achieve your target profit.

- Keep an Eye on your Account

Keeping an eye on your account and the type of transaction being done will enable you to make the necessary adjustments. It can be a necessity, mainly if a fund manager operates your gold ETF. Making the follow-up will help you know if you are doing good or bad. It will therefore help you increase the performance of your portfolio.

Conclusion

Investing in gold, just like any form of investment, requires some basic knowledge for you to succeed in it. Investing in something you know nothing about may make you incur losses. The tips above can help you make a proper investment in gold.

By Mark Adan

MarkAdanSEO@gmail.com

At Animuswebs.com, we specialise in content-led Online Marketing Strategies for our clients in the Marketing, Finance, Business industry and other sectors. With our professional writing team and our superb content creation programmes we achieve great marketing successes for our clients.

Copyright 2021 © Mark Adan - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.