Mixing of US Election Politics with Crude Oil

Politics / Crude Oil Oct 21, 2008 - 10:59 AM GMTBy: Gary_Dorsch

With two weeks left before the US presidential election, is Arizona Senator John “Maverick” McCain's sprint for the White House at a dead-end? His challenger, Illinois Democrat Barack Obama raked in $150 million in donor contributions from domestic and possibly foreign sources last month, and is planning an unrelenting brainwashing campaign until Election Day, in order to cement his lead in the opinion polls, and guide the Democrats to complete control of the US-government.

With two weeks left before the US presidential election, is Arizona Senator John “Maverick” McCain's sprint for the White House at a dead-end? His challenger, Illinois Democrat Barack Obama raked in $150 million in donor contributions from domestic and possibly foreign sources last month, and is planning an unrelenting brainwashing campaign until Election Day, in order to cement his lead in the opinion polls, and guide the Democrats to complete control of the US-government.

Democratic strategists are wildly optimistic that the ongoing financial crisis and sharp decline in the stock market can lead to a landslide Obama victory. “There is going to be an exceptionally large turnout, and that will disproportionately help Obama,” predicts Democratic pollster Peter Hart . Only two candidates have beaten the odds against them at this juncture in the election campaign. In 1980, Ronald Reagan surged from a 7-point deficit in the closing two weeks of the campaign, to a 10-point victory, beating Jimmy Carter by a landslide.

In 1948, Harry Truman was the underdog, and came back from a bigger deficit than the one McCain now faces. But if history is any guide to the future, the most likely scenario is the race will tighten slightly, and McCain would fall short of an upset victory. That's what happened to incumbent Gerald Ford in 1976, when he erased a 30-point summer-time deficit but narrowly lost by 2-points to Jimmy Carter.

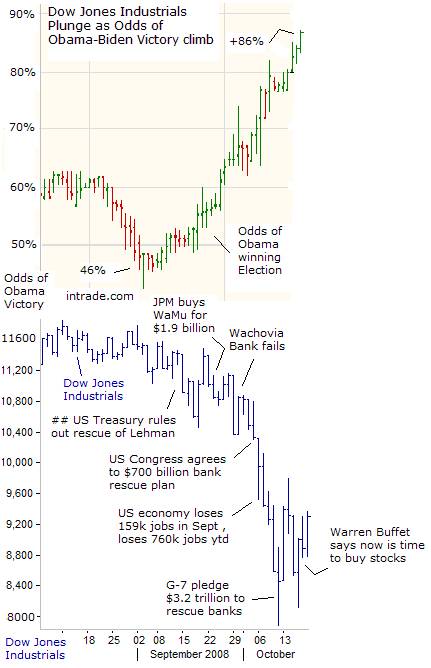

October tends to be a good month for the US-stock market if the incumbent party in the White House is about to win the presidential election. When the incumbent party is about to lose however, the stock market tends to perform poorly. Since 1900, the DJI has posted an average +2.7% gain in those presidential election years in which the incumbent party proceeded to win the election, in contrast to a -1.5% decline when that party lost. So far, the DJI is -14.6% lower in October 2008, after trading as much as -27.5% lower on the morning of October 10 th .

The odds of a McCain upset victory look even more daunting from another perspective. For the year to date, the DJI-30 is 30% lower, the biggest loss in a presidential election year through Nov 1 st , since 1932. That year, Democrat Franklin Roosevelt beat Republican President Herbert Hoover. In 1960, the DJI was -14% lower through Nov 1 st , when Democratic candidate John F. Kennedy defeated Richard Nixon, then the incumbent Republican vice president.

Traders at the on-line betting parlor intrade.com are watching the wild gyrations on Wall Street, and bidding 86-cents on the dollar in anticipation of an Obama victory, up from as low as 46-cents on Sept 8 th . Obama's surge at intrade.com was fueled by US Treasury chief Henry Paulson's reckless decision to pull the plug on Lehman Brothers, which in turn, ignited the October stock market meltdown and worst financial crisis since the Great Depression. McCain's campaign was derailed by Paulson's betrayal and the loss of $4.5 trillion in stock market wealth.

The vast majority of Americans are unfamiliar with Libor rates, the Community Re-Investment Act, credit default swaps, or the yen carry trade, and how these mechanisms impact the stock market. But they do understand that home prices are sinking, and the US stock market is 40% lower from a year ago, which combined, has wiped-out $15 trillion of household wealth. And with -763,000 jobs lost so far this year, economies abroad slowing, and hurting US-exports, most Americans are blaming the incumbent President George W. Bush, and lurching into the arms the 48-year old rookie Senator Barack Obama from Chicago .

The US stock market's swings this October have been the most volatile in history. The CBoE's Volatility Index – the VIX, recognized as the barometer of investor fear, vaulted to an unprecedented high of 81 last week, as the Dow Jones industrials plunged to the 8,200-level. Until then, the VIX hadn't traded above the 48-level for this entire decade. Irregardless of one's political persuasions, the October meltdown in the Dow Jones Industrials was closely correlated with Obama's steadily improving odds of winning the White House.

Wall Street is fearful of Social Democrats gaining a super-majority in Washington , ready to unleash higher taxes and regulations on big business. Wall Street's preferred candidate, John McCain, didn't even mention during the debates, his proposals to cut the capital gains tax rate in-half to 7.5%, and increase deductible capital losses to $15,000 from $3,000 for 2008 and 2009, in order to help investors ride out the bear market. McCain also wants to lower the US corporate tax rate by 10% to 25%, but he forgot to articulate these policies during the debates.

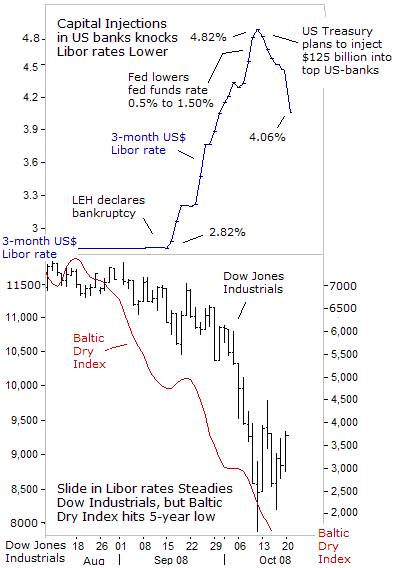

One hopeful sign for the McCain campaign has been signs of stabilization in the Dow Jones Industrials since October 10 th , amid indications that frozen credit markets are thawing-out. G-20 governments have moved to restore trust between lenders and borrowers, with $3.2-trillion in loan guarantees and capital injections last week, and in response, the 3-month London Inter-bank Offered Rate, Libor fell by 76-basis points to 4.06% today, from as high as 4.82% last week.

JP Morgan Chase lent-out between $10 billion and $15 billion in short-term funds to overseas peers at interest rates ranging from 3% to 4.5%, and not long after that, Citigroup and other US-banks followed suit, for the first time since the collapse of Lehman Brothers in mid-September. A sharp slide in US$ Libor rates can help bring down mortgage rates, and minimize further losses in the housing market.

Generally speaking, the stock market tends to bottom about 4-5 months before the end of a recession, and when economic conditions are widely expected to get substantially worse, and investors have given-up on any hope that the economy will improve in the foreseeable future. While short-term movements can be misleading, the stock market usually recovers before the economy or general investor sentiment turns upward. For McCain's campaign, a late market recovery could narrow the gap.

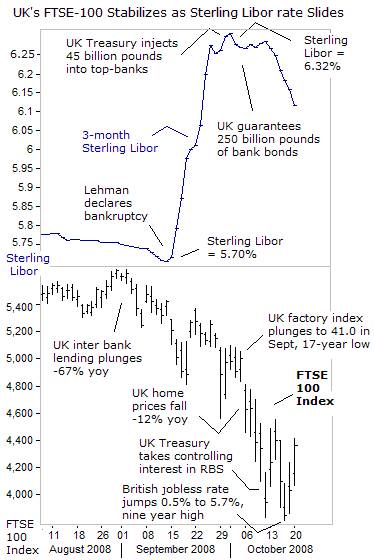

A pattern of stabilization is also seen in London , where the UK 's benchmark FTSE-100 Index, has soared 10% in the past two-days, in reaction to a 20-basis point slide in the 3-month Sterling Libor rate to 6.10% today. The UK government's bank rescue scheme, totaling 300-billion pounds ($510 billion), capped the Sterling Libor rate at 6.30%, and stock market sentiment is improving. However, the rescue scheme leaves the UK taxpayer massively exposed to potentially risky assets.

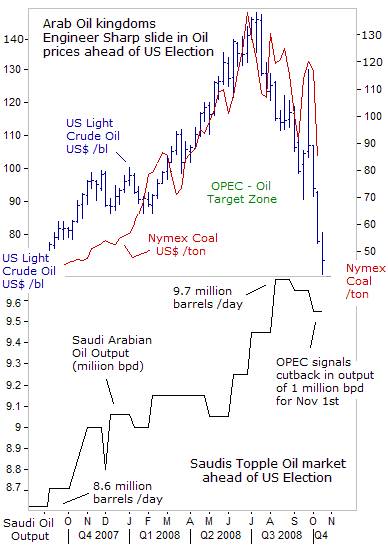

The Arab oil kingdoms have been working behind the scenes to engineer a sharp slide in oil prices ahead of the US-elections, in order to cushion the slide in global stock markets, and boost the odds of a McCain victory in November. So far, Riyadh is still pumping 700,000 bpd above its official quota target, but started to reduce its oil output in September to 9.55 million bpd, from 9.70 million bpd in August. Riyadh greased the skids under the crude oil market, which has plunged $75 per barrel, since catapulting to a record high of $147.27 on July 11 th .

However, gut-wrenching declines in the stock market, the collapse of Wall Street titans, massive government rescue operations for banks, and big job losses, have trumped what otherwise have been good news - gasoline prices in Ohio fell to $2.80 last week, down 4-cents from a year ago. The Saudis did their part to help the Republican ticket by driving gasoline prices lower. But now, faced with the alarming prospect of an Obama-Biden White House, combined with far-left leaning Democrats in Congress, the Arab oil kingdoms have decided to hedge their bets, by moving closer to Russian kingpin Vladimir Putin, Iran's chief military supplier.

The Kremlin Seeks closer Ties with OPEC

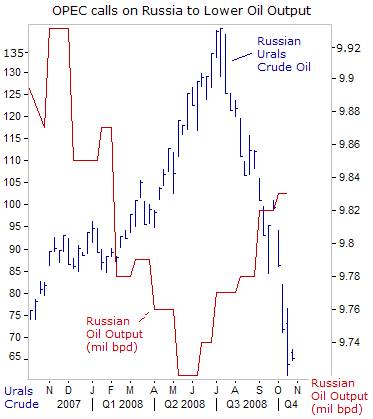

OPEC Secretary General Abdullah al-Badri visits Moscow this week to explore deeper ties with the Kremlin, in setting world oil prices. Russia relies on energy exports for 50% of its budget revenues, and the Kremlin is disturbed by the historic plunge in oil prices since mid-July. The price of Russia 's Ural Blend crude oil has plunged to $65 /barrel, and Moscow is basing this year's budget on an average oil price of $70 per barrel. As military and social spending rises next year, Moscow will need an average of $95 per barrel for Urals crude in order to balance its budget.

On October 20 th , OPEC chief Chakib Khelil called on non-OPEC producer to join the cartel with a concerted reduction in global supply. “There is a need for the contribution of oil producers like Russia , Norway and Mexico . Those countries benefit from the repercussions of OPEC decisions on prices. It would be good for OPEC, and for them, to contribute to production cuts to help stabilize sagging prices. A price between $70 and $90 should help everyone,” Khelil said, speaking ahead of an emergency meeting of OPEC on October 24 th in Vienna .

Russia , Norway , and Mexico haven't cooperated with OPEC since 2001, when they lowered oil output by a combined 450,000 bpd. Russian Energy Minister Sergei Shmatko said OPEC's al-Badri would meet with senior Kremlin leaders this week, “We will discuss the situation on the market. For us, the main thing is the format for co-operation,” Shmatko said. OPEC is signaling a production cutback of more than one-million barrels per day, starting on Nov 1 st , and is trying to get Putin's assurance that Russia will not try to fill the vacuum in OPEC's export markets.

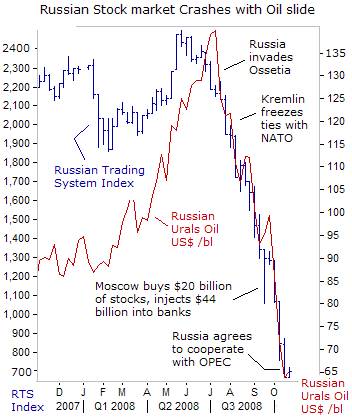

The meeting with OPEC comes at a time when the Kremlin is suffering from its biggest setback since the 1998 debt crisis. Russia 's stock market has collapsed by 70% from its peak in May, while its Urals blend crude oil has plunged by 50-percent. The Kremlin's war with Georgia, its bellicose rhetoric with Poland, threats to cut-off energy supplies to Western Europe, Putin's threat to dismantle coal miner Mechel MTL.n, and a depositor run on two retail banks, have all conspired to burst the world's last remaining stock market bubble.

Mr Putin's power in Russia has rested on his claim to have steered the country out of chaos of a tangle of debt defaults and a run on the rouble. Four years of high oil prices have left Moscow with no foreign debt and with more than $530 billion in foreign currency reserves. But, as foreign investors have been saying for years, Russia hasn't reinvest oil profits back into the industry, and production is now stagnant, while Mr Putin has failed to diversify the economy away from energy.

Vladimir Putin boasted on October 20 th , that Russia was well prepared to survive the global financial crisis while the West had been caught off guard. “ Russia 's economy is well prepared for lengthy external shocks. We did not allow ourselves to be caught unawares by the financial crisis. American, European, British structures, despite all the differences in how their systems are organized and how they work, were caught unaware.” On October 18 th Russian finance minister Alexei Kudrin indicated that the central bank will buy shares in Russian companies, mainly in state companies such as Gazprom and would sell them at a profit later on.

Moscow has already spent $67 billion of its foreign currency stash that it accumulated from high oil and natural gas prices, to prop-up its banking system and the Russian rouble, which is under speculative attack. Only a few months ago, the Kremlin was talking about pricing its oil in roubles and making the rouble a regional reserve currency, - a status closer to that of the euro and the dollar.

But that was before Russian tanks rolled into Georgia , the Russian stock market crashed 70%, and the price of Urals blend oil fell by half. Since the five-day war with Georgia, the rouble has lost 12% of its value against the dollar, and the central bank has been selling $600 million a day from its $530 billion FX stash, and the total cost of defending the rouble so far has reached $50 billion.

Moscow has pledged up to $200 billion from its reserves to help companies refinance foreign debts, and guarantee subordinated loans issued by banks. Putin also pledged $7.7 billion of budget funds to widen the remit of the Deposit Insurance Agency, to guarantee retail bank deposits. But the Kremlin's bailout plans also enable it to create near monopoly control over the Russian banking industry.

Indeed, the turmoil in Western stock markets could strengthen those in the Kremlin who argue that capitalism is too risky. In that case, the advantage will go to those, such as Mr Putin, who favor more control over key industries and the stock markets. And if America 's electorate moves to the far-left in this election, the door would be open for Putin to draw the powerful Arab oil kingdoms in the Persian Gulf, into an alliance with the “Axis of Oil” – Iran , Russia , and Venezuela .

On October 19 th , Senator Joe Biden, guaranteed that if elected, Barrack Obama would be tested by an international crisis within his first six-months in power. “Mark my words. It will not be six months before the world tests Barack Obama like they did John Kennedy. Watch, we're gonna have an international crisis, a generated crisis, to test the mettle of this guy.”

On October 19 th , Senator Joe Biden, guaranteed that if elected, Barrack Obama would be tested by an international crisis within his first six-months in power. “Mark my words. It will not be six months before the world tests Barack Obama like they did John Kennedy. Watch, we're gonna have an international crisis, a generated crisis, to test the mettle of this guy.”

“I can give you several scenarios from where it might originate," Biden said, mentioning the Middle East and Russia as high possibilities. The “Axis of Oil” – Iran , Russia , and Venezuela is praying for Obama – Biden to oust the Republicans, and will soon rattle hot spots in Central Asia and the Middle East , to jack-up sagging oil prices.

Can McCain Repeat Netanyahu's Magic Trick?

Though he is the longest serving politician in Israel , and a seasoned world figure, Shimon Peres 85, never managed to win outright an election for public office. His most embarrassing defeat happened 12-years ago, when Peres squandered a 17-point lead in the opinion polls, even with the full backing of the Israeli leftist media elite, in the 1996 race for prime minister. Instead, right winger Benjamin Netanyahu pulled-off an improbable victory, ousting Peres, the head of the Socialist Labor Party, by fewer than 30,000 votes, or a margin of less than 1 percent.

Left-wing exit polls suggested Peres would win, but as the actual votes were tallied past mid-night, in a race “too-close-to-call,” many Israelis “went to sleep with Peres, but woke up with Netanyahu.” Peres' wit and elegance makes him a favorite at the Congress of the Socialist International, an association of democratic socialist parties, but those qualities made little impression on Israeli voters.

Shimon Peres is an old hand in Israel at both elections and losing, and learned a few hard lessons in politics along the way, - “Israelis lie to the pollsters, just for the fun of it,” and as Peres is fond of saying, “Opinion polls are sweet to smell, but bitter to taste.”

Shimon Peres is an old hand in Israel at both elections and losing, and learned a few hard lessons in politics along the way, - “Israelis lie to the pollsters, just for the fun of it,” and as Peres is fond of saying, “Opinion polls are sweet to smell, but bitter to taste.”

Arizona 's John McCain can only pray the same holds true on November 4 th .

This article is just the Tip of the Iceberg of what's available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2008 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.