What Drives Gold Prices? (Don't Say "the Fed!")

Commodities / Gold and Silver 2021 Jun 11, 2021 - 07:16 PM GMTBy: EWI

Excerpted from Elliott Wave International's new FREE report "Gold Investor's Survival Guide: 5 Principles That Help You Stay Ahead of Price Turns."

There is a glaring hole in the popular understanding of what drives gold's price.

Mainstream finance believes the Federal Reserve's monetary and interest rate policies shape the trend.

That sounds like a solid explanation... except, the Fed officials themselves disagree!

Consider their own statements:

In July 2013, Fed chairman Ben Bernanke told Congress he "doesn't pretend to understand gold prices... nobody does."

Bernanke's successor Janet Yellen later concurred: "I don't think anybody has a very good model of what makes gold prices go up or down."

And at the 2014 New Orleans Investment Conference, perhaps the most famous Fed chair, Alan "the Maestro" Greenspan, explained that gold's "value...is outside the policies conducted by governments." (You know, like the highly revered quasi-government institution he used to be the head of.)

Despite the uncertainty voiced by the three most recent Fed chairs, mainstream analysts today still believe the Fed's monetary policy pushes around gold's price.

Investors accept this idea as fact because they hear it endlessly. But the notion is simply not accurate. As a result, these investors find themselves on the wrong side of the trend time and time again.

Fortunately, you don't have to be one of them.

Principle #1: Forget the fallacy that "gold follows the Fed."

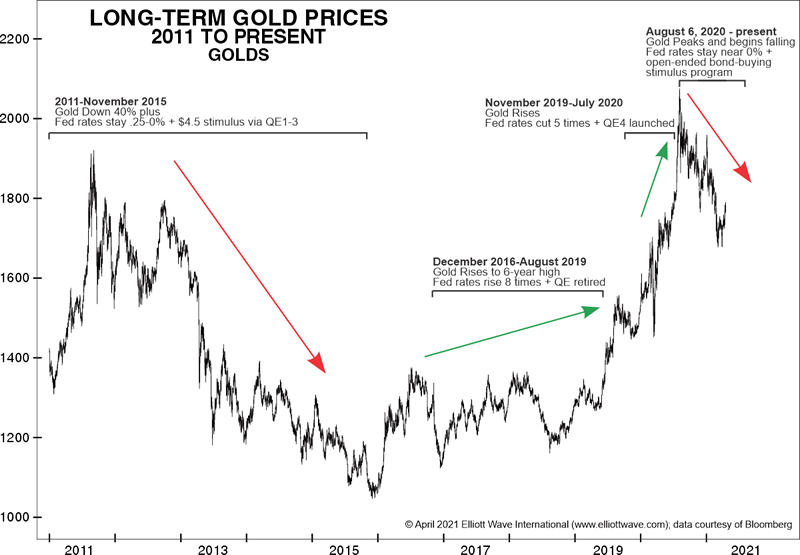

Consider this chart of gold prices alongside the Fed's monetary policy since 2011.

First red arrow: In 2011-2015, gold prices plunged 40%. By mainstream logic, gold's freefall must have coincided with hawkish Fed -- because higher rates make other investments besides gold more attractive, so gold prices fall. Right?

In fact, it was just the opposite. During the same period, in 2011-2015, the Fed left interest rates at their lowest level ever, 0% to .25%. But that's not all. The Fed also injected $4.5 trillion in stimulus into the markets and economy during this time via quantitative easing. According to conventional wisdom, either action should have pushed gold's price higher -- and together, MUCH higher.

Yet... gold fell over 40%!

First green arrow: Now look at December 2016 - August 2019, when gold prices moved mostly higher. That must mean the Fed was LOWERING interest rates at the time -- right?

Nope! During this time, the Fed RAISED rates eight times -- and QE had long been retired. Gold rose anyway.

Second green arrow: Next, look at November 2019 - July 2020. The Fed cut rates five times and launched QE4 in January 2020. Gold fell, right?

Ha! Despite the dovish Fed and the new QE, gold's rally resumed.

Second red arrow: Lastly, look at August 6, 2020. The Fed said it'd keep rates near 0% indefinitely and inject trillions in new stimulus money. Did gold rally?

Yeah, right! Gold prices peaked and turned down.

If anything, since 2011, the mainstream's understanding of the Fed/gold relationship has been backward.

Except, there is an even better explanation. Read it now in EWI's new "Gold Investor's Survival Guide." You'll learn an objective method to help you forecast gold's price moves, how to identify and stick with gold's trend and more. A $49 value, yours FREE. Get it now at elliottwave.com.

This article was syndicated by Elliott Wave International and was originally published under the headline . EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.