Apple between US China Wars

Companies / Apple Jun 28, 2021 - 03:35 PM GMTBy: Dan_Steinbock

America's most valuable $2 trillion company is no longer immune to US geopolitics. Apple's global success is an anomaly to the protectionist Trump-Biden administrations - for all the wrong reasons.

America's most valuable $2 trillion company is no longer immune to US geopolitics. Apple's global success is an anomaly to the protectionist Trump-Biden administrations - for all the wrong reasons.

Recently, Apple announced a set of additional privacy protections. The “private relay” feature will not be available to users in China. After the announcement, New York Times reported that Apple had given in to Beijing.

In fact, in addition to China, the privacy feature will not be available to users in many countries, including Belarus, Colombia, Egypt, Kazakhstan, the Philippines, Saudi Arabia, South Africa, Turkmenistan, and Uganda.

Yet, Times only targeted China.

No multinational can ignore local responsiveness

Since the 1980s, the leading multinationals have sought to reconcile global efficiencies with responsiveness to local markets. Nonetheless, many American technology giants still earn the bulk of their revenues in the high-income US and Western European markets.

In contrast, Apple has proved more innovative in global markets. In China, the company is trying to adjust to local market practices, just as all foreign and especially Chinese companies face great adjustment pressures in the US.

There’s a difference, though. Apple and other foreign ICT giants remain welcome in the Chinese mainland.

Yet, the reverse no longer applies, as evidenced by a decade of increasing persecution of Chinese technology companies in America from Huawei to Tik Tok, and the consequent plunge of Chinese FDI in America.

Where’s the money

Still another protectionist assumption is the idea that "the Chinese are taking away American jobs." The assumption is flawed.

In August 2018, Apple became the first publicly-traded US company valued at over $1 trillion; today its market capitalization amounts to $2.2 trillion. Its products are said to have some 1.7 billion users worldwide. Let’s illustrate the point with the value captured as a percent of the retail price of a smartphone (iPhone 7).

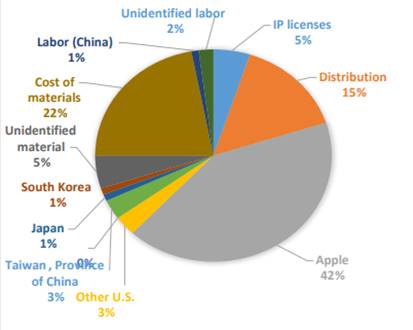

Apple captures a whopping 42% of the retail price of each iPhone sold. The rest goes to the cost of materials (22%), distribution (15%), IP licenses (5%), and countries like South Korea (1%), Japan (1%) and Taiwan (1%). Labor costs in China account for only1 percent of the total (Figure 1).

Figure 1 Value capture for iPhone 7

Source: Kendrick, J. and Kraemer, K.L. 2017, WIPO.

Usually, multinationals' revenues contribute to consumer welfare via progressive taxation. However, US companies tend to minimize taxes via creative accounting and tax havens, so there’s a gap between what’s paid officially and effectively.

Since the 1980s, these disruptive changes have dramatically contributed to erosion in progressive taxation, consumer welfare and thus to income polarization in America. That’s America’s challenge, however; not China’s.

Apple, offshoring and Taiwan

If the value capture isn’t the issue, what about offshoring to China? That’s the third misguided assumption.

Apple’s “Greater China” market includes not just China, but Hong Kong and Taiwan. It has assembled most of its products in China for a quarter of a century, thanks to Foxconn (Hon Hai), the huge Taiwanese multinational electronics contract manufacturer founded by Taiwanese billionaire Terry Gou.

Moreover, work conditions at Foxconn factories have been a matter of public debate since the early 2010s. The basic salary for a worker at a Foxconn facility is about $315 per month; less than 10% of the median American salary.

In June 2017, Foxconn said it would build a $10 billion TV manufacturing plant in southeastern Wisconsin that would initially employ 3,000 workers set to increase to 13,000, in return for the highest subsidies in US history. A few months later, a plant was launched in Mount Pleasant, Wisconsin (Figure 2).

Figure 2 The Rise and Fall of Foxconn’s US venture

June 2018 groundbreaking ceremony in Wisconsin: Guo with House of Representatives Speaker Paul Ryan, US President Donald Trump, Wisconsin Governor Scott Walker, and Christopher Murdock

Source: Wikimedia Commons

However, Foxconn began soon reconsidering its initial plant plans and the high labor costs in the US. After Biden’s election triumph, Foxconn announced it would reduce its planned investment to $672 million with 1,454 new jobs.

As long as per capita incomes will differ significantly among countries, opportunities for offshoring will abound.

US geopolitics vs Chinese market potential

And the final misguided protectionist assumption. What if Apple would refocus its operations into the US, as it is being pressured to do?

In the past decade, Apple’s quarterly revenues from Greater China have increased to $21.3 billion (1Q 2021). Its revenues from China remain around 15% of the total. That’s still significantly less relative to highly exposed US companies in China.

Last year, Apple had a great year in China, where full year shipments returned to the 2018 level, driven by both iPhone 11 and iPhone 12 models. It has recently added a dozen new Chinese suppliers. Chinese market is vital to Apple’s global future.

The developer community of Apple’s iOS app ecosystem has surged to over 4.4 million third-party developers in China. Moreover, China's shipment of wearable devices notched robust year-on-year expansion in the first quarter of 2021.

To position for the lucrative electric car future, Apple is in early-stage talks with BYD and CATL, and possible other companies over battery supplies for the "Apple Car,”. Chinese car market is critical to Apple since rapid growth remains in the mainland.

Over time, Apple’s revenues from China have potential to increase significantly, thanks to its innovative ecosystem which is hard to replicate by the competitors. Yet, the White House could derail Apple’s plans, which rely on economics, not on geopolitics.

Who’s undermining US competitiveness

To sustain its global position, Apple is trying to navigate amid the US Cold War against China. If it ignores US views, it will face pressures in the US; its largest current market. If it neglects Chinese views, it risks failure in China; its pivotal future market. What is certain is that

- Apple cannot ignore local responsiveness in any global market.

- Americans did not lose their jobs to the Chinese. Rather, income polarization in America is driven by misguided domestic policies that derail consumer welfare.

- Nor is offshoring the cause of U.S. malaise. Apple’s success has benefited especially Taiwan. Chinese workers have salaries Americans won’t accept.

- If Apple is forced out from China, it stands to lose far more in smartphones, development, wearables, electric cars and new future segments.

Apple’s greatest challenge is not China, but the underlying conflict between its ecosystem and Trump-Biden protectionism.

Dr. Dan Steinbock is the founder of Difference Group and has served at the India, China and America Institute (US), Shanghai Institute for International Studies (China) and the EU Center (Singapore). For more, see http://www.differencegroup.net/

© 2021 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dan Steinbock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.