Chasing Value in Unloved by Markets Small Cap Biotech Stocks for the Long-run

Companies / BioTech Jul 27, 2021 - 04:17 PM GMTBy: Nadeem_Walayat

Five more biotech stocks to add to the strategy of invest and forget for a potential X10 return. a reminder of why I am engaging in this binge on biotech stocks after having been focused on AI stocks for the past 5 years.

1. Biotech stocks are an unloved stocks sector whilst tech stocks over valued, even the ultra safe stocks such as the Top 10, so I am reluctant to add at current valuations hence why I hit the SELL button for the first time in many years and reduced my exposure to AI stocks by about 40%.

2. That biotech is a derivative of AI, we'll most sectors will soon become a derivative of AI because it is the PRIMARY tech megatrend of our age that will continue to broaden its reach to encompass all sectors of the economy.

3. That one of my former biotech 12xers got taken over (GW Pharma) that flooded my account with cash early May and so that focused my attention on repopulating my portfolio with 10 more biotech stocks where I expect at least 3 to 10x, with most of the rest expected to survive to varying extent. Though this is the stock market and so there are never any guarantees especially where such smallish cap stocks are concerned.

4. Our beloved AI stocks have been BID UP to high valuations, yes including Google, so they are not CHEAP, even after a 10% to 15% correction i.e. the likes of Microsoft and Amazon are discounting a lot of future earnings growth! Of course that does not necessarily mean that they are about to fall to what I would consider to be fair value let lone cheap levels as they did during March 2020 because at the end of the day they are GOOD stocks so usually command a healthy premium to invest in unless there is a market panic that marks everything lower regardless.

I had planned to have completed and posted this analysis shortly after my last biotech stocks analysis (Five More Small Cap Bio and Tech Stocks to Invest for 2021 and Beyond!), but focus shifted to crypto's on how to capitalise on the crypto bear market by investing in a select portfolio of crypto's at various buying levels, that and expectation of a correction would lower the price of these biotech stocks, which has happened even if the general market has held steady.

DISCLAIMER - Investing in Smallish cap stocks is VERY HIGH RISK. The analysis in this article is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis derived from sources and utilising methods believed to be reliable, but I cannot accept responsibility for any trading or investing losses that may be incurred as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any investing or trading activities

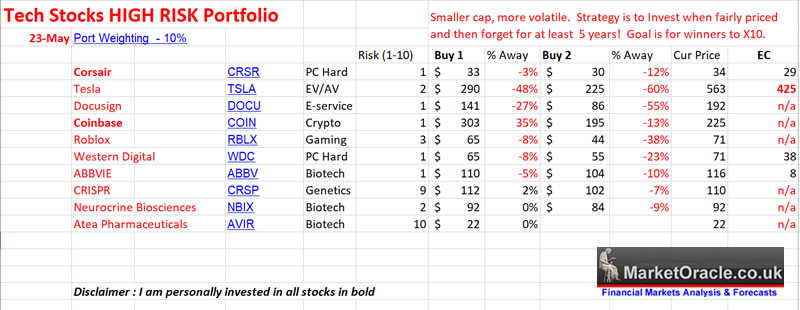

Firstly here's a reminder of the small cap bio-tech stocks state of play as per my last analysis of which I now personally hold positions in ALL 4 of the biotech stocks mentioned i.e. ABBV, CRSP, NBX, AVR, all of which are trending in the right direction. Though of course I am focused on many multiples towards 10x many years down the road.

This article is an excerpt form my latest in-depth analysis focused on finding value in unloved biotech stocks with the potential to X10 over the next 5 years. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Chasing Value with Five More Biotech Stocks for the Long-run

Contents

- RISK RATINGS

- HIGH RISK STOCK BUYING LEVELS\

- Bxxxxxxxxx - Bxxxx -- Risk 3

- Cxxxxxxxxxxxx- Cxxx - - Risk 5

- Txxxxxxxxxx - Txx - - Risk 1

- Bxxxxxxxxxxxxx- Bxxx - Risk 8

- Axxxxxxxxxxx - Axxx -- Risk 10

- High Risk Stocks Portfolio Buying Levels

- Netflix - FAANG a Buy, Sell or Hold?

- Trending towards Hyperinflation!

- Delta Variant!

- Solar CME MULTIPLE Black Swans

Including access to most recent extensive analysis - AI Predicts AI Tech Stock Price Valuations into 2024, Time to Buy Chinese Tech Stocks?

Contents:

- AI Stocks Value Forecaster (ASVF).

- How I Use ASVF6 - Percent Upwards Pressure (PUP)

- AI Stocks Buying Levels Plus ASVF & PUP

- AI Stocks Portfolio Buying Levels

- Dow Stock Market Trend Forecasting Neural Nets

- Pattern Recognition

- Trend Analysis Preprocessing

- Crossing the Rubicon With These Three High Risk Tech Stocks

- Cheap Chinese Tech Stock 1

- Cheap Chinese Tech Stock 2

- Cheap Chinese Tech Stock 3

- CME Black Swan

- You Don't Know How Big of a Bubble Your in until AFTER it BURSTS

- Stock Market Summer Correction

- REPO Market Brewing Financial Crisis Black Swan Danger

- Margin Debt Bubble

- US Bond Market Long-term Trend

- Michael "Big Short" Burry CRASH and HYPERINFLATION WARNING!

- Michael Burry's Track Record

- Michael Burry's Portfolio

- Investing During Uncertainty

- AI Stocks Portfolio Buying July Levels Update

- HEDGING AI Stocks Portfolio

- Crypto Bear Market Accumulation State

- Bitcoin Bull / Bear Indicator

- Market Oracle AI Coin Thoughts

- Biotech Brief

And access to my comprehensive analysis of Bitcoin and the crypto markets.

Bitcoin Bear Market Trend Forecast 2021 and Model Crypto Portfolio Buying Levels

- Investing in the Tulip Crypto Mania

- Bitcoin Price Trend Forecast Review

- Lessons Learned

- Cathy Crypto Wood's View on Bitcoin

- BITCOIN HALVINGS TREND TRAJECTORY

- Stock to Flow Infinity and Beyond!

- Bitcoin, Crypto's and the Inflation Mega-trend

- Black Swan 1 - Will Crypto's Get Banned?

- Black Swan 2 - GOOGLE

- Black Swan 3 - USDT Tether Un-Stable Coin Ponzi Schemes!

- BLACK SWAN 4 - Bitcoin 51% Network Attack by China?

- Black Swan 5 - Bitcoin is Already Obsolete

- US Trending Towards Hyperinflation

- BITCOIN TREND ANALYSIS

- Bitcoin Bear markets analysis - How low could she blow?

- Bitcoin Trend Forecast

- Bitcoin Long-term probable Next bull market price target

- Alternative Scenarios

- My Crypto Bear Market Investing Strategy

- Crypto 1 - Ethereum (ETH) $2600

- Crypto 2 - Bitcoin $40,375

- Crypto 3 - Ravencoin $0.078

- Crypto 4 - Cardano $1.59

- Crypto 5 - Pokadot $25

- Crypto 6 - ChainLink $26

- Crypto's 7 to 10

- Creating The Perfect Crypto

- How to Invest in Crypto Without Getting SCAMMED

- CHIA SCAM COIN

- Binance vs Coinbase

- Have ARK Invest Funds Bottomed?

Of which this video gives a taste of -

For crypto trading and investing see Binance for 10% discount on trading fees - Discount Code LZ728VLZ

For managing your crypto's see Coinbase

For GPU mining check out Nicehash (affiliate links).

My analysis schedule includes:

- More X10 Biotech Tech Stocks - 70% done

- Stock Market Trend Analysis

- UK House Prices Trend Analysis - 10% done

- How to Get Rich! - 70% done

- US Dollar and British Pound analysis

- Gold and SIlver Price Analysis

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your AI data preprocessing analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.