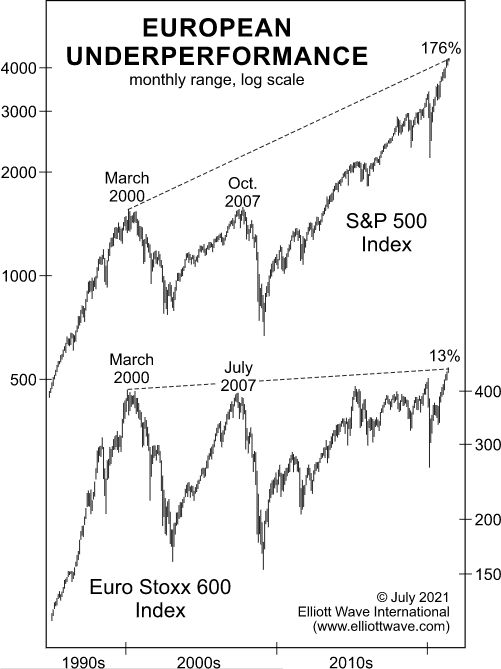

Dramatic Divergence between US and European Stock Markets

Stock-Markets / Global Stock Markets Aug 05, 2021 - 11:59 AM GMTBy: EWI

This chart shows a "dramatic divergence" between U.S. and European stocks

Cryptocurrencies and so-called meme stocks have certainly received a lot of attention from investors.

Another investment category that has been in favor recently is European equities. No, they may not be quite as "hot" as, say, bitcoin -- but they've been receiving more attention than usual.

Let's start with some recent headlines:

- U.S. investors are pouring money into European stock funds (Marketwatch, May 27)

- European Stocks Are Coming In From the Cold (Bloomberg, June 17)

- It's a Good Time to Invest in Europe (Kiplinger, June 24)

The July Global Market Perspective, an Elliott Wave International monthly publication which provides coverage of 50+ worldwide financial markets, offers more insight:

According to a June survey by Bank of America, more than a third of global fund managers are overweight eurozone equities, their highest exposure to Europe since 2018.

So, is it time to jump on the European equities' bandwagon?

Well, let's return to the July Global Market Perspective for the big picture. Here's a chart and commentary:

[It's] true. The Euro Stoxx 50 has handily beaten the S&P 500 in dollar terms this year. However, take a look at this stunning chart showing the dramatic divergence between the two regions over the past two decades.

The price patterns of the main stock indexes of two of the region's largest economies are also highly revealing.

The July Global Market Perspective provides detailed Elliott wave analysis of Germany's DAX and Britain's FTSE 100 which every global investor should review. Both indexes have reached critical junctures.

Also see charts of three European meme stocks -- and, get analysis of cryptocurrencies, forex, bonds, metals, energy and much more -- all in all, coverage of 50+ worldwide financial markets.

It's all inside the July Global Market Perspective, which you can access for free by joining Elliott Wave International's Global Market Perspective Gala FreePass Event, which runs from now through August 6.

Here's another quote from the July Global Market Perspective:

In a broad benchmark of U.S. stocks known as the Russell 3000 Index, there are 726 companies whose earnings don't cover their interest payments, a red flag to pros. These zombies are up an average of 30% in 2021 -- trouncing the 13% return for the whole index -- 41 have doubled since New Year's eve.

Even explicitly dire warnings don't seem to register. A bankruptcy plan under consideration by GTT Communications Inc. would wipe out shareholders, which is typical in Chapter 11 cases. Nevertheless, the company's stock is up about 69% since then.

Defiance of warnings is a trait of retail investors.

Continue to read our global financial analysis so you can prepare for major global financial shifts that will likely take most global investors by surprise.

Just follow this link: Elliott Wave International's Global Market Perspective Gala FreePass Event (now through August 6).

This article was syndicated by Elliott Wave International and was originally published under the headline Why a Global Fund-Manager Favorite May Start to Flounder. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.