U.S. Housing Market: Not "a Bubble This Time Around"?

Housing-Market / US Housing Aug 14, 2021 - 10:20 PM GMTBy: EWI

Here's what usually coincides with a big decline in real estate prices

Here's what usually coincides with a big decline in real estate prices

You probably know that the U.S. housing market has been red hot.

A certified financial planner wrote a July 20 article for Kiplinger, mentioning the record price levels in many areas of the country, and then added a personal observation:

I witnessed the price rise first-hand. I recently returned from a family vacation in the North Carolina mountains, where many homes now sell for double or triple the price compared to just a couple of years ago.

Stories abound of buyers signing contracts on homes without even doing a walk through. Some real estate agents are advising buyers to forgo inspections, saying they will just slow the process.

Yes, it's a maniacal residential real estate market.

Indeed, here's what the recently published July Elliott Wave Theorist, a monthly publication which provides analysis of financial markets and cultural trends, had to say:

Two excerpts from an article posted last week on the property market in my local area sum up the prevailing view:

First,

"It's the craziest market that I've seen in 25 years of experience," [Mr. X] said.

But,

[Mr. X] said he believes there will not be a bubble this time around, unlike the situation that unfolded in 2008.

It is ever the same: "I remember a top yesterday, and there may be a top in some distant future tomorrow," but there is never a top today!

The same type of psychology applies to stocks. Indeed, the trends of the real estate and stock markets tend to be strongly correlated.

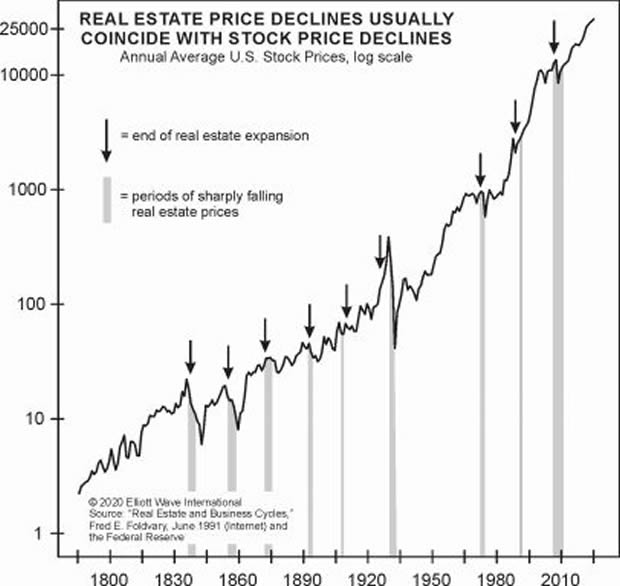

This chart from Robert Prechter's 2020 edition of Conquer the Crash has been shown before in these pages, and it's a good time to show it again. Here's the brief commentary:

Real estate prices have always fallen hard when stock prices have fallen hard. The chart displays this reliable relationship.

So, if you want to get a good idea of when home prices will likely tumble, keep an eye on the Elliott wave pattern of the stock market.

You can learn about the Elliott wave model for analyzing and forecasting financial markets by reading Frost & Prechter's Wall Street classic, Elliott Wave Principle: Key to Market Behavior. Here's a quote from the book:

In the 1930s, Ralph Nelson Elliott discovered that stock market prices trend and reverse in recognizable patterns. The patterns he discerned are repetitive in form but not necessarily in time or amplitude. Elliott isolated five such patterns, or "waves," that recur in market price data. He named, defined and illustrated these patterns and their variations. He then described how they link together to form larger versions of themselves, how they in turn link to form the same patterns of the next larger size, and so on, producing a structured progression. He called this phenomenon The Wave Principle.

You can access the online version of the book for free once you become a member of Club EWI, which is the world's largest Elliott wave educational community.

Club EWI membership is also free.

Here's the link to get started: Elliott Wave Principle: Key to Market Behavior -- free and instant access.

This article was syndicated by Elliott Wave International and was originally published under the headline U.S. Housing Market: Not "a Bubble This Time Around"?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.