The Rise And Fall Of Gold Stocks

Commodities / Gold and Silver Stocks 2021 Aug 21, 2021 - 08:03 PM GMTBy: Kelsey_Williams

The rise and fall of gold stocks is a story of hurt and disappointment. That is because most of the time gold stocks are in decline.

Below are four charts which depict the sad story. Following each chart I will make some brief comments…

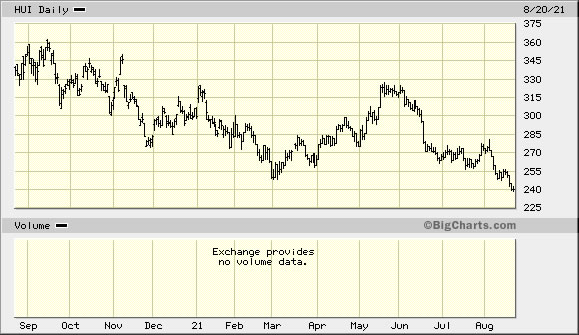

The HUI is back to its low reached earlier this year in March, at just under 255. Where it goes from here is anybody’s guess but you don’t need trend lines to see the progression of lower highs and lower lows.

The chart above shows that gold stocks are at their lowest levels since the peak in August 2020. Also, we can see that the HUI rested briefly at this same level when gold stocks were on their way up last year after the collapse in March 2020.

There is a possible (imaginary) line of support which dates back to the summer of 2018. A drop in gold stocks from here could fall from here and touch that line of support which comes in below 200 for the HUI.

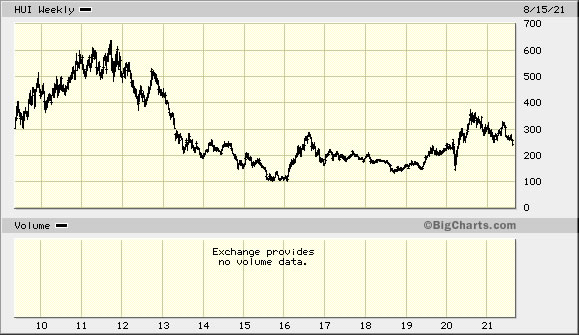

The longer-term chart above provides additional confirmation of possible support just under 200 for the HUI. The line of support (same as in the previous chart) actually dates back to HUI lows reached in 2015-16.

However, even at 255 currently, the HUI is sixty percent lower than its peak in 2011 of almost 650. On its own, that is bad enough. Compared to the price of gold, it is terrible.

The HUI to Gold Ratio illustrates how poorly gold stocks have performed relative to gold…

HUI (NYSE Arca Gold Bugs Index) to Gold Ratio

When gold peaked at a new high of $2060 oz. last August, the HUI peaked at 350 which was lower by forty-five percent from its 2011 peak.

The current HUI to Gold Ratio is .14 compared to a high of .64 in November 2003. The steep downtrend is intact and looks to have renewed itself.

Below is a chart of the XAU, another gold stock index which is narrower in scope; but it tracks similarly to the HUI…

Both the HUI and the XAU compare similarly to gold, but not favorably. Either index could be used to illustrate the poor absolute and relative performance of gold stocks.

SUMMARY

Gold stocks, generally speaking, underperform gold on the upside and drop more than gold on the downside.

The current trend of underperformance has been in place for the past two decades.

If you are speculating on new highs for gold and want to own it, then buy it. Don’t expect gold shares to outperform gold itself.

If you own gold stocks, consider switching to physical gold or a gold ETF.

If you are gambling on a reversal of the current trend, or you are just stubborn, you need to be prepared for the possibility (likelihood?) of a near-term drop in gold stock prices of 20-25 percent.

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2021 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.