Top Three Biggest Mistakes Made By Options Traders

Interest-Rates / Options & Warrants Aug 22, 2021 - 06:44 PM GMTBy: Chris_Vermeulen

I have been trading options and coaching / mentoring new options traders for years. I have seen new traders who were blindly successful and others who were so frustrated on the verge of giving up, I have seen it all. Over the years, I have seen some very common themes among all traders, especially with options. Options trading can be very rewarding but it is not as easy as buying and selling stocks. There are many more factors and variables you must take into consideration when trading options especially if you are swing trading them or holding them for an extended period of time.

There is a certain skill it requires that is a mix of technical, statistical, and fundamental analysis. These are not skills everyone has and you have to master all three if you want to be a really successful trader. I have noticed stock traders tend to have a good amount of fundamental and technical skills but usually lack in the statistical area. This can cause a problem when it comes to their success. While trading stocks, this might be a great formula that works but when switching to options it could be a losing formula. Many traders don’t know where they went wrong.

So below are the top three most common mistakes I see new options traders are making on a regular basis that prevents them from being profitable in trading stock options:

1. Understanding Historical and Implied Volatility

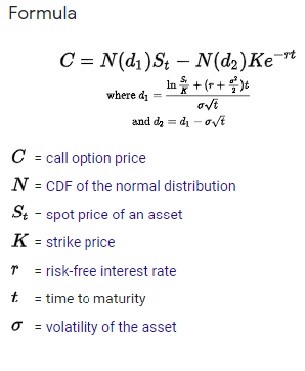

Volatility plays a huge part in determining the price and value of an option. You have to remember these assets are priced based on expected fair value usually by the Black-Scholes Merton (BSM) model. Below is the formula:

But let’s face it, not many people can really understand that. All you need to know is depending on when volatility moves how the price moves with it. The easiest way to do this is to use an options trading platform like ThinkorSwim or TradeStation and let the platform do the heavy lifting to determine what-if scenarios if volatility goes up or down on price.

2. Calculating The Cost of Buying Options

Often, I have seen traders buy options way out of the money hoping for a big move. Many times, that big move does not happen, then these traders lose. Even if you buy an option at the money (ATM) you still are expected that underlying stock to move greater than the overall cost of the option. For example, let’s assume there is a stock called XYZ trading at $100. You buy a call option that expires one month out for $10. You are assuming that XYZ will move up $10 to $110 just to break even in that month. So, your real “intrinsic” cost is $110. But wait, there is more, you are expecting this to happen within one month. There is a timer on this event. So, you need a relatively big move of 10% in less than one month.

3. A Belief They Can Buy Options And Make Millions In A Short Time

It is 100% possible to buy huge positions in options and make millions in a very short time but it is not practical nor is it probable. It is really just gambling. Gambling is not a good investing or trading strategy. Sure, people have won big but for every big winner you hear about, there are thousands blowing up their account. Usually what I see is people who are successful will keep trading and just like in the casino world they will give it all back and then some. It is pretty tragic to watch this, and I actually feel more sorry for the ones that have beginner’s luck because they are the ones that end up in the worst spot. As a person who lived this myself and I have blown up my account 3 times it is not fun and it can break a person both mentally and sometimes physically. RIP to the Robinhood options trader who killed himself after not understanding how TSLA option position. Slow and steady is what wins here. Base hits and not home runs. It’s okay to go for the occasional home run but that should be a VERY small percentage of what you trade. Look for consistent income and returns from your options trades. The bottom line is trading options is not a get rich quick ideology and if anyone tells you that they are not telling the whole story.

Every day on OTS – The Technical Traders we do define risk trades that protect us from black swan events 24/7. Many may think that is what stop losses are for. Remember the markets are only over about 1/3 of the hours in a day. Therefore, a stop loss only protects you for 1/3 of each day. Stocks can gap up or down. With options, you are always protected because we do define risk in an option spread. We cover with multiple legs which are always on once you own.

For those of you who are interested in Options Trading, our resident specialist Neil Szczepanski will be hosting a LIVE two-part Intermediate Course beginning on Wednesday, August 25, 2021. Neil will dive deep into the different strategies and outline what are the best trade setups and what to avoid – helping you to become a more knowledgable, confident, and advanced options trader. To learn more, or to register for the course, kindly click on the following link: INTERMEDIATE OPTIONS MENTORING COURSE.

As something entirely new, check out my initiative URLYstart to learn more about the youth entrepreneurship program I am developing. This is an online program of gamified entrepreneurship designed to introduce and inspire youth to start their own businesses. Click-by-click, each student will be guided from their initial idea, through the startup process all the way to their first sale and beyond. Along the way, our students will learn life lessons such as communication, perseverance, goal setting, teamwork, and more. My team and I are passionate about this project and want to reach as many people as possible!

Have a great day!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.