AI Predicts AI Tech Stock Price Valuations into 2024

Companies / AI Aug 28, 2021 - 11:32 PM GMTBy: Nadeem_Walayat

Dear Reader

This analysis is focused on my continuing journey to gradually off load my stock analysis processing power onto neural nets where this net attempts to forecast the value of AI stocks 3 years out based on my EC indicator resulting in a upwards pressure under the stock price indicator.

This article is an excerpt form my recent in-depth analysis : AI Predicts AI Tech Stock Price Valuations into 2024, Time to Buy Chinese Tech Stocks?

Contents:

- AI Stocks Value Forecaster (ASVF).

- How I Use ASVF6 - Percent Upwards Pressure (PUP)

- AI Stocks Buying Levels Plus ASVF & PUP

- AI Stocks Portfolio Buying Levels

- Dow Stock Market Trend Forecasting Neural Nets

- Pattern Recognition

- Trend Analysis Preprocessing

- Crossing the Rubicon With These Three High Risk Tech Stocks

- Cheap Chinese Tech Stock 1

- Cheap Chinese Tech Stock 2

- Cheap Chinese Tech Stock 3

- CME Black Swan

The whole of which was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month. https://www.patreon.com/Nadeem_Walayat.

AI Stocks Value Forecaster (ASVF).

My initial attempts some years ago at feeding raw financial data such as PE ratios, EBITA, PEG into neural nets failed to deliver anything useful, clearly it was not going to be that easy! What's required is to preprocess the data to make the various inputs better gel together rather than producing noise which means input from human intelligence (me) to preprocess the data before training the neural nets, and so was born what I call the Expensive / Cheap (EC) Indicator that includes 15 stock financial indicators all fine tuned manually to resolve in better being able to discriminate between stocks in fundamental valuation terms, add price to that to become 16 inputs. that have been preprocessed as per their formulation into the EC indicator.

IMPORTANT POINTS REGARDING USE OF THE ASVF6

1. That it is trained on bull market price and EC financial data, so it is unknown how it would behave during a bear market, probably over estimate future outlook for a stock prices, but it's unknown as there is a lag between price movements and corporate financial data. I have thrown bad numbers in and it does still tend to project higher prices but to a far less extent, but it does have a bull market bias.

2. That it is unknown how accurate the valuation forecasts will turn out to be as it is not actually forecasting price i.e. trend analysis, but price in terms of valuations. How much a stock will be worth in relative terms compared to what has come to pass under it's EC values..

3. That the data is limited to the stocks that I generate an EC for until I get around to writing better routines to auto generates the data to calc the EC with error checking..

4. That the readings are volatile i.e. there is very little smoothing of the forecasts i.e. if Google fell today by $400 then the forecast would fall by about roughly $400 to track the price lower, if it rose by $400 then the forecast would go up by about $400, So it is definitely not a trading tool but rather a relative future prospects valuation tool.

5. That it is still developmental i.e. the EC indicator is constantly being refined which means that preprocessing for inputs changes which can effect the forecasts i.e. I may discover a flaw in the formulates that requires a rethink, though which was the whole point of creating the EC indicator as if the EC indicator is useful than the preprocessing should also prove useful.

6. The key here is preprocessing the data, that it is always being fine tuned as per the construct of the EC indicator.

How I Use ASVF6 - Percent Upwards Pressure (PUP)

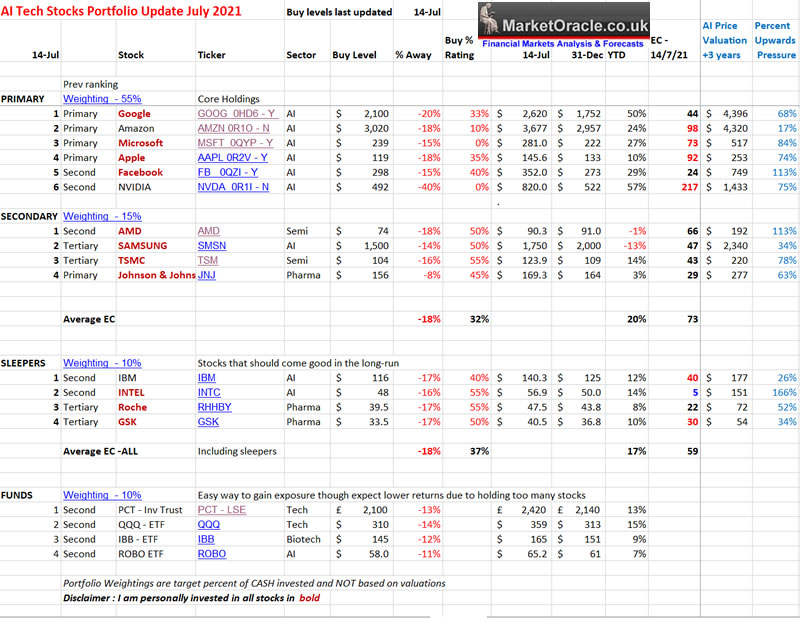

(Note all data in the AI / buying levels calc's are based on data upto 14th July 2021)

In my opinion the most important use for this tool is in the 2nd new column on my table AI stocks portfolio table, the Percent Upwards Pressure (PUP) which is basically the ASVF divided by the current stock price for percent change.

What this shows is literally the amount of UPWARDS pressure a stock is currently experiencing as the price as it is being PULLED towards it's future forecast which to me is far more useful than an always distant 3 year price forecast.

For instance it tells me which stocks are likely to have mild or no maybe even no price corrections due to the fact they have a high degree of upwards buying price pressure which in market terms translates into a LOT of investors waiting on the sidelines for the price to drop so that they can BUY! So what happens? The price does NOT drop instead it continues trending higher frustrating waiting to buy investors.

This is one of the key problems we have when trying to buy a deviation from the high. What do we do if the stock FAILS to fall? FAILS to see sense and follow the other stocks lower. Well we now get to peak under the markets hood and have advance warning of stocks that are going to be strong in relative terms come what may.

So for instance here I am sat waiting for Nvidia to correct towards my buying levels after selling all of my holdings at $715, having ignored the AI's advice that it would be a bad idea to SELL Nvidia stock, and what did Nvidia do it continued rocketing higher to well above $800 and is parked at $820 as I write (14th July 2021), and even after updating the EC levels the AI is still telling me (+171%) that it is not a good idea to sell Nvidia.

But what is of use right now is the Upwards Pressure Indicator.

It gives an alternative opinion on whether I should be buy, sell or hold an AI stock, an independant indicator. However, definitely not an automated trading system!

What I am actually looking for is if the indicator is telling me something significantly different, so that I can take a deeper look at that stock.

Whilst Yes having a distant price target can be comforting, but 3 years is too LONG! Especially for a primitive AI! And especially as we all know that company reports can be suspect, that can show huge swings between quarters especially at market junctures, so I would not take the 3 year valuation forecasts too seriously but instead focus on PUP.

AI Stocks Buying Levels Plus ASVF & PUP

Google $2620, ASVF $4396, PUP 168% WHITE CHAPEL AI Dominance!

Google is the primary stock on my list, the Neural Net (NN) confirms why it will remain so many years before I see a reason to completely disinvest from this stock, despite being up 50% year to date the stock has a high upwards pressure under it of 68%.

Google looks set to spread it's AI tentacles into the hardware space which means in the not to distant future it's going to be competing against the semiconductor tech giants for market share. Google AI's initial chip market to disrupt will be smartphone's in many ways similar to what Tesla is doing with autonomous vehicles right now Google will soon be seen be doing to smartphone's as Google's in house White Chapel chip that in hardware spec terms is LESS sophisticated than Qualcom's Snap dragons that it seeks to compete against, which on face value implies to expect middle of the road performance given its 8 core specs. However the key difference is that the chip has been designed by AI and is in a constant state of revision, Google AI continuously improving the design where today's traditional processor generations that extend from 12 to 18 months cut down to only mere days but even hours! This gives you a taste of what is coming and why the likes of Qualcom and Apple amongst others should be worried though also have an increasing input of AI in the design of their processors just not to the extent that Google has.

What this means is I will take advantage of short-term downwards stock price volatility to load up with Google stock. Of course when investing one needs to keep an eye on valuations for that is what ensures the probability for successful investments i.e. buying at low valuations and selling at high, but Google looks set to continue to grow its earnings well into the distant future. It;s just a question of which corporations that are slow to react will pay the price.

So as things Stand Google remains my primary AI stock to be invested in as it continues to demonstrate its lead as it trends towards AI dominance. Even so right now I cannot pay 35 times earnings so will either wait for earnings to play catchup and look to buy Google stock at under 28X earnings.

AMAZON $3677, ASVF $4320, PUP 17%

With only 17% upwards pressure confirms that I was right to de-risk by selling ALL of my Amazon stock. Similarly poor upwards pressure translates into under relative performance ( Up 24% YTD). When the market corrects, I now even more so than before expect Amazon to correct hard. Neither I nor the AI sees much justification for the stocks current surge higher, and my long standing buying level of $3020 may end proving to be significantly higher than where Amazon could trade down to.

Microsoft $281, ASVF $517, PUP 84%

Microsoft gets a stronger reading than my perception of the stock i.e. as per my last analysis I saw it as a middle ranking of the top AI stocks, hence sold 50% of my holdings, instead the AI see's the stock as having far greater upwards potential and support under it, even more than Google!

Apple $145.6, ASVF $253, PUP 74%

I have not been a fan of Apple's prospects relative prospects since at least November 2020 i.e. expected under performance which has transpired as the stock is only up (+10% YTD. But the AI is giving Apple benefit of doubt saying that it may not have much downside during a correction, so I don't agree with the AI.

Facebook $352, ASVF $749, PUP 113%

Facebook along with Google for a while have been my two best AI stocks., Unfortunately it does look like I made a mistake of selling 70% of my holdings, since which the stock has risen as indicated it would by the AI due to continuing immense upwards pressure of 113%. Though I don't see myself accumulating any Facebook stock above $298. Which could come back to bite me if Facebook fails to correct to below $300, if so next time I will take better note of the ASVF.

Nvidia $820, ASVF $1433, PUP 75%

The AI is effectively saying I was wrong to sell ALL of my holdings at $715 as it prices future prospects for the stock on par with that of Google, which I don't agree with. Anyway I remain uber bearish on Nvidia that I see as floating on thin air, even to the extent of going SHORT on the stock (with a tight stop)! So will ignore the ASVF in this case.

AMD $90.3, ASVF $192, PUP 113%

AMD has gone nowhere year to date but the AI is saying it has huge upwards pressure which means corrections should be milder than for others. Which concurs with my expectations Though it looks like I can forget about my fantasy buying level around $60, instead it looks like I will be a lucky to get a dip to below $80! Definitely not a stock to exit, which luckily I did not sell any of during my recent selling binge.

Samsung $1750, ASVF $2340, PUP 34%

Samsung after the stock price surge off the March 2020 low to the recent 2070 high appears to be going back to sleep, 33% upwards pressure is not much, the AI suggests its probably best to move Samsung to the sleeping giant category. Still it is yielding 3.,77% whist we wait for this sleeping giant to wake up again!

TSMC $124, ASVF $220, PUP 78%

The AI rates TSMC as a middle of the road AI stock, which fits my overall view of the this semiconductor stock that basically has very little effective competition for it's fab's right now, but fab plants ARE being built hence future prospects are more measured..

JNJ $169.3, ASVF $277, 63%

The AI confirms that JNJ should continue trending higher out of its preceding trading range.

IBM $90.3, ASVF $177, PUP 26%

The AI agrees with my decision to sell ALL of my IBM stock towards the top of its trading range. The AI does not see much upside potential for IBM. I am little more hopeful though whilst it is in it's trading range I will continue to sell at the top with a view to buying towards the bottom. Though I remain more optimistic for a whole host of quantum reasons on IBM in the long run.

INTEL $56.9, ASVF $151, PUP 166%

INTEL the literal sleeping giant that I have repeatedly flagged as being one of the few good buys out there right now, and the AI confirms this by giving it the highest upwards buying pressure of all the stocks so far at 166%. And as I have stated several times that I would not be surprised if Intel in a few short years time is trading towards $200. which the AI is confirming, I will definitely buy more Intel on a dip below $50.

Roche $47.5, ASVF $72, PUP 52%

A PUP of 52% is not that bad for this Big Pharma as the sector as a whole is unloved, maybe a sign to accumulate into pharma stocks during a correction.

GSK $40.5, ASVF $54, PUP 34%

Why am I still holding GSK? Oh yeah, the 5% dividend yield, something to remember when just looking at the stock charts. Dividends have delivered an effective 80% gain (against buying price and if reinvested) over the past 10 years so not quite as bleak an investment as it first appears. Still the AI confirms not to expect much upside for the stock price and so I may put a limit order in to sell towards the top of its' trading range.

The bottom line is that Amazon is a ticking time bomb for it's stock investors whilst Intel is the hidden gem.

TESLA

This also makes me wonder if most of us are misunderstanding Tesla and why the PE ratio for Tesla could be mostly irrelevant. Yes Tesla is an automaker but what I am increasingly becoming aware of is that Tesla has an exponentially increasing driving dataset, each of it's Tesla models has a myriad of sensors that transmit data back to Tesla, so forget the dozens or even hundreds of cars that others in the self drive game have deployed, Tesla has over 1 million cars passively generating DATA for Tesla! No other corporation comes anywhere close to that and so that is the REAL value of Tesla! Though still I would not consider buying north of $300.

AI Stocks Portfolio Buying Levels

The rest of this extensive analysis has first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month. https://www.patreon.com/Nadeem_Walayat.AI Predicts AI Tech Stock Price Valuations into 2024, Time to Buy Chinese Tech Stocks?

Contents:

- AI Stocks Value Forecaster (ASVF).

- How I Use ASVF6 - Percent Upwards Pressure (PUP)

- AI Stocks Buying Levels Plus ASVF & PUP

- AI Stocks Portfolio Buying Levels

- Dow Stock Market Trend Forecasting Neural Nets

- Pattern Recognition

- Trend Analysis Preprocessing

- Crossing the Rubicon With These Three High Risk Tech Stocks

- Cheap Chinese Tech Stock 1

- Cheap Chinese Tech Stock 2

- Cheap Chinese Tech Stock 3

- CME Black Swan

Including access to my most recent extensive analysis updating AI stocks buying levels as we head towards the window for a significant correction even a possible stock market crash.

AI Stocks Portfolio Buying and Selling Levels, Bubble Valuations 2000 vs 2021

- Stock Market Bubble Valuations 2000 vs 2021

- Microsoft to the Moon - OUCH!

- CISCO to the Moon - OUCH!

- INTEL to the Moon - OUCH!

- Tech Stocks in a Bubble today?

- China / US Stock Markets Divergence

- AI Stocks Portfolio Buying and SELLING Levels

- AI Stocks Portfolio Buy / Sell Table Update

- High Risk Stocks

- Market Oracle AI Coin Mothballed

- Global Warming Code RED

Also prospects for Financial Crisis 2.0 - Investing in a Bubble Mania Stock Market Trending Towards Financial Crisis 2.0 CRASH!

- You Don't Know How Big of a Bubble Your in until AFTER it BURSTS

- Stock Market Summer Correction

- REPO Market Brewing Financial Crisis Black Swan Danger

- Margin Debt Bubble

- US Bond Market Long-term Trend

- Michael "Big Short" Burry CRASH and HYPERINFLATION WARNING!

- Michael Burry's Track Record

- Michael Burry's Portfolio

- Investing During Uncertainty

- AI Stocks Portfolio Buying July Levels Update

- HEDGING AI Stocks Portfolio

- Crypto Bear Market Accumulation State

- Bitcoin Bull / Bear Indicator

- Market Oracle AI Coin Thoughts

- Biotech Brief

And access to my comprehensive analysis of Bitcoin and the crypto markets.

Bitcoin Bear Market Trend Forecast 2021 and Model Crypto Portfolio Buying Levels

- Investing in the Tulip Crypto Mania

- Bitcoin Price Trend Forecast Review

- Lessons Learned

- Cathy Crypto Wood's View on Bitcoin

- BITCOIN HALVINGS TREND TRAJECTORY

- Stock to Flow Infinity and Beyond!

- Bitcoin, Crypto's and the Inflation Mega-trend

- Black Swan 1 - Will Crypto's Get Banned?

- Black Swan 2 - GOOGLE

- Black Swan 3 - USDT Tether Un-Stable Coin Ponzi Schemes!

- BLACK SWAN 4 - Bitcoin 51% Network Attack by China?

- Black Swan 5 - Bitcoin is Already Obsolete

- US Trending Towards Hyperinflation

- BITCOIN TREND ANALYSIS

- Bitcoin Bear markets analysis - How low could she blow?

- Bitcoin Trend Forecast

- Bitcoin Long-term probable Next bull market price target

- Alternative Scenarios

- My Crypto Bear Market Investing Strategy

- Crypto 1 - Ethereum (ETH) $2600

- Crypto 2 - Bitcoin $40,375

- Crypto 3 - Ravencoin $0.078

- Crypto 4 - Cardano $1.59

- Crypto 5 - Pokadot $25

- Crypto 6 - ChainLink $26

- Crypto's 7 to 10

- Creating The Perfect Crypto

- How to Invest in Crypto Without Getting SCAMMED

- CHIA SCAM COIN

- Binance vs Coinbase

- Have ARK Invest Funds Bottomed?

For crypto trading and investing see Binance for 10% discount on trading fees - Discount Code LZ728VLZ

For managing your crypto's see Coinbase

For GPU mining check out Nicehash (affiliate links).

My analysis schedule includes:

- Silver Price Trend Analysis, AI Stocks Portfolio Update - 50% Done

- Stock Market Trend Forecast September to December 2021

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada - 15% done

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your AI data preprocessing analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.