Why "Losses Are the Norm" in the Stock Market

InvestorEducation / Learning to Invest Oct 14, 2021 - 11:59 AM GMTBy: EWI

"I can measure the motions of bodies, but I cannot measure human folly."

Did you know that Sir Isaac Newton "lost his shirt" in the South Sea Bubble of the 1720s?

This great scientist and mathematician lost more than the equivalent of a million 2021 dollars.

Here's a brief description of Newton's investment actions from Robert Prechter's landmark book, The Socionomic Theory of Finance:

[Sir Isaac Newton] invested a little bit early in the trend and "wisely" took a small profit. Watching the trend continue, he finally bet heavily and "wisely" held on for the long run. He eventually sold out at a near-total loss.

After this financial loss, Newton said:

"I can measure the motions of bodies, but I cannot measure human folly."

Newton's unfortunate investment story is instructive because it summarizes why stock market losses have been the norm among investors after a full market cycle.

In other words, investors are typically "timid traders early in a bull market and confident long term holders at the peak."

To drive the point home more starkly, let's look at how investors made out in a mutual fund over a 10-year period versus the performance of the fund during the same time span.

Let's start with this Dec. 31, 2009 Wall Street Journal quote:

The decade's best performing U.S. diversified stock mutual fund [is] Ken Heebner's $3.7 billion CGM Focus Fund, which rose 18.2% annually. ...

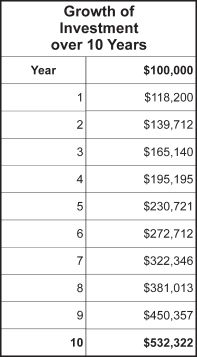

Here's a table of the mutual fund, showing the growth of an initial $100,000 investment:

As you can see, that initial investment more than quintupled in value as it grew at 18.2% annually, compounded. Quite a performance in a decade when the S&P 500 lost value.

Now, let's look at how much money investors in the fund made.

Let's return to that 2009 Wall Street Journal article:

The typical CGM Focus shareholder lost 11% annually in the 10 years ending Nov. 30. ...

Yes, you read that right.

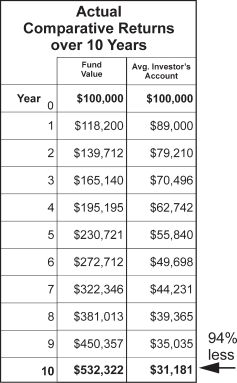

Let's return to The Socionomic Theory of Finance for a look at another table of the mutual fund:

The average investor in CGM Focus Fund during that 10-year period turned $100,000 into $31,200 for a loss of 68.8%. That is 94% less than the growth of the money in the fund.

The reason for that loss boils down to "herding" or "following the crowd."

As that Wall Street Journal article said:

These investor returns incorporate the effect of cash flowing in and out of the fund. Shareholders often buy a fund after it has had a strong run and sell as it hits bottom.

If you'd like to learn how Elliott waves reflect the repetitive patterns of "crowd behavior," you are encouraged to read the Wall Street classic, Elliott Wave Principle: Key to Market Behavior, by Frost & Prechter. Here's a quote from the book:

The Wave Principle is governed by man's social nature, and since he has such a nature, its expression generates forms. As the forms are repetitive, they have predictive value.

You can access the online version of the book for free after you become a Club EWI member. Club EWI is the world's largest Elliott wave educational community and is free to join. As a Club EWI member, you'll enjoy free access to a wealth of Elliott wave resources on investing and trading without any obligations.

Follow this link to get started right away: Elliott Wave Principle: Key to Market Behavior -- free and unlimited access.

This article was syndicated by Elliott Wave International and was originally published under the headline Why "Losses Are the Norm" in the Stock Market. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.