Best AI Tech Stocks ETF and Investment Trusts

Companies / Tech Stocks Oct 19, 2021 - 03:37 PM GMTBy: Nadeem_Walayat

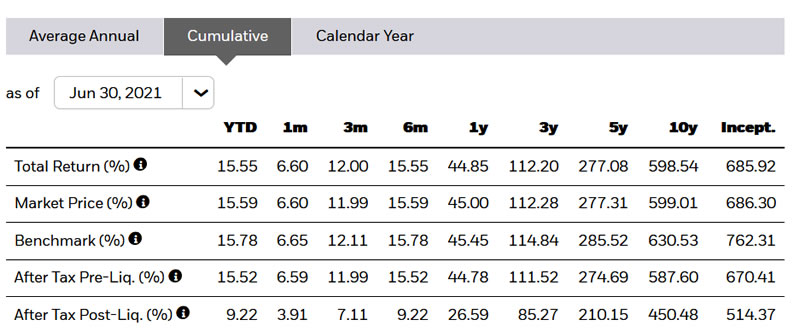

You all know I'm not a funds guy, I prefer to micro manage my portfolio i.e. if I want to sell ALL of my Amazon holdings then I SELL all of my Amazon holdings which is not possible with funds. However in pursuit of an ETF that closely matches my fully invested AI stocks portfolio then the iShares Expanded Tech Sector ETF that has been in existence for 10 years in which time comes close by holding all 6 of my Top 6 AI stocks in meaningful levels which has apparently delivered a return of 600% over the past 10 years and carries a relatively low expense ratio of 0.43% (management fee).

The fund is up 20% year to date which is set against the Nasdaq up 16%, S&P up 20%, so appears to deliver adequate performance, so is NOT along the lines of cathy maniac woods gambles on loss making stocks that is down about 5% year to date.

Whilst looking at the ETF's actual stock chart shows the price rising from $56 in August 2011 to $414 today, which is a gain of 639%.and 245% over the past 5 years, that's pretty good!

In terms of how closely the fund matches my AI stocks portfolio. Here are the etf's top 7 holdings. Again when fully invested the amounts are not too far off my own breakdown.

| MICROSOFT CORP | 9.4% |

| APPLE INC | 9.3% |

| AMAZON COM INC | 7.58% |

| FACEBOOK CLASS A INC | 5.95% |

| ALPHABET INC CLASS A | 4.52% |

| ALPHABET INC CLASS C | 4.31% |

| NVIDIA CORP | 3.58% |

So about 40% of the fund matches my top 6 AI stocks! And continues with Intel at 1.4% but drops off with AMD at 0.88%, and IBM at 0.86%. But then adds a further 300 stocks including tiny holdings of WDC and CRSR.

So this fund does come close to my portfolio of stocks, as for whether I would invest in it, unfortunately it cannot be bought within an ISA or SIPP or even an ordinary dealing account in the UK! When trying to make a trade I get a pop up stating "We are unable to trade this security as there is no KID/KIID document available." So I-shares need to get their admin workers to do their jobs and comply with UK requirements by compiling the KID/KIID docs! I've sent ishares a message asking them to do so, so who knows maybe they will listen?

I popped a trade query for SLV ETF and that too comes up as cannot buy, though I can sell what I already hold. Another reason to avoid funds. I would have been tempted to have limited exposure to the Ishares Tech ETF , say upto 5% of portfolio keeping in mind they do charge 0.43% per annum. But does represent a cost effective way of picking up exposure to the basket of the Top 8 AI stocks (including Intel and IBM), but lacks exposure to chinese stocks and others such as TSMC.

Ones does all that hard work to find a good ETF that one would invest in only for the waste of space at the FCA to block one from investing, only allowed to invest in the garbage funds that they authorise (for kickbacks). Looking back at the news the new rules came in force January 2018 and any hiccups were supposed to be temporary but here we stand over 3 1/2 years on!

Anyway this ETF so far is one of the closest matches to my AI stocks portfolio.

Best UK Tech Stocks Investment Trust?

During March 2020 looking for a quick fix to buy more after gorging myself on tech stocks I turned to trusty old PCT for quick UK exposure as a one stop shop for broad exposure to the top 5 out of 6 of my top AI stocks, though it's performance is lacking up only 6.7% year to date and 17% over the past 12 months most of which is NOT down to sterling's strength that and it's hefty 1% management fee continues to make it a sort of shorter term Investment hence why I sold out towards it's recent highs.

Now with the advantage of time to ponder the pros and cons here is probably one of the best AI Investment Trusts, with the focus being on trusts rather than funds for the obvious reason they trade as stocks so not subject to fund manager shenanigans in terms of preventing redemptions.

Scottish Mortgage Investment Trust - LSE:SMT

Primary focus is on performance and in those terms this UK listed fund has done well! Up 11.15% year to date, and up 44.9% on the past 12 months! So definitely a better performer than PCT! And of course it can be held with in an ISA and SIPP and other UK tax free wrappers.

As for its top 10 holdings, we'll it more reflects my high risk stocks portfolio than my AI stocks portfolio.

| Fund % | ||

|---|---|---|

| 1 | Moderna | 8.5% |

| 2 | Illumina | 6.6% |

| 3 | ASML | 5.6% |

| 4 | Tencent | 4.2% |

| 5 | Tesla Inc | 4.1% |

| 6 | NIO | 3.5% |

| 7 | Alibaba | 3.3% |

| 8 | Delivery Hero | 3.0% |

| 9 | Kering | 2.7% |

| 10 | Amazon.com | 2.6% |

| Total | 44.3% |

In terms of AI portfolio it holds -

| Fund % | ||

|---|---|---|

| 10 | Amazon.com | 2.6% |

| 13 | Nvidia | 2.1% |

And that's it! So not AI but more bio tech with a mix of software that apparently performs well and carries a relatively low annual charge of 0.34%. Would I invest in SMT ? Yes, and given it's relative performance I would be more likely invest in SMT than PCT at its buying level.

This article is an excerpt form my recent in-depth analysis : Stock Market FOMO Going into Crash Season, Chinese Stocks and Bitcoin Trend Update

- FOMO Fumes on Negative Earnings

- Cathy Woods ARK Funds Performance Year to Date - Chinese Stocks Big Mistake

- INTEL The Two Steps Forward One Step Back Corporation

- AMD Ryzen 3D

- New Potential Addition to my AI Stocks Portfolio

- Why is Netflix a FAANG Stock?

- Stock Market CRASH / Correction

- How to Protect Your Self From a Stock Market CRASH / Bear Market?

- Chinese Tech Stocks CCP Paranoia

- VIES - Variable Interest Entities

- CCP Paranoid

- Best AI Tech Stocks ETF?

- Best UK Investment Trust

- AI Stocks Buying Pressure Evaluation

- AI Stocks Portfolio Current State

- AI Stocks Portfolio KEY

- What to Buy Today?

- INVEST AND FORGET HIGH RISK STOCKS!

- High Risk Stocks KEY

- Bitcoin Trend Forecast Current State

- Crypto Bear Market Accumulation Current State

- Crazy Crypto Exchanges - How to Buy Bitcoin for $42k, Sell for $59k when trading at $47k!

The whole of this extensive analysis was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month . https://www.patreon.com/Nadeem_Walayat.

Including access to my most recent in-depth analysis - Silver Price Trend Forecast October 2021 to May 2022, CHINOBLE! AI Stocks Buying Plan

- UK Inflation Soaring into the Stratosphere, Real rate Probably 20% Per Annum

- The 2% Inflation SCAM, Millions of Workers take the Red Pill

- Silver Previous Forecast Recap

- Gold Price Trend Implications for Silver

- Silver Supply and Demand

- Silver vs US Dollar

- Gold / Silver Ratio

- SILVER Trend Analysis

- Long-term Trend Analysis

- Formulating a Trend Forecast

- Silver Price Trend Forecast October 2021 to May 2022

- Silver Investing Strategy

- SIL ETF - What About Silver Mining Stocks?

- Gold Price Trend Brief

- Why the CCP is Living on Borrowed Time and Needs a War

- Understanding the Chinese Regime and What it is Capable Of

- Guanxi

- Chinese People do NOT Eat Dogs Newspeak

- CHINOBLE! Evergrande Reality Exposes China Fiction!

- AI Stocks Portfolio Investing Strategy

- AI Stocks Portfolio Amendments

- AI Stocks Portfolio Current State

- October Investing Plan

- HIGH RISK STOCKS INVEST AND FORGET PORTFOLIO

- Why China Could Crash Bitcoin / Crypto's!

- My Next Analysis

Also my recent latest extensive analysis on the prospects for the stock market into Mid 2021 see - Stock Market FOMO Hits September Brick Wall - Dow Trend Forecast Sept 2021 to May 2022

Contents:

- Stock Market Forecast 2021 Review

- Stock Market AI mega-trend Big Picture

- US Economy and Stock Market Addicted to Deficit Spending

- US Economy Has Been in an Economic Depression Since 2008

- Inflation and the Crazy Crypto Markets

- Inflation Consequences for the Stock Market

- FED Balance Sheet

- Weakening Stock Market Breadth

- Why Most Stocks May Go Nowhere for the Next 10 Years!

- FANG Stocks

- Margin Debt

- Dow Short-term Trend Analysis

- Dow Annual Percent Change

- Dow Long-term Trend Analysis

- ELLIOTT WAVES Analysis

- Stocks and 10 Year Bond Yields

- SEASONAL ANALYSIS

- Short-term Seasonal Trend

- US Presidential Cycle

- Best Time of Year to Invest in Stocks

- 2021 - 2022 Seasonal Investing Pattern

- Formulating a Stock Market Trend Forecast

- Dow Stock Market Trend Forecast Sept 2021 to May 2022 Conclusion

- Investing fundamentals

- IBM Continuing to Revolutionise Computing

- AI Stocks Portfolio Current State

- My Late October Stocks Buying Plan

- HIGH RISK STOCKS - Invest and Forget!

- Afghanistan The Next Chinese Province, Australia Living on Borrowed Time

- CHINA! CHINA! CHINA!

- Evergrande China's Lehman's Moment

- Aukus Ruckus

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada and China - 30% done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your AI data preprocessing analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.