Chinese Tech Stocks CCP Paranoia and Best AI Tech Stocks ETF

Stock-Markets / Stock Market 2021 Oct 26, 2021 - 10:17 PM GMTBy: Nadeem_Walayat

Dear Reader

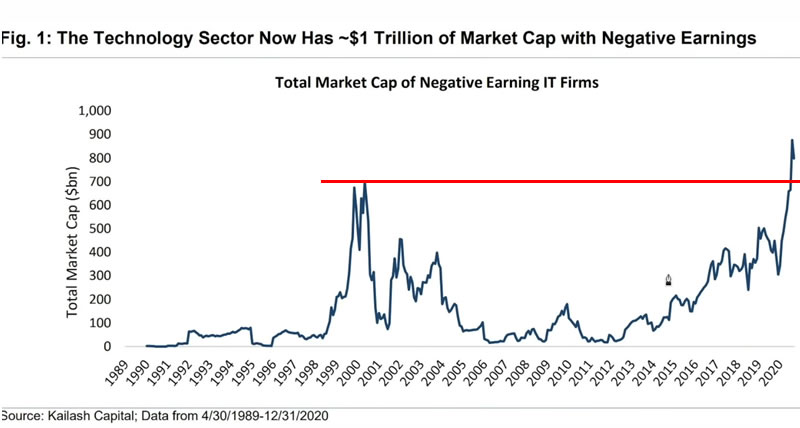

The stock market is continuing to rally on FOMO fumes with the Dow up 1.5% for August as the market enters the seasonally worst month of the year for stocks, followed by October, and we all know what October's tend to herald, especially for markets that have run well beyond every expectation and value metric that one can think of which is true for a wide spectrum of stocks from our AI tech giants right through to the junk that populates the likes of Cathy Woods ARK Funds, metrics as I covered in recent analysis such as the Reverse REPO market RED FLAG, then we have margin debt soaring to well beyond all previous market highs which actually would be expected in nominal terms given inflation, however Margin debt has also soared to new highs as a percentage of GDP 3.9% vs 3% in 2000. Here's another flashing RED LIGHT that of the market cap of negative earning stocks exceeding that of the dot com bubble, so folks enjoy your FOMO whilst it lasts, I personally have battened down the hatches for the hurricane that's coming our way that will likely blow novice investors out of the water, especially those who are investing on margin!

This is Part 2 of my extensive analysis (Part 1 - Stock Market FOMO Going into Crash Season)

Contents:

- FOMO Fumes on Negative Earnings

- Cathy Woods ARK Funds Performance Year to Date - Chinese Stocks Big Mistake

- INTEL The Two Steps Forward One Step Back Corporation

- AMD Ryzen 3D

- New Potential Addition to my AI Stocks Portfolio

- Why is Netflix a FAANG Stock?

- Stock Market CRASH / Correction

- How to Protect Your Self From a Stock Market CRASH / Bear Market?

- Chinese Tech Stocks CCP Paranoia

- VIES - Variable Interest Entities

- CCP Paranoid

- Best AI Tech Stocks ETF?

- Best UK Investment Trust

- AI Stocks Buying Pressure Evaluation

- AI Stocks Portfolio Current State

- AI Stocks Portfolio KEY

- What to Buy Today?

- INVEST AND FORGET HIGH RISK STOCKS!

- High Risk Stocks KEY

- Bitcoin Trend Forecast Current State

- Crypto Bear Market Accumulation Current State

- Crazy Crypto Exchanges - How to Buy Bitcoin for $42k, Sell for $59k when trading at $47k!

The whole of which (Stock Market FOMO Going into Crash Season, Chinese Stocks and Bitcoin Trend Update) was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Also gain access to my latest just published analysis highly timely analysis -

Bitcoin NEW All time High is TRIGGER for Future Alt Coins Price Explosion

Contents:

- Bitcoin & Ethereum 2021 Trend

- Crypto Portfolio Current State

- The BITCOIN NEW ALL TIME HIGH Changes EVERYTHING!

- Ravencoin to the MOON!

- What am I doing?

- How to Invest in Crypto's

- Bitcoin 2022 Price Target

- Ethereum 2022 Price Target

- Ravencoin 2022 Price Target

- Cardano (ADA) 2022 Price Target

- Chainlink 2022 Price Target

- Pokadot 2022 Price Target

- Solano 2022 Price Target

- Litecoin 2022 Price Target

- Arweave 2022 Price Target

- Stellar Lumens - XLM 2022 Price Target

- Eth Classic 2022 Price Target

- Vechain 2022 Price Target

- EOS 2022 Price Target

- Earnings Noise Delivers INTEL And IBM Buy Opps

- Facebook and Google Could CRASH 10% Post Earnings Day

- High Risk Stocks Swings and Roundabouts

As well as access to why inflation will be far from transitory, batton down the hatches for whats to come-

Protect Your Wealth From PERMANENT Transitory Inflation

- Best Real Terms Asset Price Growth Countries for the Next 10 Years

- Worst Real Terms Asset Price Growth Countries for the Next 10 Years

- The INFLATION MEGA-TREND

- Ripples of Deflation on an Ocean of Inflation!

- Stock Market Trend Forecast Current State

- US Dollar - Stocks Correlation

- US Dollar vs Yields vs Dow

- Stock Market Conclusion

- 34th Anniversary of the Greatest Crash in Stock Market History - 1987

- Key Lesson - How to REALLY Trade Markets

- AI Stocks Portfolio Current State

- October Investing Plan

- HIGH RISK STOCKS INVEST AND FORGET PORTFOLIO

- Can US Save Taiwan From China?

And my extensive analysis of Silver concluding in a trend forecast into Mid 2022.

Silver Price Trend Forecast October 2021 to May 2022, CHINOBLE! AI Stocks Buying Plan

- UK Inflation Soaring into the Stratosphere, Real rate Probably 20% Per Annum

- The 2% Inflation SCAM, Millions of Workers take the Red Pill

- Silver Previous Forecast Recap

- Gold Price Trend Implications for Silver

- Silver Supply and Demand

- Silver vs US Dollar

- Gold / Silver Ratio

- SILVER Trend Analysis

- Long-term Trend Analysis

- Formulating a Trend Forecast

- Silver Price Trend Forecast October 2021 to May 2022

- Silver Investing Strategy

- SIL ETF - What About Silver Mining Stocks?

- Gold Price Trend Brief

- Why the CCP is Living on Borrowed Time and Needs a War

- Understanding the Chinese Regime and What it is Capable Of

- Guanxi

- Chinese People do NOT Eat Dogs Newspeak

- CHINOBLE! Evergrande Reality Exposes China Fiction!

- AI Stocks Portfolio Investing Strategy

- AI Stocks Portfolio Amendments

- AI Stocks Portfolio Current State

- October Investing Plan

- HIGH RISK STOCKS INVEST AND FORGET PORTFOLIO

- Why China Could Crash Bitcoin / Crypto's!

- My Next Analysis

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month,https://www.patreon.com/Nadeem_Walayat.

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

Stock Market CRASH / Correction

We will soon be moving into the window for a stock market correction where I penciled the probable expectations for it to take place sometime between Mid Sept to Mid October, though it could start earlier hence why I was not willing to wait around and de risked ahead of the window.

How much could the general indices such as the Dow drop? I have in mind a drop of somewhere between 15% to 20% as being the most provable outcome, though it is early days, so it could be less or it could a more but 15% to 20% is what I have had in mind for the likes of the Dow for some time.

Whether it will be just a correction and resume it's raging bull market or signal start of a bear market proper is uncertain, probability favours continuation but this is not 2011 when we were in a hated stealth bull market that few took seriously instead now every tom dick and harry thinks that stocks can only go up! And so will assume that buying the dip is a one way bet to stock market riches. Which is why one needs to focus on VALUATIONS! Buy when Stocks are CHEAP! For it allows one to survive BEAR MARKETs and not end up with a 20 year Dead Parrots like Cisco and Intel!

Just as bull markets see stocks OVER VALUED, bear markets tend to see stocks UNDER VALUED. Which is why I am reluctant to buy stocks when they are trading above a PE of 20, as there is little margin for error, a stock on a PE of 20 could during a bear market trade down to a PE of 10! Which means if earnings stay static that's a 50% DROP IN VALUE! Which is why I tend to iterate that my portfolio is thus structured that during a bear market or crash I would be fine with my portfolio falling in value by the worse case scenario of 50%, THAT IS THE RISK OF INVESTING IN STOCKS that most of the Johnny come latelys have no experience of or clue of what could hit them! Investing on margin with their 10% or 20% stops is going to get them WIPED OUT!

For me a 50% drop would be a great buying opportunity! I WOULD BE SO HAPPY IF MY PORTFOLIO CRASHED BY 50% IN VALUE AS I WOULD DOUBLE MY PORTFOLIO! Maybe even TRIPLEd it ! For I understand that one can easily recover from a 50% drop, but NOT from a 90% DROP that would become a dead parrot investment!

It is a inevitable that a lot of noob retail investors are going to get badly burned and their PANIC actions will feed the decline which is why the anticipated correction of 10% to 15% could easily turn into a 25%, 30% even 50% bear market as falling prices trigger margin calls, forced selling results in a cascade of falling prices! Which is why I never invest on margin as that is just asking to go broke!

So if you are not fine with a 50% draw down then maybe you need to bloody well start de risking along the highs then pay the price for letting greed get the better of you! After all all those who made say 400% on Cisco going into the March 2000 highs lost ALL of their gains and MORE during the subsequent 90% collapse! Imagine if they had sold say half, they would have still come out the other end with a decent 100% profit instead of a loss that would have crushed their will to invest for the next 20 years, perhaps only to resume investing a few months ago given that we are in a mania that is sucking everyone into it's buy the dip vortex. Forget buying the dip for now instead SELL THE HIGH!

What if I am Wrong and There is No Correction?

We'll I have always considered a correction and crash to be temporary given the exponential nature of the AI mega-trend, which is one of the reasons that whilst i was selling over valued AI stocks, I was also loading up with mostly high risk biotech stocks and eventually jumping in with both feet into the downtrodden Chinese tech giants trading at CHEAP valuations. I say thank you to Winnie the Pooh President of China, you may be a dictator but you did deliver me a buying op so thank you for that.

If I am wrong and stocks don't fall then it is likely I will buy back at least some of my positions that I sold back during late October. That is the price I knew I could pay when I sold them. Though I can't say I will buy back every stock I sold for instance I may still be unable to stomach the high valuations of Amazon and Nvidia, but I will at least buy some Google, Facebook, Apple and Microsoft and aim to buy more Intel and AMD, though not sure about IBM but likely that too as well.

So even if I turn out to be wrong and a correction fails to materialise to any significant extent, then I was still RIGHT to sell 80% of my AI stocks when I did for had I not done so then I would NOT have gone on the hunt for high risk biotech stocks to the extent that I did and likely dismissed buying any chinese stocks as I would have considered them to be adding too much extra a risk too my already fully invested AI stocks portfolio.

So bare in mind, that when ones focus is on certain stocks (AI stocks) then there will be lack of focus on other potential opportunities, So by eliminating focus on what the AI stocks are doing , it can literally open ones eyes on what else is out there at a particular point in time because by the time some thing becomes a BIG INVESTING NEWS story then it is usually already too late to invest i.e. what's the point of investing in Tesla at $700! The time ito invest in Tesla when it was trading at under $200 when it was on few peoples investing radar! Now everyone wants a piece of Tesla!

How to Protect Your Self From a Stock Market CRASH / Bear Market?

Firstly stock market crashes are always TEMPORARY, so the worst thing one can do during a stock market crash is to SELL!

Secondly, the best way to ensure that the stock one is invested in actually does bounce back i.e. many financial stocks for obvious reason did not bounce back following the financial crisis, similarly many stocks after the dot com bust have YET to bounce back some 20 years on and a good 50% went bust..

So what is it that has prevented such stocks from bouncing back after a stock market crash / bear market?

That they were either OVER VALUED or experienced a COLLAPSE in earnings, and likely a mixture of BOTH!

So, rather than getting carried away with imagining how much higher ones core stocks could go, one needs to take a cold hard look at ones core holdings valuations for it is THAT which will determine what happens during a crash and a bear market.

Again a STOCK MARKET CRASH should prove TEMPORARY for Good stocks that are fairly valued. However the higher the valuation then the higher the risk that the market will re-rate the the stock. So even if you buy into the dollar cost averaging mantra, understand that VALUE is KEY! If the stock is expensive then be prepared to pay the price in terms of lack of performance post crash or post bear market.

As during a decade long bull market P/E's can reach levels which were once upon a time seen to be crazy with increasingly many coming out with statements that the valuation metrics of the past no longer apply. If you hear yourself saying that then you are asking to pay the iron price!

As a simple rule for growth stocks I look to pay less than a PE of 20, which means today there is very little that one can buy that one would expect would easily survive a crash and soon recover after a bear market. Amazon Trading at X56 is not going to recover after a CRASH or BEAR market for many, many years!

So take this as another reminder not to get too carried away with paper profits for when the bear bites they will vanish if not crystallised in advance of and you could have to contend with market valuations of sub 20, which for a stock trading on a PE of 40 or more, even with strong earnings growth is going to take many years to recover from. Whereas a growth stock trading on a PE of 20 will soon shrug it off.

The only way one can protect oneself from a crash or bear market the extent of which cannot be known in advance is to ensure one has not got carried away with allowing stocks to run to crazy valuations else be prepared to give up ALL of the value above a PE of 20 just as occurred during March 2020.

Chinese Tech Stocks CCP Paranoia

Don Xi Jin Ping Corleone continues to extract an ever escalating VIG from the chinese tek giants, three of which Bidu, Alibaba and Tencent perked my recent interest to start accumulating into once they crossed below a PE of 20 and for the fact their earnings growth continues to compound on an exponential trend trajectory, so buying chinese stocks should be a no brainier over a 3 to 5 year hold, i.e. new all time highs should be eventually a done deal.

However, as I keep pointing out we are dealing with a mafia enterprise in the Chinese Criminal Party (CCP) and so all must bow their heads down before Emperor Xi Jin Ping who has all the whole marks of absolute power having gone to his head, i.e. he is starting to go the way of all dictators by going a little insane, demanding tributes to the tune of hundreds of billions of dollars. For instance Tencent recently pledged to offer the crime syndicate $100 billion, likely soon to be followed by the other tek giants.

At this point in time it is difficult to say how long the tech blood bath will continue until the mafia that runs China has gorged itself full on hundreds of billions of dollars, but at this point in time I still see a fall in the chinese tech stocks as being temporary for I can not imagine that the Chinese mafia will actually kill the goose that lays the golden eggs, I am sure there will be some confucius quotes being brought to the attention of Xi Jin Ping.

So yes, under valued chinese stocks could go a lower, just as over valued US stocks have gone a lot higher, so there will could be pain in for those investors who don't have a clue about how to invest!

BUY when CHEAP and SELL when EXPENSIVE!. Investing isn't rocket science! Instead the weak hands focus on the draw down, who then make the fatale mistake of exiting early on fears that the lows could be revisited once more!

For instance look at all the fools who sold out of Apple at $5 because they imagined the stock price could once more revisit $2 as it had several times, instead at the time Apple under a PE of 20 was CHEAP! And remained CHEAP for MANY, MANY YEARS!

So looking back at the stock chart one can imagine why didn't everyone pile into Apple when it was dirt cheap at $5 or less? It's because investors were fearful of stock once more trading to back down to the lows and thus even if they were smart enough to buy at $2 or $3 tended to sell out at $5 or $6. Instead here we stand with Apple recently have skirted $150, some X30 higher!

However, HOWEVER these ARE chinese stocks, which means that the risks of accounting fraud and outright theft courtesy of the CCP mafia are HIGH so one needs to tread carefully, not get carried away investing, many thinking that investing in Alibaba is like investing in Amazon it is NOT because of what the CCP mafia does from time to time, for instance one only needs to look at what happened to the $100 billion home tutoring market which was destroyed overnight. I am not saying they will do the same to the likes of Alibaba but on a scale of 1 to 10 they WILL extract blood form these chinese tech giants and further afield affluent chinese which is why Chinese people have parked $100 billions in the UK property market to escape the clutches of the Chinese CCP mafia. For instance even chinese citizens are not allowed to own the land their homes sit on, whist at the same time Chinese investors own huge swaths of agricultural land and property across the United States!

Whilst many I am sure will say that the likes of the US is also seeking to regulate the likes of Facebook and Google, but the key difference is that the US regulations are towards privacy concerns whereas Chinese regulatory action is to prevent any pockets of emerging threats of power and influence on the masses outside of the total control of the CCP. There is a HUGE difference between regulations in the US and regulations in China, they are NOT the SAME and consequentially the investing risks are much higher.

VIES - Variable Interest Entities

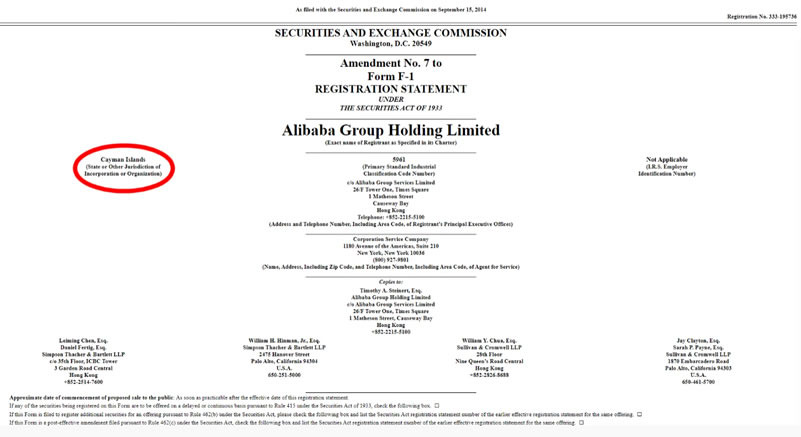

Right form the outset before the more recent warnings surrounding VIEs I stated that I would be investing in the three chinese tech giants Hong Kong listings rather than the NYSE listings of BABA, BIDU and TECHEY i.e. 0700, 9988, 9888 due to the VIEs being deemed as being much higher risk which was initially based on the risk of US delisiting of chinese stocks which I deemed to be a low risk at the time given the watered down proposals of giving a 3 year advance warnings for any delistiings. However when looking under the hood I was not entirely comfortable with investing in companies that are registered in the Cayman Islands rather than Hong Kong or China which is basically asking for trouble, high risk of getting scammed regardless of what the talking heads state, legally one is not invested in Alibaba China, legally one is invested in Alibaba Group Holding Limited, a Cayman Islands company, good luck with that if anything goes wrong and they shut up shop one day!

However for me the greater risk has always been of what the CCP would do, i.e. the whole point of creating the VIEs is to get around chinese laws of preventing foreign investment, so the CCP could at any time declare the Chinese tech giants to cease and desist with VIEs, which is ironic given the amount of capital china has invested abroad! So to specifically counter that risk I have invested using the HK exchange, a pain in the butt do so but nevertheless necessary to reduce already elevated risks, which is why I had been avoiding investing in chinese stocks in the first place until their recent lows. Though I am sure the likes of XI Jinping has many billions of dollars squirreled away in western assets such as property and stocks so if the CCP ever do press the doomsday investing button then they should also forfeit their investments in western assets, reap what they sow, If foreigners investing in Chinese assets lose because of the CCP dictatorship then so should Chinese nationals investing in western assets be it property, stocks or bonds and experience a similar fate i.e. a deterrent not to cross the line.

If CHINA does what it appears it could do in terms of destroying the value of foreign investors holdings then that would be another prime example that the Chinese government really is GANGSTER MAFIA organisation that seeks to SCAM Western Investors by means of VIEs, the worlds most sophisticated SCAMMER, stealing hundreds of billions of dollars for which there will be a day of reckoning much as Admiral Yamamoto realised when he watched the Zero's land safely back on his aircraft carriers flight decks on 7th December 1941, the CCP mafia would be well served to learn the lessons from history.

The bottom line is always keep in mind that Chinese stocks ARE HIGH RISK, so do not get carried away by buying the DIP! After 2 buys on each of the 3 target stocks I am now fully invested and very much doubt that I will buying anymore where approx 8% of my stocks portfolio is currently invested in Chinese stocks (AI+High Risk+ Cash on account =100%).

CCP Paranoid

What we are witnessing with regards the chinese Tech giants is likely the tip of an iceberg of a paranoid chinese communist party that appears to be going through the process of eliminating any pockets of power and influence out side of their direct control that ranges from corporations, to celebrities to billionaires all of which are being forced to bow to the CCP and I fear this is only the beginning for there are no limits to the degree of which the totalitarian state will go right down to the suppression of what ordinary individuals can think.

There are news stories of dozens of Chinese celebs disappearing, being silenced, erased from the media landscape with many being forced to flee China. Any chinese with any sizeable amount of wealth could soon become targets for their wealth to be stolen from them.

Watch for news over the coming months to emerge of hidden prison camps housing tens of thousands of formerly wealthy chinese citizens who have been stripped of their wealth to enrich Chinese communist party members as well as squash emerging pockets of power. Reminds me of the James Bond Movies will the evil billionaires seeking to take over, well that's likely how the CCP viewed Alibaba's Jack Mai and thus silenced him.

Best AI Tech Stocks ETF?

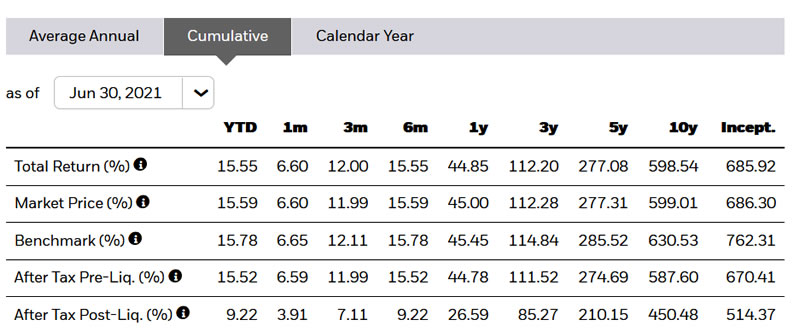

You all know I'm not a funds guy, I prefer to micro manage my portfolio i.e. if I want to sell ALL of my Amazon holdings then I SELL all of my Amazon holdings which is not possible with funds. However in pursuit of an ETF that closely matches my fully invested AI stocks portfolio then the iShares Expanded Tech Sector ETF that has been in existence for 10 years in which time comes close by holding all 6 of my Top 6 AI stocks in meaningful levels which has apparently delivered a return of 600% over the past 10 years and carries a relatively low expense ratio of 0.43% (management fee).

The fund is up 20% year to date which is set against the Nasdaq up 16%, S&P up 20%, so appears to deliver adequate performance, so is NOT along the lines of cathy maniac woods gambles on loss making stocks that is down about 5% year to date.

Whilst looking at the ETF's actual stock chart shows the price rising from $56 in August 2011 to $414 today, which is a gain of 639%.and 245% over the past 5 years, that's pretty good!

In terms of how closely the fund matches my AI stocks portfolio. Here are the etf's top 7 holdings. Again when fully invested the amounts are not too far off my own breakdown.

| MICROSOFT CORP | 9.4% |

| APPLE INC | 9.3% |

| AMAZON COM INC | 7.58% |

| FACEBOOK CLASS A INC | 5.95% |

| ALPHABET INC CLASS A | 4.52% |

| ALPHABET INC CLASS C | 4.31% |

| NVIDIA CORP | 3.58% |

So about 40% of the fund matches my top 6 AI stocks! And continues with Intel at 1.4% but drops off with AMD at 0.88%, and IBM at 0.86%. But then adds a further 300 stocks including tiny holdings of WDC and CRSR.

So this fund does come close to my portfolio of stocks, as for whether I would invest in it, unfortunately it cannot be bought within an ISA or SIPP or even an ordinary dealing account in the UK! When trying to make a trade I get a pop up stating "We are unable to trade this security as there is no KID/KIID document available." So I-shares need to get their admin workers to do their jobs and comply with UK requirements by compiling the KID/KIID docs! I've sent ishares a message asking them to do so, so who knows maybe they will listen?

I popped a trade query for SLV ETF and that too comes up as cannot buy, though I can sell what I already hold. Another reason to avoid funds. I would have been tempted to have limited exposure to the Ishares Tech ETF , say upto 5% of portfolio keeping in mind they do charge 0.43% per annum. But does represent a cost effective way of picking up exposure to the basket of the Top 8 AI stocks (including Intel and IBM), but lacks exposure to chinese stocks and others such as TSMC.

Ones does all that hard work to find a good ETF that one would invest in only for the waste of space at the FCA to block one from investing, only allowed to invest in the garbage funds that they authorise (for kickbacks). Looking back at the news the new rules came in force January 2018 and any hiccups were supposed to be temporary but here we stand over 3 1/2 years on!

Anyway this ETF so far is one of the closest matches to my AI stocks portfolio.

Best UK Tech Stocks Investment Trust?

During March 2020 looking for a quick fix to buy more after gorging myself on tech stocks I turned to trusty old PCT for quick UK exposure as a one stop shop for broad exposure to the top 5 out of 6 of my top AI stocks, though it's performance is lacking up only 6.7% year to date and 17% over the past 12 months most of which is NOT down to sterling's strength that and it's hefty 1% management fee continues to make it a sort of shorter term Investment hence why I sold out towards it's recent highs.

Now with the advantage of time to ponder the pros and cons here is probably one of the best AI Investment Trusts, with the focus being on trusts rather than funds for the obvious reason they trade as stocks so not subject to fund manager shenanigans in terms of preventing redemptions.

Scottish Mortgage Investment Trust - LSE:SMT

Primary focus is on performance and in those terms this UK listed fund has done well! Up 11.15% year to date, and up 44.9% on the past 12 months! So definitely a better performer than PCT! And of course it can be held with in an ISA and SIPP and other UK tax free wrappers.

As for its top 10 holdings, we'll it more reflects my high risk stocks portfolio than my AI stocks portfolio.

| Fund % | ||

|---|---|---|

| 1 | Moderna | 8.5% |

| 2 | Illumina | 6.6% |

| 3 | ASML | 5.6% |

| 4 | Tencent | 4.2% |

| 5 | Tesla Inc | 4.1% |

| 6 | NIO | 3.5% |

| 7 | Alibaba | 3.3% |

| 8 | Delivery Hero | 3.0% |

| 9 | Kering | 2.7% |

| 10 | Amazon.com | 2.6% |

| Total | 44.3% |

In terms of AI portfolio it holds -

| Fund % | ||

|---|---|---|

| 10 | Amazon.com | 2.6% |

| 13 | Nvidia | 2.1% |

And that's it! So not AI but more bio tech with a mix of software that apparently performs well and carries a relatively low annual charge of 0.34%. Would I invest in SMT ? Yes, and given it's relative performance I would be more likely invest in SMT than PCT at its buying level.

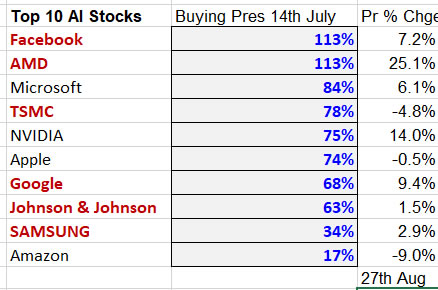

AI Stocks Buying Pressure Evaluation

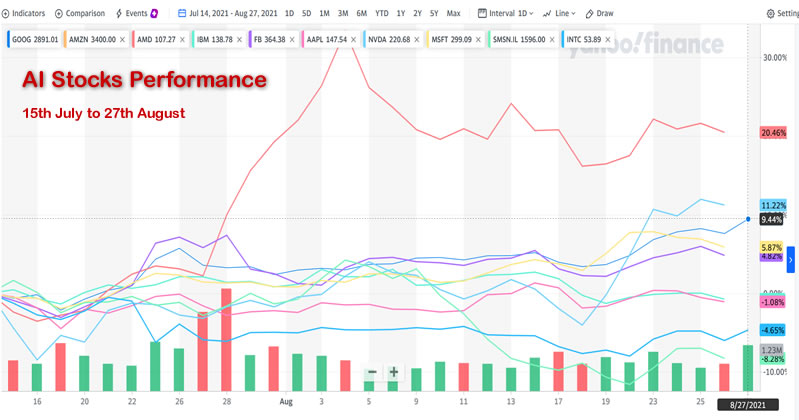

Its now over 6 weeks since I first posted the AI generated forecasts where I deemed the resulting Buying Pressure as being the most important derived indicator for what the stocks are likely to do. For instance Facebook and AMD were expected to be the strongest, and not far behind Microsoft, Apple, Google, where Nvidia strength was contrary to my expectations for this over valued stock. Basically the AI was saying that I had a mistake mistake by selling out of Microsoft, Apple and Nvidia etc. The only decision it was concurring with was that Amazon was expected to be weak with only 17% upwards buying pressure, as was Samsung at 34%. and IBM on 26%. Whilst an unloved Intel continued to carry huge unrealised potential hence my seeking to accumulate more on any dips below $50.

So how has this indicator faired over the subsequent 6 weeks, here are the AI stocks listed in order of buying pressure and their performance since the Mid July run.

The 2 strongest stocks are up 25% and 7.2%, whilst the 2 weakest stocks are Down 9% and Up 2.9%. So the buying pressure even on this short-time frame proved useful in ones decision making process where the higher the buying pressure for primary and secondary stocks then the greater the probability for higher stock prices, whilst Sleepers tend to do their own thing. So the ASVF has passed it's first real world, real time test as one should always be skeptical of black boxes which is basically what neural nets are i.e. I do not know exactly what it's doing in terms of determining it's weights and outputs.

The bottom line is that an indicator can only be taken seriously if it continues to deliver going FORWARD, and not the back testing garbage that many tend to be obsessed with.

Again for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Especially my highly timely analysis on the crypto markets and where they are likely to go next - Bitcoin NEW All time High is TRIGGER for Future Alt Coins Price Explosion

In advance of which I posted a video on why Ravencoin was on the cusps of breaking out higher that would mark the start of a trend to new all time highs i.e. from 0.11 to above 0.29.

My analysis schedule includes:

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada and China - 65% done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Your cryptos accumulating analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.