Wild Choppy Stock Market Moves

Stock-Markets / Financial Markets 2021 Nov 01, 2021 - 01:50 PM GMTBy: Monica_Kingsley

One-sided S&P 500 session, perhaps a bit too much – the bulls are likely to face issues extending gains when VIX is examined. The stock market sentiment remains mixed, and one could easily be pardoned for expecting larger gains on yesterday‘s magnitute of the dollar slump. And long-dated Treasuries barely moved – their daily candle approximates nicely the volatility one as both give the impression of wanting to move a bit higher while their Thursday‘s move was a countertrend one.

Not even value was able to surge past its Wednesday‘s setback, which makes me think the bears can return easily. At the same time, tech stepped into the void, and had a positive day, balancing the dowwnside S&P 500 risks significantly. The very short-term outlook in stocks is unclear, and choppy trading between yesterday‘s highs and 4,550 shouldn‘t be surprising today.

At the same time, precious metals could have had a much stronger day – but the sentiment was risk-off in spite of the tanking dollar and doubted yields as the rising tech and gold at the expense of silver illustrate. Miners recent outperformance was absent just as much as commodities vigor with the exception of copper. And it‘s more celebrations in the red metal following its steep and far reaching correction, that‘s the part of missing ingredients as much as fresh inflation fears (yes, adding to risk-off mood, inflation expectations declined yesterday).

All in all, it looks like a case of abundance of caution prior to next week‘s Fed, compounded by sluggish incoming data, where just cryptos are ready to move first.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

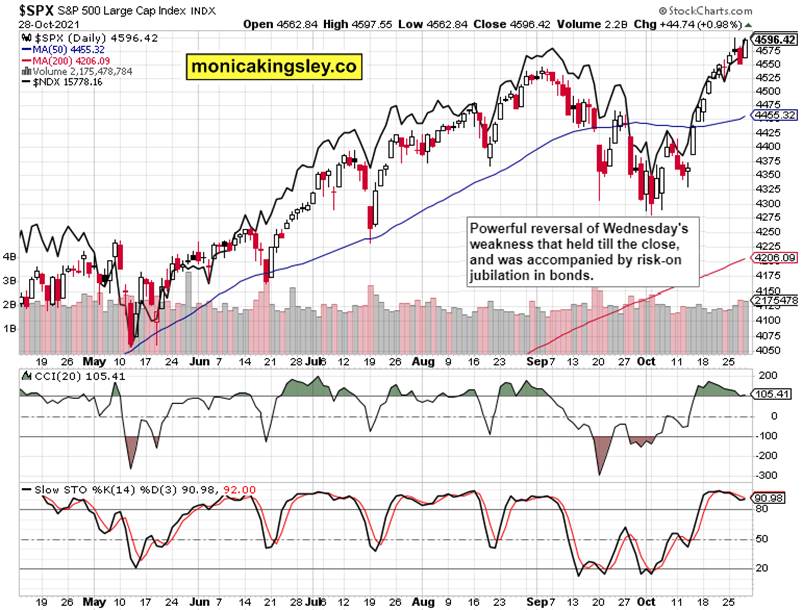

S&P 500 and Nasdaq Outlook

S&P 500 decisively reversed upwards, but the daily indicators barely moved – the consolidation doesn‘t look to be over.

Credit Markets

HYG entirely reversed Wednesday‘s plunge but the low volume flashes amber light at least – the bulls are likely to stop for a moment.

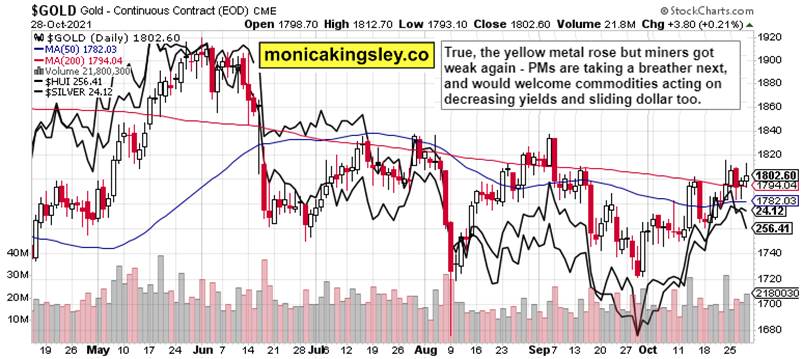

Gold, Silver and Miners

Gold upper knot doesn‘t bode as well as it did the prior Friday, and the same goes for miners. The yellow metal‘s strength was sold into, making it short-term problematic for the bulls.

Crude Oil

Crude oil held $81 on not too shabby volume but the bulls are still on the defensive until $84 is overcome. When XLE starts outperforming VTV again, the outlook for black oil would improve considerably. Natgas falling this steeply yesterday isn‘t inspiring confidence either.

Copper

Copper finally reversed, and the upswing is a promising sign even though I would like to have seen higher volume. Again, the red metal remains well positioned to join in the commodities upswing once the taper announcement is absorbed.

Bitcoin and Ethereum

Bitcoin bulls are pausing while Ethereum ones keep running – cryptos are providing an encouraging sign (to be taken up by real assets) going into the Fed next week.

Summary

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.