Omicron Covid Wave 4 Impact on Financial Markets

Stock-Markets / Financial Markets 2021 Nov 30, 2021 - 02:52 PM GMTBy: Monica_Kingsley

Day That Changed the World?

S&P 500 and pretty much everything apart from Treasuries and safe haven plays down precipitously, with panic hitting oil the hardest. The post Thanksgiving session turned out not so light volume one, but the fear wasn‘t sending every risk-on asset cratering by a comparable amount. What we have seen, is an overreaction to uncertainty (again, we‘re hearing contagion and fatality rate speculations – this time coupled with question mark over vaccine efficiency for this alleged variant), and the real question is the real world effect of this announcement, also as seen in the authorities‘ reactions.

Lockdowns or semi-equivalent curbs to economic activity are clearly feared, and the focus remains on the demand side for now, but supply would inevitably suffer as well. Do you believe the Fed would sit idly as the economic data deteriorate? Only if they don‘t extend a helping hand, we are looking at a sharp selloff. Given the political realities, that‘s unlikely to happen – the inflation fighting effect of this fear-based contraction would be balanced out before it gets into a self-reinforcing loop. With the fresh stimulus checks lining up the pocket books, Child and Dependent Care Tax Credit etc., we‘re almost imperceptibly moving closer to some form of universal basic income. Again, unless the governments go the hard lockdown route over scary medical prognostications (doesn‘t seem to be the case now), such initiatives would cushion financial markets‘ selloffs.

Looking at Friday‘s price action, PMs retreat shows that all won‘t be immediately well in commodities, where oil looks the most vulnerable to fresh bad news in the short run (while stocks would remain volatile, they would find footing earliest). Demand destruction fears are though overblown, but the dust looks to need more time to settle than it appeared on Friday above $72-$73:

(…) New corona variant fears hit the airwaves, and markets are selling off hard. We can look forward for a light volume and volatile session today – S&P 500 downswing will likely be cushioned by the tech, but high beta plays will be very subdued. Commodities are suffering, and especially oil is spooked by looming (how far down the road and in what form, that’s anyone’s guess) economic activity curbs / reopening hits. Precious metals are acting as safe havens today (mainly gold) while the dollar is retreating – and so will yields, at least for the moment. Time for readjustment as the wide stop-loss in oil was hit overnight – it’s my view that the anticipated demand destruction taken against the supply outlook, is overrated.

When the (rational / irrational) fears start getting ignored by the markets, we‘re on good track.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

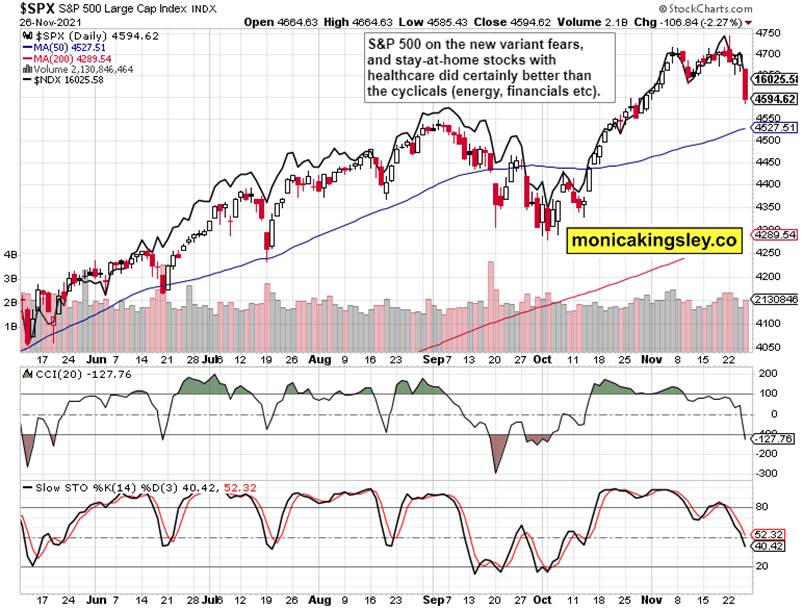

S&P 500 and Nasdaq Outlook

S&P 500 is still far out of the woods, and a good sign of better days approaching would be tech and healthcare sound performance joined by financials and energy clearly on the mend. Earliest though, HYG should turn.

Credit Markets

It‘s too early to call a budding reversal in credit markets – HYG needs to not merely retrace half of its daily trading decline. Money coming out of hiding in Treasuries, would be a precondition of prior trends returning. They will – they had been merely punctured.

Gold, Silver and Miners

Precious metals gave up opening gains, and with the hit to inflation expectations, lost the developing tailwind. It would though come back in an instant once calm minds prevail or fresh stimulus gets sniffed out.

Crude Oil

Crude oil had a catastrophic day – how far are we along capitulation, remains to be seen. The oil sector didn‘t decline by nearly as much, highlighting the overdone and panicky liquidation in black gold.

Copper

Copper decline didn‘t happen on nearly as high volume as in oil, making the red metal the likelier candidate for a rebound as the sky isn‘t falling.

Bitcoin and Ethereum

Bitcoin and Ethereum marching up on the weekend, were a positive omen for the above mentioned asset classes. In spite of cryptos still being subdued, the overall mood is one of catious optimism and risk very slowly returning.

Summary

- Friday‘s rout isn‘t a one-off event probably, and S&P 500 would turn higher probably earlier than quite a few commodities. Cynically said, the variant fears let inflation to cool off temporarily, even as CPI clearly hasn‘t topped yet. As demand destruction was all the rage on Friday, supply curbs would get into focus next, helping the CRB Index higher – and that‘s the worst case scenario. Precious metals certainly don‘t look to be on the brink of a massive liquidation – the current selloff can‘t be compared to spring 2020. For now, the price recovery across the board remains the question of policy, of policy errors.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.