Gold Withstands the Storm. Will Miners Drag It off the Raft?

Commodities / Gold and Silver 2022 Feb 11, 2022 - 05:32 PM GMTBy: P_Radomski_CFA

In line with bearish bets, miners have thrown a match. Gold, however, doesn’t want to leave the ring without a fight. How long will it stay high?

While gold remains relatively firm despite stock market turbulence, rising real yields, and bearish technical indicators, even a confluence of headwinds hasn’t been able to knock the yellow metal off its lofty perch. However, mining stocks haven’t been so lucky. With my short position in the GDXJ ETF offering a great risk-reward proposition, the junior gold miners’ underperformance has played out exactly as I expected.

Moreover, with major spikes in volume preceding predictable sell-offs (follow the vertical dashed lines below), I’ve warned on several occasions that the GDX ETF is prone to tipping its hand – we saw this volume spike in January, which was the 2022 top (as of today). In addition, with mining investors’ power drying up by the day, the medium-term looks equally unkind.

Please see below:

On Wednesday, gold miners fell. Even though they declined by just $0.06, it was profound. The miners were following gold higher during the early part of Wednesday’s (Feb. 9) session, but they lost strength close to the middle thereof and were back down before the closing bell.

If the gold price reversed and then declined during the day, that would have been normal. However, gold stayed up.

This tells us that the buying power has either dried up or is drying up.

When everyone who wanted to get into the market is already in it, the price can do only one thing (regardless of bullish factors) – fall. Those who are already in can then sell. Monitoring the markets for this kind of cross-sector performance is one of the more important gold trading tips.

Look, I’m not saying that declines now are “guaranteed”. There are no guarantees in the markets. There might be buyers that haven’t considered mining stocks that would now enter the market, but history tells us that this is unlikely. Instead, declines are very likely to follow.

Yesterday’s big daily decline confirmed my above comments. Gold miners declined much more than gold did, and they did so at above-average volume. The latter indicates that “down” is the true direction in which the precious metals market is heading.

To that point, the HUI Index provides clues from a longer-term perspective. When we analyze the weekly chart, it highlights investors’ anxiety. For example, after hitting an intraweek high of roughly 260, the HUI Index ended the Feb. 10 session at roughly 250 – just 3.99 up from last Friday – that’s an intraweek reversal.

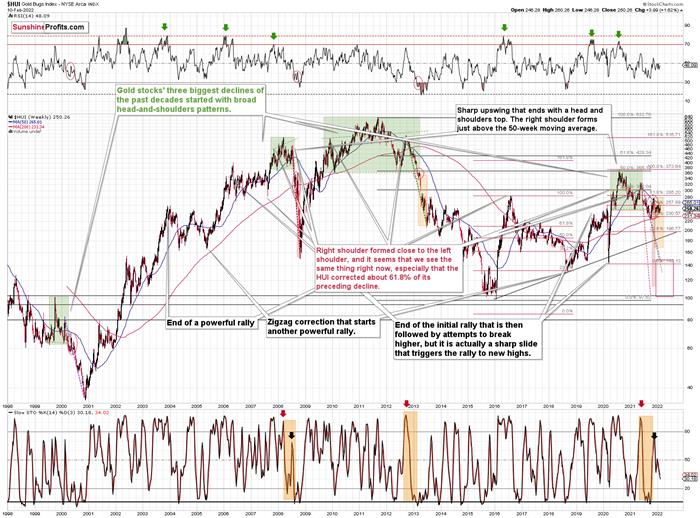

Furthermore, with the index still in a medium-term downtrend, shades of 2013 still profoundly bearish, and sharp declines often preceded by broad head and shoulders patterns (marked with green), there are several negatives confronting the HUI Index. As such, a sharp drawdown will likely materialize sooner rather than later.

Please see below:

Finally, the GDXJ ETF is the gift that keeps on giving. For example, with lower highs and lower lows being part of the junior miners’ roughly one-and-a-half-year journey, false breakouts have confused many investors. However, while I’ve been warning about the weakness for some time, more downside is likely on the horizon. To explain, I wrote on Feb. 10:

I emphasized before that juniors hadn’t moved above their 50-day moving average, and that they stayed below their rising blue resistance line. Consequently – I wrote – the downtrend in them remained clearly intact.

Yesterday’s reversal served as a perfect confirmation of the above. The previous breakdowns were verified in one of the most classic ways. The silver price has been quite strong recently, which is also something that we see close to the local tops.

The reversals in mining stocks, the situation in gold, outperformance of silver, AND the situation in the USD Index (the medium-term support held) together paint a very bearish picture for the precious metals market in the short and medium term.

All in all, if the weakness continues, I expect the GDXJ ETF to challenge the $32 to $34 range. However, please note that this is my expectation for a short-term bottom. While the GDXJ ETF may record a corrective upswing at this level, the downtrend should continue thereafter, and the junior miners should fall further over the medium term.

In conclusion, gold showcased its steady hand throughout the recent volatility. However, mining stocks have cracked under the pressure. With the latter’s underperformance often a bearish omen for the former, the yellow metal’s mettle may be tested over the medium term. As such, while the long-term outlooks for gold, silver, and mining stocks remain profoundly bullish, a final climax will likely unfold before their secular uptrends continue.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.