The Quantum AI Mega-trend - m = f - Everything is Waving!

Companies / Quantum Computing Mar 02, 2022 - 05:07 PM GMTBy: Nadeem_Walayat

Imagine in the 1960's most had little idea of the world that the transistor would herald beyond that of maybe transistor radios and colour Tv's! Personal computers weren't even in most peoples imagination given that the movies and media of the day painted a picture of computing equating to giant super computers.

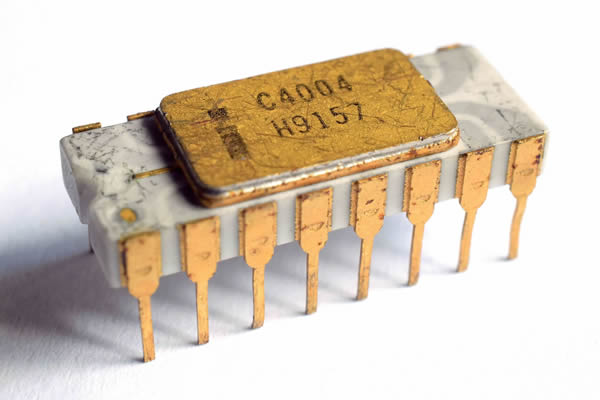

Imagine in the 1970's when few paid attention to Intel's 4004 processor that started the microprocessor ball rolling all thanks to Japan's Nippon Calculating Machine Corporation (Busicom) that contracted the tech start up to design 12 custom chips for them, in response to which rather than developing 12 custom chips Intel decided it was more cost effective to just develop one multipurpose processor that could be programmed and so was born what would become the 4004. Only one problem the Japanese company Busicom owned the rights to the chip! Intel eventually offered to return Busicom's $60k investment in exchange for the rights which the struggling Japanese company agreed to and the rest is history! Or will be when IBM gave Intel what it had been seeking for a decade, a big buyer with deep pockets to commit to volume orders for it's processors by ordering 10,000 units per year from 1982 onwards. All forgotten today just how small Intel was for a good 13 years since inception and that it was only when IBM started making use of Intel processors in IBM PC's that Intel started to take off.

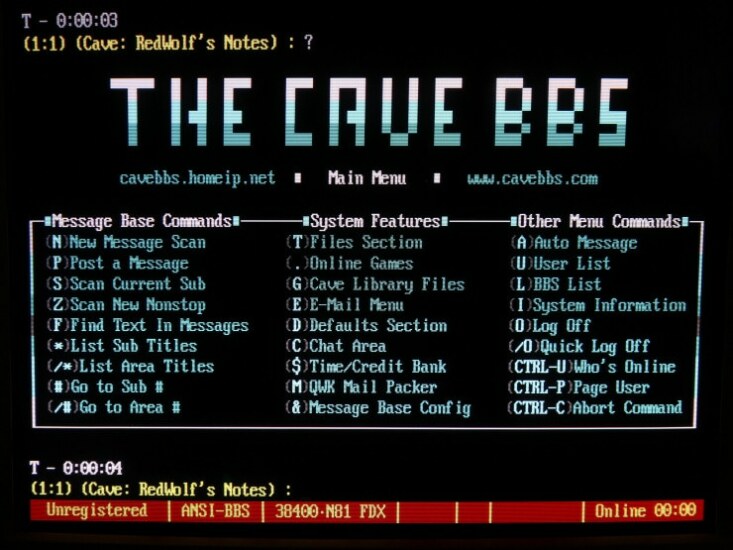

Imagine in the 1980's with primitive inter-network services offering mostly low resolution text to dial into. coupled with hobbyists such as my self running bulletin board systems that other BBS's would dial into during the early hours to exchange information such as documents, images and emails that would take several days to hop between BBS systems to reach their destinations in the UK alone, with a good chance that many would get lost along the way. Whilst trans atlantic emails could take several weeks to reach their final destinations, little had any idea that this would become the corner stone of every day life as the internet has been now for a good 20 years!

And so it is with emerging artificial intelligence, AI will change everything on an epic scale, a trend that is now starting to become manifest with self driving cars that are literally just around the corner with humanoid robots to follow not long after.

However, the biggest change of the lot, bigger even than AI is once more not even on most peoples radar and that is Quantum Computing through which we can only truly begin to grasp the true nature of reality as so far even with the standard model of particle physics we only vaguely glimpse at the true nature of reality that likely has yet to condense down to probable single point like particle from which everything follows.

QUANTUM COMPUTERS WILL CHANGE EVERYTHING FOR OUR REALITY IS QUANTUM in nature, everything resolves to the Quantum level. Not so long ago we thought that the Sun could not be older than a 100 million years (Lord Kelvin 1866) because it would have burnt itself out by now if it were any older.

It would be a good 50 years with the advent of Quantum Mechanics before we start to get a glimpse into the true nature reality that our existence is built upon, that drives the likes of the SUN, fusion largely courtesy of quantum tunneling that allows protons to overcome electromagnetism and fuse unto helium

For instance quantum entanglement implies that everything is instantly connected via a wave function as energy ripples or excitations in quantum fields.

Empty space is not empty, virtual particles are constantly coming in and out of existence, the so called vacuum fluctuation. We exist in a reality that is mind bending and boggling fluctuations of virtual particles that come in and out of existence. Something from nothing means that the sum of the whole equals nothing!

We need quantum computers to investigate where the quantum fields come from which will likely herald a new era (for good or for bad) the implications for which we can barely imagine in sci-fi movies. For instance to answer whether the universe is deterministic or not.

Perhaps the ultimate fate for humanity is in some eons in the far distant future like Gods in their last act give birth to the next singularity fine tuned for matter, stars, black holes, galaxies, with a sprinkling of life baring planets universe. Perhaps that is how our universe also began? An intelligence in a dying universe giving birth to our fine tuned universe as their final act before they headed off into their long night.

Until then, let's make sure we are well positioned to ride both the AI and Quantum mega-trends that most still fail to comprehend the exponential nature of whenever the financial world gives us opportunities to accumulate into such as they did in March 2020 and just as they are doing right now during February 2022 because one day people are going to wake up and smell the coffee and realise what's happening, but of course by then it will be too late to look back in hindsight wish one had acted years earlier just as one does today at Intel of the 1970's and so on.

This article is an excerpt from my recent in-depth analysis that mapped out how low AI tech stocks could trade during the stock market panic of 2022.

Stock Market in the Eye of the Storm, Visualising AI Tech Stocks Buying Levels

Content:

m = f - Everything is Waving!

How to Invest in Stocks 20202 and Beyond

Stock Market Calm In the Eye of the Storm

Stock Market Forward Guidance

50% DRAWDOWNS ARE THE NORM!

Current State of Draw downs

Quantum AI Stocks Portfolio Current

AI Tech Stocks Buying Levels

Earnings Growth Factor

GOOGLE TO BE SLICIED INTO 20 PIECES!

FACBOOK MISSION ACCOMPLISHED Whilst CNBC Clowns Buy the TOP and SELL the BOTTOM!

MICROSOFT Short and Sharp

Still Waiting to Take a BITE out of APPLE

NVIDIA is ARMless - To Buy or Not to Buy, that is the question.

AMD - The Chip Master

TSMC - The World's Supreme Chip Fabricator

AMAZON the Dark Horse!

ARKK SARK SHORT FUND

That was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Also access to my most recent analysis focused on continuing to capitalise on the downward spiral in stock price in response to first Inflation Panic and now added to by War Panic.

World War 3 Phase 1 - Putin WINS Ukraine War!

What Putin Plans for Ukraine

JRS.L Capitalising on Russia's War CRASHED Stocks

THE 2020's INFLATION MONSTER!

Stock Market Trend Forecast Current State

Stock Market FOMO Gives Way to FEAR of Buying the Dip

AI Stocks Portfolio Current State With Updated Buying Levels

FACEBOOK Stock 45% CRASH - Game Over for META?

FACEBOOK RINSE AND REPEAT

INVESTING LESSON - HAVE A PLAN AND THEN EXECUTE IT!

HIGH RISK STOCKS - INVEST AND FORGET

High Risk Stocks Portfolio Revised Buying Levels

GROWTH STOCKS TO CAPITALISE ON THE PANIC OF 2022

1. XXXX - RANK 1 - $121.8, PE 7.8, EGF 38%

2. XXXX - RANK 1 - $58.5, PE 9.9, EGF 30%

3. XXXX- RANK 2 - $16.7, PE 8.7, EGF 33%

4. XXXX - RANK 2 - $89.5, PE 17.2, EGF 23%

5. XXXX - RANK 2 - $49.7 - PE 196, EGF 188%

And gain access to my recent timely analysis lays out how to invest in during the panic of 2022, to be soon followed by scheduled analysis that continues my trend forecast into the end of 2022.

HOW TO SUCCESSFULLY INVEST IN STOCKS During 2022 and Beyond

CONTENTS:

1. UNDERSTAND WHAT INVESTING IS

2. INVEST IN GOOD COMPANIES

3. UNDERSTAND THAT WHICH ONE IS INVESTING IN

4. STOCK PRICES

5. EARNINGS CATCHUP TRADING RANGE TREND PATTERN

6. EMOTIONAL INVESTING

7. MONITORING AND LIMITING EXPOSURE IS MOST IMPORTANT

8. BUY AND SELL on the Basis of VALUATIONS

9. INVESTORS BIGGEST MISTAKE

10. BEST TIME TO BUY STOCKS

11. WORST TIME TO BUY STOCKS

12. BUY VOLATILITY

13. INVESTING TIME

14. FUND MANAGERS

15. OPTIONS

16 . INFLATION

17. INVEST AND FOREGET

AI Tech Stocks Draw down and End of Year 2022 Price Targets

CATHY WOOD ARK GARBAGE

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- Opportunities in CRASHED Small Cap Tech Growth Stocks

- Stock Market Trend Forecast Mid Feb to End 2022

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada and China - 65% done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst capitalising on stock market panic selling

Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.