Gold Likes Recessions - Could High Interest Rates Lead to One?

Commodities / Gold and Silver 2022 Mar 13, 2022 - 02:12 PM GMTBy: Arkadiusz_Sieron

We live in uncertain times, but one thing is (almost) certain: the Fed’s tightening cycle will be followed by an economic slowdown – if not worse.

We live in uncertain times, but one thing is (almost) certain: the Fed’s tightening cycle will be followed by an economic slowdown – if not worse.

There are many regularities in nature. After winter comes spring. After night comes day. After the Fed’s tightening cycle comes a recession. This month, the Fed will probably end quantitative easing and lift the federal funds rate. Will it trigger the next economic crisis?

It’s, of course, more nuanced, but the basic mechanism remains quite simple. Cuts in interest rates, maintaining them at very low levels for a prolonged time, and asset purchases – in other words, easy monetary policy and cheap money – lead to excessive risk-taking, investors’ complacency, periods of booms, and price bubbles. On the contrary, interest rate hikes and withdrawal of liquidity from the markets – i.e., tightening of monetary policy – tend to trigger economic busts, bursts of asset bubbles, and recessions. This happens because the amount of risk, debt, and bad investments becomes simply too high.

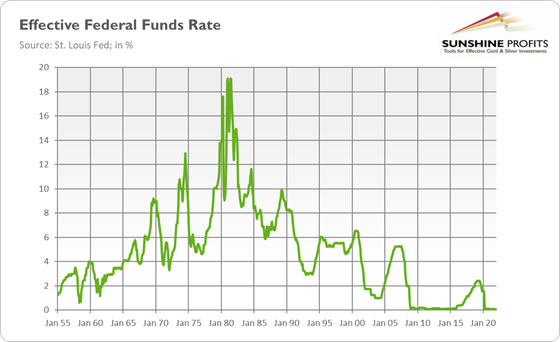

Historians lie, but history – never does. The chart below clearly confirms the relationship between the Fed’s tightening cycle and the state of the US economy. As one can see, generally, all recessions were preceded by interest rate hikes. For instance, in 1999-2000, the Fed lifted the interest rates by 175 basis points, causing the burst of the dot-com bubble. Another example: in the period between 2004 and 2006, the US central bank raised rates by 425 basis points, which led to the burst of the housing bubble and the Great Recession.

One could argue that the 2020 economic plunge was caused not by US monetary policy but by the pandemic. However, the yield curve inverted in 2019 and the repo crisis forced the Fed to cut interest rates. Thus, the recession would probably have occurred anyway, although without the Great Lockdown, it wouldn’t be so deep.

However, not all tightening cycles lead to recessions. For example, interest rate hikes in the first half of the 1960s, 1983-1984, or 1994-1995 didn’t cause economic slumps. Hence, a soft landing is theoretically possible, although it has previously proved hard to achieve. The last three cases of monetary policy tightening did lead to economic havoc.

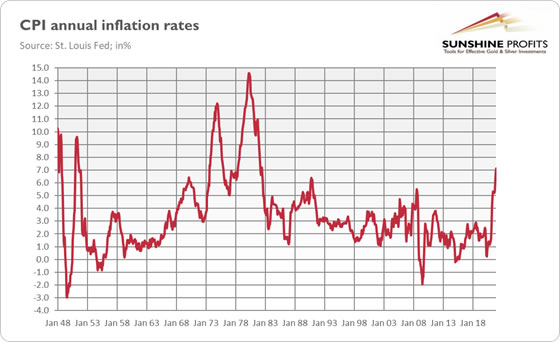

It goes without saying that high inflation won’t help the Fed engineer a soft landing. The key problem here is that the US central bank is between an inflationary rock and a hard landing. The Fed has to fight inflation, but it would require aggressive hikes that could slow down the economy or even trigger a recession. Another issue is that high inflation wreaks havoc on its own. Thus, even if untamed, it would lead to a recession anyway, putting the economy into stagflation. Please take a look at the chart below, which shows the history of US inflation.

As one can see, each time the CPI annul rate peaked above 5%, it was either accompanied by or followed by a recession. The last such case was in 2008 during the global financial crisis, but the same happened in 1990, 1980, 1974, and 1970. It doesn’t bode well for the upcoming years.

Some analysts argue that we are not experiencing a normal business cycle right now. In this view, the recovery from a pandemic crisis is rather similar to the postwar demobilization, so high inflation doesn’t necessarily imply overheating of the economy and could subsidy without an immediate recession. Of course, supply shortages and pent-up demand contributed to the current inflationary episode, but we shouldn’t forget about the role of the money supply. Given its surge, the Fed has to tighten monetary policy to curb inflation. However, this is exactly what can trigger a recession, given the high indebtedness and Wall Street’s addiction to cheap liquidity.

What does it mean for the gold market? Well, the possibility that the Fed’s tightening cycle will lead to a recession is good news for the yellow metal, which shines the most during economic crises. Actually, recent gold’s resilience to rising bond yields may be explained by demand for gold as a hedge against the Fed’s mistake or failure to engineer a soft landing.

Another bullish implication is that the Fed will have to ease its stance at some point in time when the hikes in interest rates bring an economic slowdown or stock market turbulence. If history teaches us anything, it is that the Fed always chickens out and ends up less hawkish than it promised. In other words, the US central bank cares much more about Wall Street than it’s ready to admit and probably much more than it cares about inflation.

Having said that, the recession won’t start the next day after the rate liftoff. Economic indicators don’t signal an economic slump. The yield curve has been flattening, but it’s comfortably above negative territory. I know that the pandemic has condensed the last recession and economic rebound, but I don’t expect it anytime soon (at least rather not in 2022). It implies that gold will have to live this year without the support of the recession or strong expectations of it.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.