The Biggest Threat to Your Money (not inflation)

Companies / Cyber Crime Apr 04, 2022 - 06:41 PM GMTBy: Stephen_McBride

As Russian tanks rolled into Ukraine, Russian hackers infiltrated Ukraine’s internet.

On the morning of the invasion, alarms started ringing inside Microsoft’s Threat Intelligence Center. It detected a “wiper” attack, headed straight for Ukraine’s banks—a hack that would wipe away all of the banks’ data.

Hours later, Russian hackers crippled tens of thousands of satellite modems, knocking out internet access across Ukraine… including the websites of the country’s defense ministry and army.

It was the largest attack of its kind in Ukraine’s history. And it didn’t stop there…

Data from cybersecurity firm Check Point Software shows cyberattacks on Ukraine tripled in the first week of battle.

Cybercrime is, hands down, the most overlooked threat to your money today. We all think “it’ll never happen to me.”

But as I’ll show you, we can’t ignore this threat any longer. Today, I’ll give you an actionable tip on how to deal with it. As you'll see, it could save you tens or even hundreds of thousands of dollars.

- But first… have you seen cybersecurity stocks lately?

You likely know tech stocks have had a rough ride lately.

Over 40% of Nasdaq stocks have been cut in half over the past few months.

But it’s a different story when you look at the largest cybersecurity stocks in the world.

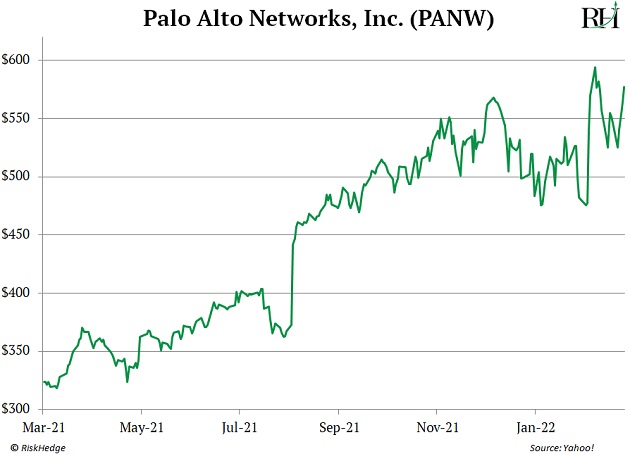

Here’s $57 billion cybersecurity giant Palo Alto Networks Inc. (PANW):

Look at Leidos Holdings Inc. (LDOS), one of the US government’s largest cybersecurity contractors:

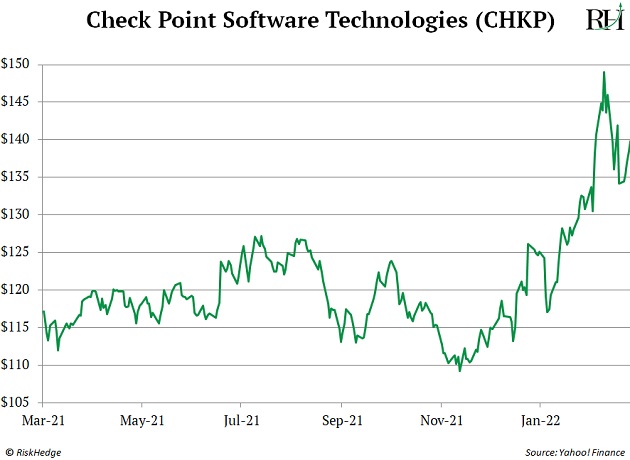

And Check Point Software Technologies (CHKP), another giant cybersecurity software company:

Most tech-related stocks have dipped into bear market territory. Yet cybersecurity stocks are at or near record highs!

I bet cybersecurity firms secretly love when news of a big hack hits the headlines. It’s like free advertising for their services, and it can juice their stock prices too.

Look at how each stock above jumped in late February as Russia launched its offensive.

- It was a record-breaking year for cyberattacks.

The FBI estimates Americans lost over $4 billion to hackers last year.

Port of Los Angeles Executive Director Gene Seroka recently told Bloomberg it now stops 40 million cyber threats each month.

Three of the world’s largest companies, Nvidia… Samsung… and Microsoft were hacked in the past few weeks.

These organizations spend tens of millions of dollars shoring up their cyber defenses each year. They own some of the most sophisticated networks in the world. Yet, hackers still cut into their networks like a hot knife through butter.

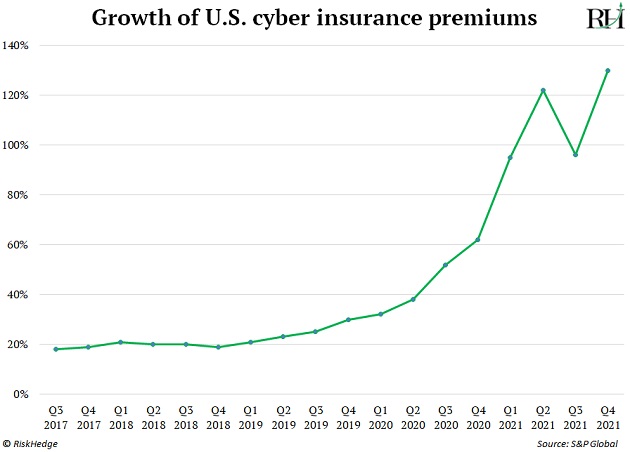

- Two years ago, Illinois’ Bloomington School District was paying $5,000 for cyber insurance….

Its bill quadrupled to $22,000 this year.

The market for insuring yourself against cyberattacks grew from nothing to $15 billion/year over the past decade.

And the cost of cyber insurance is going through the roof right now. Research from consulting firm Marsh shows US insurance premiums jumped 130% in the fourth quarter of 2021 alone.

What gives?

Cyber insurers make money when companies take out insurance and then avoid getting hacked. But everyone is getting hacked right now.

And being a victim isn’t cheap. A new report from IBM shows the average cost of a data breach jumped to a record $4.2 million last year.

When you get hacked, you have to hire expensive cybersecurity experts to find and fix the problem. And you might need to rip out and replace all your computer systems.

Victims are turning to insurers to cover the costs, who are raking up billions of dollars in losses.

- Imagine if someone robbed $5 million in cash from a bank…

It would be plastered across every newspaper in the world.

Yet, hackers routinely steal millions of dollars, and you never hear about it. In fact, Cybersecurity Ventures estimates cybercrime cost firms $6 trillion in 2021.

Because cyberattacks happen through a computer screen, they seem "less real" than, say, someone robbing a bank.

But the consequences of being hacked are very real. Longtime RiskHedge readers who read my Florida lawyer story know a cyberattack can literally ruin your life.

Hackers can steal your money, ruin your credit, access your secrets, and devastate your reputation by assuming your identity.

- Here’s my #1 piece of guidance for you…

First off, don’t think “it won’t happen to me.”

Hackers have infiltrated the most secure networks on the planet. They target millions of Americans every year. If hackers single you out... you better believe they’ll find a way in.

Call your homeowners insurance provider and ask if cyberattack coverage and identity theft is covered by your policy. If it’s not, ask if it offers it as an add-on. If you get another “no,” reach out to one of the big insurers like AXA, AIG or Chubb, which offer this service.

I’ve recommended cyber insurance to you before, and I’m pounding the table on it again. Covering yourself from hackers is more important than buying any stock I, or anyone else, will ever recommend.

Imagine spending days, probably weeks, cleaning up the mess of a cyberattack? You’d have to cancel cards, change passwords, and fight fraudulent charges.

When I first recommended taking out cyber insurance, my colleague added it to his existing plan for just $1 a month. It likely costs more today. As I said, cyber premiums are going through the roof.

Even if it costs 100 bucks a month, it’s worth having cyber insurance. It will ensure you don’t bear the brunt of the costs when hackers come knocking.

You can get an online quote from insurers, like Liberty Mutual. They’ll cover you up to $25,000 for lost wages and expenses. Like all insurance, you hope to never use it. But it might just save you tens of thousands of dollars one day.

3 Breakthrough Stocks Set to Double Your Money in 2022

Get our latest report where we reveal our three favorite stocks that can hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2022 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.