Wolfe Wave Corporate Earnings Contraction Well Underway

Stock-Markets / Corporate Earnings Oct 28, 2008 - 05:40 AM GMTBy: Ty_Andros

We are nearing the first crescendo of the unfolding Crack-up Boom. As outlined in the 2008 outlook entitled “Wolf Wave, aka Thrill ride” the markets are set to experience an emotional and financial EXPLOSION. A coming explosion outlined many times since the April 2007 Tedbits “Fingers of Instability” series first identified the WOLFE wave. Those predictions have since materialized in a grander manner then I ever could have anticipated.

We are nearing the first crescendo of the unfolding Crack-up Boom. As outlined in the 2008 outlook entitled “Wolf Wave, aka Thrill ride” the markets are set to experience an emotional and financial EXPLOSION. A coming explosion outlined many times since the April 2007 Tedbits “Fingers of Instability” series first identified the WOLFE wave. Those predictions have since materialized in a grander manner then I ever could have anticipated.

Incomes are COLLAPSING throughout the G7 and much of the world. The finest assets on the planet are about to land into NEW hands as their current owners were, as Warren Buffet puts it, “swimming naked when the tide went out”, and now they will pay the ultimate price of surrendering their most valuable possessions and businesses for pennies on the dollar. Make no mistake, it has been done intentionally by the banking cartels which own and control the Federal Reserve and have done this according to a well worn playbook. That the public is REPLACING worthless coupons, called G7 currencies, with their own future earnings is “right by the playbook”, for to them money is easily replaced by the stroke of a keyboard. Even King Midas would have been jealous.

Since the beginning of September, up to over 7 trillion dollars, Pounds, Euros, Swiss Francs, Aussie Dollars, Korean Won, etc. have been printed out of thin air and the bill for them has been sent to you and your children. Perpetual slavery of inextinguishable debt brought to you by your public servants and their partners in the international banking cartels. When crisis appears, you are in the most danger you can imagine and this time is no different, as they use FEAR (false evidence appearing real) to “save” you from their MALFEASANCE and corruption.

This current crisis was manufactured in Washington DC and its BIGGEST campaign supporters on WALL STREET . Even today after all the losses, the greatest money being spent in the elections which loom are from WALL STREET and the commercial banks. The economic rescue plan is none of the sort. It is a rolling up of the banking system by the public serpents and the banking industries they are rescuing.

The idea that people can't survive unless they can BORROW money is obscene and nothing less then modern day serfdom. They have placed the public out on a limb to which only they hold the solution, and what is that: BORROW MORE MONEY, go further out on the limb. Virtually the entire public is out on this limb. With the banking industry putting itself in the position of saying BORROW more or we will saw it off and down you will go. People make terrible choices when faced with this, and in this case they are blaming the system rather then those who run and operate it. Who are they? They are public servants and the banking elites. Why do they insist on lending to the POOR? Why to control them of course, and create crisis which allows them to run amok at the impoverished public's behest. It's called supporting the devil.

Do you know why politicians, the main stream press and bankers HATE Capitalism? Because Capitalism is the road to individual freedom. It is the road to “more for less” of everything you consume, it is the road to rising middle classes, it is the road to your children having a better life than you have had. No better way to debauch Capitalism than to debase the currency as getting ahead becomes impossible, they then deflect the blame to culprits other then themselves. It is how they have destroyed you by destroying the conditions for entrepreneurs and small business owners to rise up and destroy entrenched big businesses and crony capitalists who have bought off the politicians who always stand for “less of everything for more money”. The G7 is about to become another casualty of these would-be fascist dictators and socialists.

The political classes are in ascension into dictatorships; the next Hitler looms directly ahead as the public is impoverished through the coming hyperinflation and collapsing wealth creation, personal incomes and business and economic output. As economic output falls the printing presses and credit creation will substitute with the bill sent to YOU! The G7 publics are functionally illiterate. They can read and write but cannot think as they are ignorant of history, logic and common sense having never been taught these things by the PUBLIC SCHOOLS. George Orwell's 1984 and ANIMAL FARM has ARRIVED.

This is a sad fact, but for prepared investors it is the greatest opportunity in history as the greatest transfer of wealth in history unfolds, from those that hold their wealth in paper to those that don't. Most of the biggest money in the world is caught OFFSIDES as the bankers repossess the REAL assets their owners' default on. The big money of the world has bought the bonds and both parties will be left BROKE and then the G7 central banks print the money, issue bonds to the respective G7 governments to SAVE you and the financial system but putting the public in hock for the bill (perpetual inextinguishable debt). The public are the patsies and the perpetrators in the banking systems and respective governments are insidious, immoral and despicable, consumed by greed and the desire for power over others.

The WOLF!

As regular readers know, the wolf wave was identified in March of 2007 in the original “Fingers of Instability” series (see Tedbits Archives at www.TraderView.com ). Let's take a look at those words and the WOLF wave pattern from that missive:

Just like the housing bubble before it, they just bought, bought, bought as everything was a sure bet. These people have now migrated to new opportunities thinking it was a sure thing. Now the Ce ntral Banks have to redouble their efforts or see financial Armageddon. Markets are now pulling back and doing what all markets do after a formidable run higher, “backing and filling”, correcting and consolidating previous gains; gains which were the product of a massive liquidity injection following the last episode of market weakness (2001 to 2006). But the sloshing of that and previous episodes of fiat money and credit injections over the last 50 years are imprecise; they are either going too far or not far enough in money and credit creation. Now we are seeing the mother of all waves, with never before seen profits as a percentage of GDP, but it is now oscillating in the other direction. And…

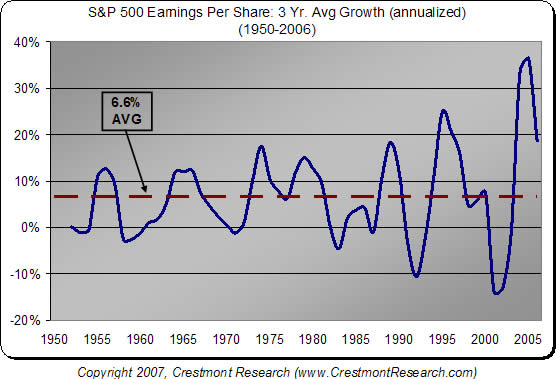

We are in a wolf wave and the amplification of each wave up or down is expanding. A chart of a wolf wave looks like a megaphone, small on one end amplifying out over time . Wolves attack and eat things and it is no different with economies and asset markets, they are eaten when a wolf appears. A good example of a wolf wave is from John Maudlin's latest letter and, by extension, Crestmont Research. Here he shows corporate profits since 1950. John can be reached at john@frontlinethoughts.com

See the megaphone formation? It is called a Wolf Wave. We are at a fairly good level of profits now. But it projects a nuclear winter in corporate profits dead ahead (see chart below). From Record highs never seen in fifty years, to record lows also not seen in the same period, below the lows of 2001-2002. This chart is a testament to how fiat money and credit creation has made steady growth and economic stewardship become more and more unmanageable over a long period of time, it is clear that monetary policy is also following this wolf wave pattern, either too hot or too cold. Politicians (and their “something for nothing” constituents) in the western world see these enormous profits and are set to attack the creators and holders of this wealth, they want the money and will put in place new taxes and entitlement mandates to claw back this gusher of wealth, thereby accelerating the downside of this wave. We all want business cycles that cleanse past excesses but the up and downs are now out of control, there is no consistency. No orderly form to the business and economic cycles, everything now is either booming or busting.

This is as frightening a chart as I have seen since the one I used in “ Sea Change ” (see Tedbits archives at www.traderview.com ). The wealth of the world is rotating. Combine the message of the two charts and commentaries and it signals big trouble in the US , then in Europe and then the rest of the world. Now let's look at the micro picture of corporate profits:

![[Chart]](../images/2008/corporate-earnings-oct08_image003.gif)

Corporate profits are collapsing and accelerating to the downside as indicated by the macro look…

The financial and central banks' authorities must prevent this collapse in profits and stock asset values at all costs. You can clearly see what Greenspans last episode of liquidity created. Notice how the wolf wave really started to wildly amplify and get out of control when he took over at the helm of the Federal Reserve in the mid 1980's!! This is the Greenspan Put at work. Now we will see the encore, as the financial leaders of the world try to save the most stupid money in the world from their poor decisions and mal-investments (from previous easy money episodes) by buying these inflated valuations in any asset you can imagine. It's called Hot Money and is chasing yields around the world! And of course these assets were bought with borrowed money, because easy, “below market rate” credit is abundant and available to anyone with any qualifications (the sub-prime borrowers are the exception, but if asset prices fail to hold up it will move up the ladder). And since inflation is massively understated they are borrowing the money at below market rates even now.

They bought those assets with the belief that markets and asset prices never go down, and anybody who studies markets knows it is a two-way street. The reversion to the mean projects big time pain. The shake out will be enormous unless these financial leaders step in right now to flatten it out like the mid 1970's. This is the specter of the ghosts of Christmas past. This is a highly deflationary picture if the money printing and credit creation doesn't accelerate from here. It must be global in nature. And it is coming when it already is at record levels, as global currency reserves are approximately 18% higher year over year throughout the world. Can anybody say Weimar Republic on a global scale? Argentina ? Zimbabwe ?

The US is in dire straights and the politicians are set to add it to the bonfire if they follow through with their current plans (see previous Tedbit above) of taxing, mandating wages and benefits, costly regulations and destroying future business creation. The attack on “foreign and domestic” capital currently building steam in Washington DC is reckless and potentially ruinous to the United States specifically, and world economies in general. The stupidity spilling from the mouths of the Presidential contenders is unbelievable, these people that claim they are ready to guide us into the future. The ultimate ignoramuses (the US Congress) are at the wheel of the US economy and set to strike like a poisonous viper. And of course their only concern is the next US election, not doing the right thing for the long run. And as I have said before, Europe has its own coterie of like-minded idiots. Serving only their ambitions for power by promising something for nothing to the least prepared of their constituents. These constituents also happen to hold the majority of votes over the educated parts of the electorates.

A recent missive from Steve Roach summed up Washington 's coming attack in its four-section summary:

“It's a new game in Washington D.C. The pendulum of political power has swung in a decidedly pro-labor direction. It's a shift with potentially profound consequences for the US and global economy - to say nothing of financial markets still steeped in denial.

Conclusions: There are three legs to the stool of Congress's pro-labor agenda: (1) Proposals have been offered that would provide direct support to lower- and middle-income workers; these include a minimum wage hike, a boost to labor unionization, and relief from the Alternative Minimum Tax. (2) Bills have been introduced that focus on returns at the upper end of the income distribution; the targets here are executive compensation, hedge funds, and private equity. (3) Anti-China legislation is gaining momentum; several new bipartisan efforts have been introduced in both the House and the Senate that focus on the all-contentious currency issue. (4) There is broad bipartisan support for these actions, with possible veto-proof margins on anti-China trade initiatives.

Market implications: Our client polling suggests that financial markets remain largely in denial over the ramifications of Washington 's pro-labor agenda. If such initiatives become law, markets would be hit hard; anti-China actions could take a big toll on the US dollar and longer-term US real interest rates.

Risks: The biggest risk comes when US joblessness starts to rise - an inevitable outcome at some point in the not-so-distant future. In that context, pro-labor Washington politics - especially anti-China proposals - will only gather deeper and broader bipartisan support”. Thanks Steve.

The “something for nothing” crowd is firmly in control of the halls of power in the US and Europe ; both politically and at the reigns of finance and Ce ntral Banking. We have had calm sailing in the markets since late 2002 (due to unbelievable amounts of stimulus from Alan Greenscam, er, Greenspan and now Ben Bernanke, the father of no M3 reporting), now four years later, confidence is at superman levels and the miscalculation that things go on forever is the only thing on investors minds. They have short memories, just like their leaders. There is big money here for the smartest among us, for all the rest of us it is disaster directly ahead.

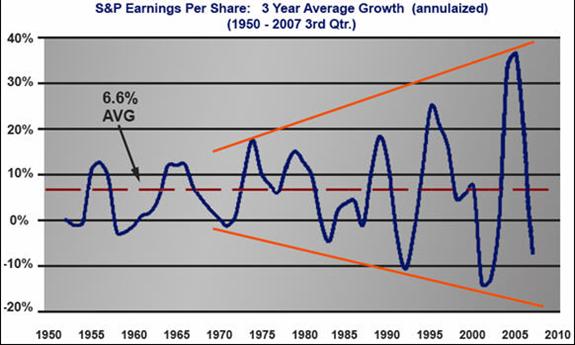

Keep in mind that this was written in MARCH 2007, and look around you. It's like it was written YESTERDAY. Now let's take a look at the wolf wave TODAY :

It is slicing through the lower boundaries of the mega phone and a democratic supermajority LOOMS as people are desperate for someone to SAVE them! And they are turning to the people who CAUSED it . Incomes are being EATEN alive, personal, corporate, state, municipal, and, at the same time, NOMINAL asset values are being destroyed as well.

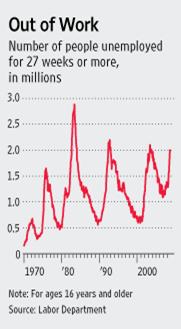

Take a look at these long term charts of unemployment from a recent www.wsj.com :

When people are OUT OF WORK, incomes and revenues plummet all up and down the economy. Those aren't peaks; those are base patterns pointing much, much higher in ALL three examples. You shall soon see a monthly job report with 400 to 500 thousand lost jobs, assuming they don't HIDE the ugly TRUTH of business and employment in America . But rest assured, the G7 is in the boat with us.

Everybody is scrambling for the “financial” lifeboats, but just as the Titanic was short of them so are the G7 economies. Things will soon get vicious as those who believe in PAPER money are DESTROYED, and their former wealth falls into the hands of the same culprits that perpetrated it then. Majorities of the G7 no longer “produce more then they consume” and they are headed for the poorhouse and bankruptcy; courtesy of G7 public servants and central banks.

EVERYTHING that creates wealth, produces more then it consumes, as well as savings, are about to come under withering attacks. SO THERE WILL BE LESS AND LESS of it. Misery spread in ever widening circles. Everyday low prices at WALMART are about to be redistributed to run amok UNIONS who serve no one but themselves. Massive hyperinflation to pay for it as wealth creation FAILS and is substituted with government imposed socialism with politicians deciding who gets what. The father of the SUB PRIME debacle himself recently spoke on the coming expansion of government spending to SAVE you:

"I think at this point there needs to be a focus on an immediate increase in spending and I think this is a time when deficit fear has to take a second seat . . . I believe later on there should be tax increases. Speaking personally, I think there are a lot of very rich people out there whom we can tax at a point down the road and recover some of the money." -- Barney Frank, October 20, 2008

Here's another quote from a recent www.wsj.com about the next round of stimulus:

“The latest plan is even worse than the spring round of $100 billion or so in tax rebate checks. At least rebates allowed taxpayers to spend their own money. Under this stimulus the government will tax or borrow $150 billion to $300 billion in order to spend the money on social and pork-barrel programs. The latest draft would direct dollars to food stamps, another expansion in unemployment insurance, home heating subsidies, more aid to states and cities, and "infrastructure" like roads, bridges and public transit. Because of Davis-Bacon wage requirements on these brick and mortar projects, a portion of the dollars would coincidentally flow to the Democrats' biggest campaign contributors: unions. Call it a political "rebate" check.

On Tuesday Senator Obama said this spending would create millions of new jobs by closing a federal "investment deficit." Over the past eight years the federal budget has exploded by more than $1.1 trillion, much of it for the very programs that Democrats want to spend more on. Let's start with infrastructure. Three years ago Congress passed a transportation bill of more than $286 billion. The transportation budget is up 22% after inflation in the past eight years. Roads and bridges can help economic growth if they increase productivity by more than the amount they cost in higher taxes or borrowing. But not if they are bridges to nowhere as so many of these projects are.”

All of this to SAVE you. More “power and money” for them and less for you; inflation and deficits which you, your employers and children must pay for. Stealth taxes on your paper money “while it sits in the bank” and they inflate its value away through FIAT money and credit creation.

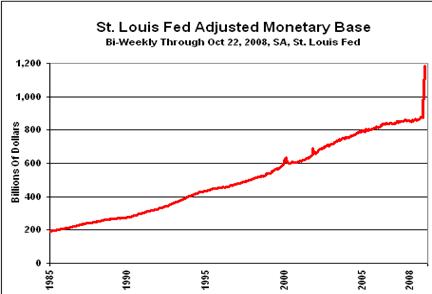

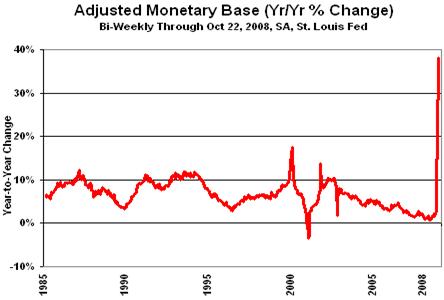

Take a look at money creation on the most basic levels which is HIGH POWERED, as it is the fuel of the fractional banking systems of the G7:

UP 38% year over year and almost triple the size of any monetary expansion since 1985; and you haven't seen ANYTHING yet. This is the face of FUTURE inflation. Add to this the HUGE expansion of government to save and provide for you, where $1.00 goes in and .10 cents of goods or services comes out; the rest goes to line the pockets of their CAMPAIGN contributors and the government enforcers they have SPAWNED in leviathan government. THIS IS WHY THE STOCK MARKETS ARE COLLAPSING and will continue to do so until they turn higher in a ZIMBABWE-like rally to escape the debasement and the “Crack-Up Boom” EXPLODES in your face.

In conclusion: Stock Markets can rally but sell into them. The collapse in incomes has just begun to unfold. Since wealth creation and income is COLLAPSING, fiat money and credit creation MUST rise to FILL the gap. When the socialist dictators take the reigns of power put your hand on your wallets as it shrinks without them even putting a hand on it. They will steal your money to “spread the wealth”. The hardest hit will be the ones that VOTED them into power with the PRINTING press. Further enlarging their constituencies of impoverished citizens who DO NOT know from where wealth comes and who are voting for the things most detrimental to their futures. As I said: George Orwell's Animal Farm and 1984 are now becoming REALITY. I await the new “Ministry of Truth”, but government statistics are ALREADY a form of that .

I believe the stock markets ultimately will fall another 50% or more before the loss of incomes is fully PRICED into them. As will ALL assets which require BIDDERS to support them because the bidders are being DESTROYED by the coming new devils known as the Democratic supermajority and the new PINOCHIO known as BHO, and the new Geppettos known as trial lawyers, radical environmentalists, union bosses, teacher's unions and authoritarian federal, state and municipal governments! These people and things cost BIG money and you know who gets to pay? YOU!

BHO and his PARTNERS in mayhem are moving the tax tables to a structure that is obscene; take a look at this recent excerpt from a www.wsj.com outlining the dire states for those that actually PAY for things:

Barack Obama is offering voters strong incentives to support higher taxes and bigger government. This could be the magic income-redistribution formula Democrats have long sought.

Sen. Obama is promising $500 and $1,000 gift-wrapped packets of money in the form of refundable tax credits. These will shift the tax demographics to the tipping point where half of all voters will receive a cash windfall from Washington and an overwhelming majority will gain from tax hikes and more government spending.

In 2006, the latest year for which we have Census data, 220 million Americans were eligible to vote and 89 million -- 40% -- paid no income taxes. According to the Tax Policy Center (a joint venture of the Brookings Institution and the Urban Institute), this will jump to 49% when Mr. Obama's cash credits remove 18 million more voters from the tax rolls. What's more, there are an additional 24 million taxpayers (11% of the electorate) who will pay a minimal amount of income taxes -- less than 5% of their income and less than $1,000 annually.

In all, three out of every five voters will pay little or nothing in income taxes under Mr. Obama's plans and gain when taxes rise on the 40% that already pays 95% of income tax revenues.

The plunder that the Democrats plan to extract from the "very rich" -- the 5% that earn more than $250,000 and who already pay 60% of the federal income tax bill -- will never stretch to cover the expansive programs Mr. Obama promises.

What next? A core group of Obama enthusiasts -- those educated professionals who applaud the "fairness" of their candidate's tax plans -- will soon see their $100,000-$150,000 incomes targeted. As entitlements expand and a self-interested majority votes, the higher tax brackets will kick in at lower levels down the ladder, all the way to households with a $75,000 income.

Calculating how far society's top earners can be pushed before they stop (or cut back on) producing is difficult. But the incentives are easy to see. Voters who benefit from government programs will push for higher tax rates on higher earners -- at least until those who power the economy and create jobs and wealth stop working, stop investing, or move out of the country.

CAN YOU SAY OBSCENE. The “SOMETHING FOR NOTHING” predators on the march. These people DESERVE what they are about to get and it IS NOT a free lunch; they are the FIRST victims of these policies, then the rest of us will be….

The money required to save the G7 financial systems and bloated state and municipal sectors, insurance companies and soon general conglomerates such as GE, and NATIONAL champions in the G7 will be at least 5 times what has been CREATED to date. Bernanke is now OUTDOING the maestro himself, but now he has been joined by every CENTRAL BANK and government in the developed world. You must keep your cash NOW and get ready to get into TANGIBLE assets which will REPRICE to reflect the unfolding DEBASEMENT. Don't be fooled by gold and silver as when you sell, the DEBASERS will buy it from you before it rockets higher. BONDS are bombs, avoid them at ALL costs, and sell into rallies. As they ultimately WILL CRASH just as stocks and the economies are. The greatest REFLATION in history is in front of us as they will do as all have done before them in a fiat currency financial system: They will print the money. As Public Serpents, er servants try to save what can't be saved the next great depression will unfold except it will briefly be deflationary then will become hyperinflationary.

This is the GREATEST OPPORTUNITY in history as YOU will get to be the beneficiary of the transfer of wealth if you position yourself PROPERLY. You can still hold cash and fix it if you like. Markets are all still MASSIVELY mispriced to reflect the unfolding future. Do not despair or succumb to the misinformation you are BOMBARDED with daily. Stock, Bonds, currencies, commodities, natural resources, everything is MISPRICED. Volatility that is already high is set to CONTINUE. VOLATILITY IS OPPORTUNITY ! Learn how to capture it.

Public servants will use the unfolding debacles as their excuse to SAVE you, and will extend their control and MISALLOCATION of precious capital to activities which WILL DESTROY the economies of the G7 rather than to activities which create wealth in the PRIVATE sector -- just as Roosevelt's NEW DEAL did in the 1930's; and the public servants will blame it on someone else, just as they did then, and the public is dumber now then they were then so they will GET AWAY with it AGAIN. The Crack-Up Boom just moved a little closer on the horizon…..

Don't miss the next edition of Tedbits and the “Crack-Up Boom” series….

Please remember that subscribers generally receive Tedbits two to three days before it is posted on the web. Subscribers will also start receiving guest essays from leading economic pundits, and a blog looms soon. So if you want it early and the added features SUBSCRIBE NOW it's FREE!

Please remember that subscribers receive Tedbits two to three days before it is posted on the web. Subscribers will also start receiving guest essays from leading economic pundits, and a blog looms soon. So if you want it early and the added features SUBSCRIBE NOW it's FREE!

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2008 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.