Google, Microsoft, Apple, Amazon, Facebook Tech Stocks Earnings BloodBath Week Buying Opportunities

Companies / Corporate Earnings Apr 25, 2022 - 01:39 PM GMTBy: Nadeem_Walayat

In advance of my US housing market trend forecast to be posted before the end of this month here is a timely look at the big AI tech stocks that are reporting earnings next week, where the dominos could finally start falling as they continue Friday's plunge on break of key support levels for the likes of Nvidia and Google, where after a long wait big buying levels are finally starting to get triggered in the latest phase of the stealth stocks bear market that is cycling through target stocks like the tasmanian devil as we saw during the past week, with Friday's plunge ending what had been an developing stocks bounce, where my focus was on Google as it finally broke below $2400, a level that I had long flagged to patrons of where I would be buying big and in advance of warned Patrons for several weeks not to jump the gun regardless of what the indices were doing.

Stock Market Big Picture

My big picture remains as I have been iterating for the past 3 months in that I expect the Dow to target a volatile trend to below 31k.

5th Feb 2022 - We are in for a volatile trend with a downwards bias for much of 2022, as I wrote to expect on the 5th of Dec 2021 accompanied by revised trend forecast graph.

Following which my expectations were for the Dow to target a trend to $31k as illustrated below -

As things stand an interim corrective rally into Mid May has been delayed for at least a few days as the March lows look set to be breached during the coming week. Especially if the Apple and Microsoft nuts also finally crack, unless they post near perfect results, and the same is true for Google. The Dow is currently targeting a trend to $32k, looking further out I see the final low during late summer a probably between 31k and 29k during August before the Dow resolves in a trend towards new all time highs during Q4, expectations which are subject to my forthcoming in-depth analysis.

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

Quantum AI Stocks Bloodbath Potential Opportunities

The once over loved and over hyped tech sector is now HATED! Which is what one wants when accumulating stocks trading at deep discounts to their highs, though once more note that ALL stocks trading above a PE of 20 have a high probability of trading below 20 times earnings given the valuation reset that I warned to prepare for over 9 months ago.

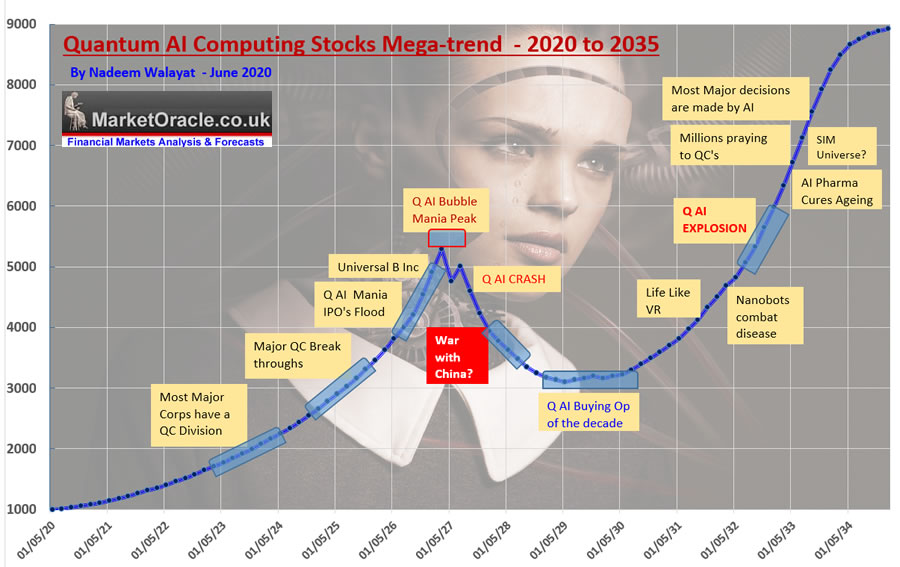

Though understand this everything that happens this year is just a mere inconsequential quantum fluctuation in the Quantum AI mega-trend as the Quantum wave continues vibrate towards quantum supremacy. I often get asked when the sleeping giants such as Intel will come alive and how could the stock price soar. To which my typical response is that it is a sleeping giant and will likely X4 to $200, but the fact is that I am getting asked such questions illustrates that many do not really understand what they are investing in for if you did they would not be asking such questions. And the fact that one does ensures that when the stock price does soar some will likely get out after a 50% or maybe 100% advance and then be forever asking me when will the Intel stock price will drop again so they can buy back in.

REMEMBER WE are NOT investing in normal stocks, these are NOT NETFLIX, ZOOM AND THEIR KIN! THESE ARE QUANTUM AI TECH STOCKS that are riding an EXPONENTIAL TREND.

BUYING LEVELS - Remember folks buying levels are NOT price targets or forecasts, buying levels are so as to be ENABLE one to accumulate a position at DEEP discounts to stocks highs, for instance my buying level for Google of $2625 has been in force since $3000! Which prevented me from buying any significant Google above $2625 which during the bear market was revised down to $2452 and as as I iterated in my recent articles I sought sub $2400 for any big buys. So understand that the whole point of buying levels is that they should eventually be achieved else what is the point of having buying levels that never get triggered. As for how buying levels are derived, the starting point are chart support resistance levels and valuation scenarios that are further refined using spooky maths, such as the Fine Structure Constant i.e. looking at the current AMD chart support is at 81 spooky maths turns this into 82.2, where I have a limit order at, whilst the buying level becomes $84 for a slightly higher probability of being achieved,

See my earlier articles for explanations of EGF, EC etc...HOW TO SUCCESSFULLY INVEST IN STOCKS During 2022 and Beyond and Stock Market in the Eye of the Storm, Visualising AI Tech Stocks Buying Levels

And remember folks one cannot invest with the benefit of hindsight, so it is no good looking at the chart and thinking as if by magic one could have time traveled and bought at the precise lows instead of at x,y,z buying levels, thus buying levels at least prevent one from stupidly FOMO-ing into stocks near their highs, or prevent one from firing all of ones investing ammo early during the bear market. Instead buying levels satisfy the urge to buy new lows by nibbling whilst waiting for the big buys, this way whatever transpires one has at least increased ones exposure to the AI Mega-trend which is the primary name of the game, not picking tops and bottoms but increasing exposure to a mega-trend that most remain largely clueless to the extent that it is already changing all of our lives for better or worse. So in the long run it does not matter that much if one buys Google near $2600 than near $2300, just that it makes one feel like they have put some extra effort into squeezing a few percent extra out of the markets.

This article is an excerpt from my latest timely just posted article in the countdown to Big tech stocks earnings reports this week (Google, Microsoft, Apple, Amazon, Facebook, Intel etc) that breaks down how low they could go and where I will be accumulating at deep discounts.

AI Tech Stocks Earnings BloodBath Buying Opportunity

That was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Whilst my most recent just posted analysis is - UK House Prices Three Trend Forecast 2022 to 2025, where I pealed away every layer of the UK housing market I could think of to arrive at a high probability of trend forecast, no following of the consensus herd here!

UK House Prices Trend Forecast 2022 to 2025

THE INFLATION MEGA-TREND

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

Fed Inflation Strategy Revealed

Russian Sanctions Stagflation Driver

RECESSION RISKS 2023

UK Debt Inflation Smoking Gun

Britains' Hyper Housing Market

UK Population Growth Forecast 2010 to 2030

UK House Building and Population Growth Analysis

UK Over Crowding Ratio

Overcrowding Implications for UK House Prices

UK Housing Market Affordability

UK House Prices Real Terms Sustainable Trend

UK House Prices Relative to GDP Growth

UK House Prices Momentum Forecast

UK House Prices and the Inflation Mega-trend

Lets Get Jiggy With UK INTEREST RATES

Is the US Yield Curve Inversion Broken?

UK house Prices and Yield Curve Inversions

Interest Rates How High WIll they Go?

Work From Home Inflationary BOOM?

Formulating a UK House Prices Forecast

UK House Prices 2022 to 2025 Trend Forecast Conclusion

Peering into the Mists of TIme

Risks to the Forecasts

US House Prices Trend Forecast 2022-2024

So if you want immediate access to a high probability trend forecast of UK house prices, with US and global housing markets analysis to follow soon then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- Earnings bloodbath Buying Opportunities - Complete

- US House Prices Trend Forecast - 70%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

- State of the Crypto Markets

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst BUYING the panic selling falling knives.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.