A Strengthening US Dollar Is A Double-Edged Sword

Currencies / US Dollar May 09, 2022 - 10:22 PM GMTBy: Chris_Vermeulen

The US Dollar continues to attract capital from investors all over the world. But could this be a double-edged sword for US stocks? As capital flocks to the USD, this in turn hurts US multinationals as they need to convert their weak foreign currency profits back into USD.

The USD safe-haven trade may eventually trigger a broad and deep selloff in US stocks. As the USD continues to strengthen, corporate profits for US multinationals will shrink or disappear.

US Multinational $1 Billion Revenue Example:

- $1 billion in revenue-generating a 15% net profit with a net neutral 0% currency translation equals a $150 million profit.

- $1 billion in revenue-generating a 15% net profit with a negative -15% unfavorable currency translation expense equals a $0 profit!

In addition, the impact of inflation on the global consumer will lead to a pullback in consumer spending which will further reduce corporate revenues and profits. The combination of the global currency dislocation along with the economic cool off will bring on a global recession.

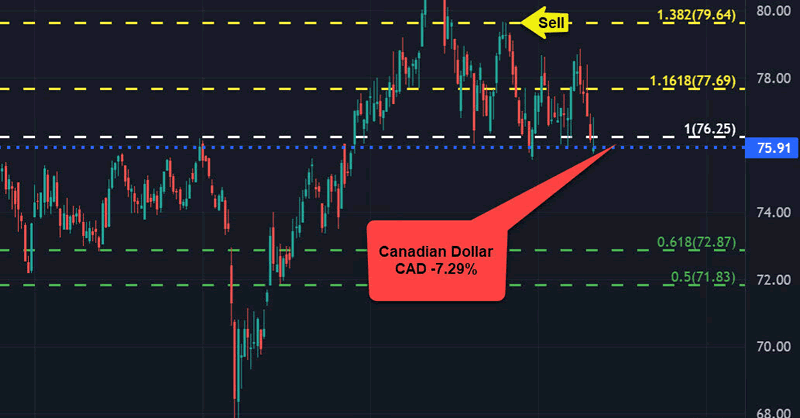

The following chart by Finviz shows the percentage the USD has appreciated against all the major global currencies year to date:

Let’s review a few of these primary currencies to get a better idea of how much capital is migrating out of each of these countries and into the US dollar.

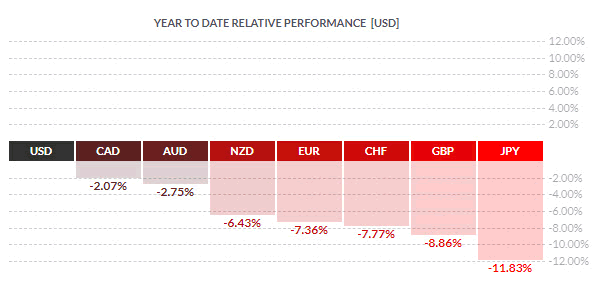

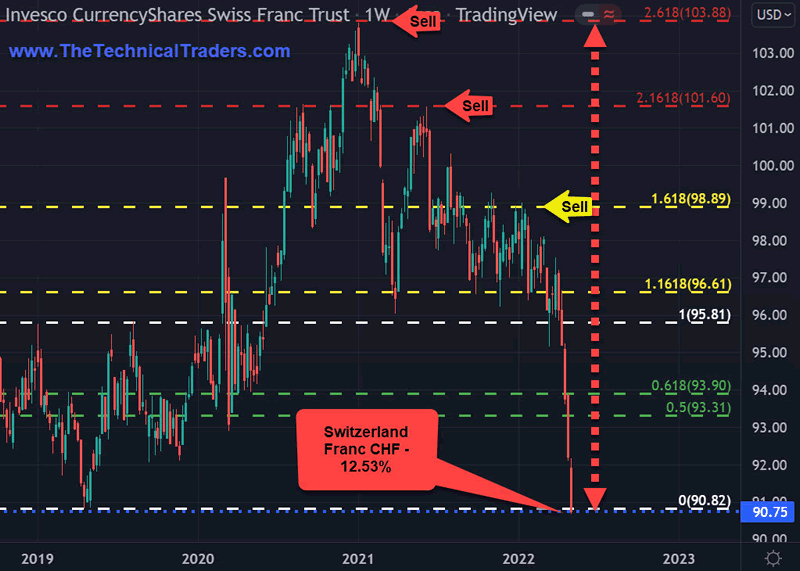

CANADIAN DOLLAR LOSING -7.29%

The Canadian Dollar CAD peaked in the first week of June 1, 2021. The Canadian economy has benefited greatly from soaring energy and commodity prices, strengthening metals markets, and strong real estate prices. But despite this economic strength capital is still migrating out of the CAD and into the USD.

INVESCO CURRENCY SHARES • CANADIAN DOLLAR TRUST ETF • ARCA • WEEKLY

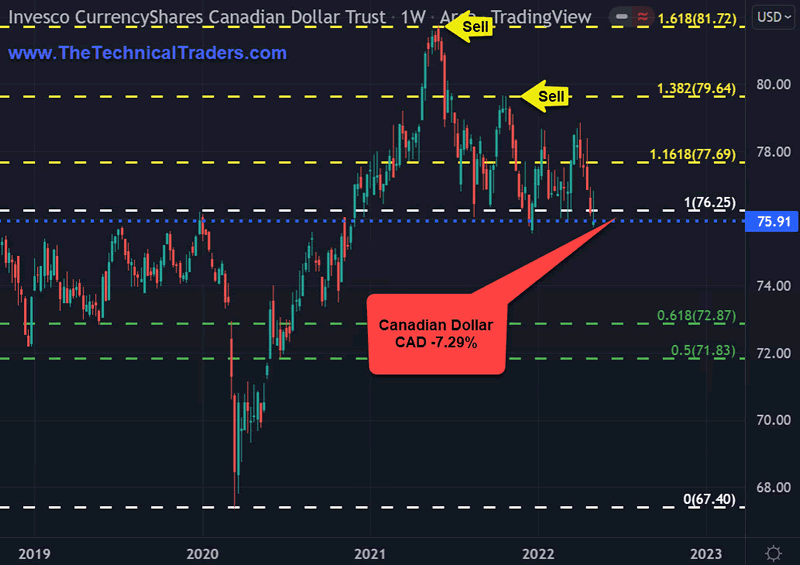

SWITZERLAND FRANC LOSING -12.53%

The Switzerland Franc CHF peaked in the first week of January 6, 2021. The CHF has long been considered a safe haven for global capital during times of risk-off global market stress. The primary factor hurting the CHF is its current fiscal policy and negative interest rate of -0.75%. Therefore, the USD is still the preferred safe-haven currency due to CHF’s negative rate. Capital continues to flow out of the CHF into the USD.

INVESCO CURRENCY SHARES • SWISS FRANC TRUST ETF • ARCA • WEEKLY

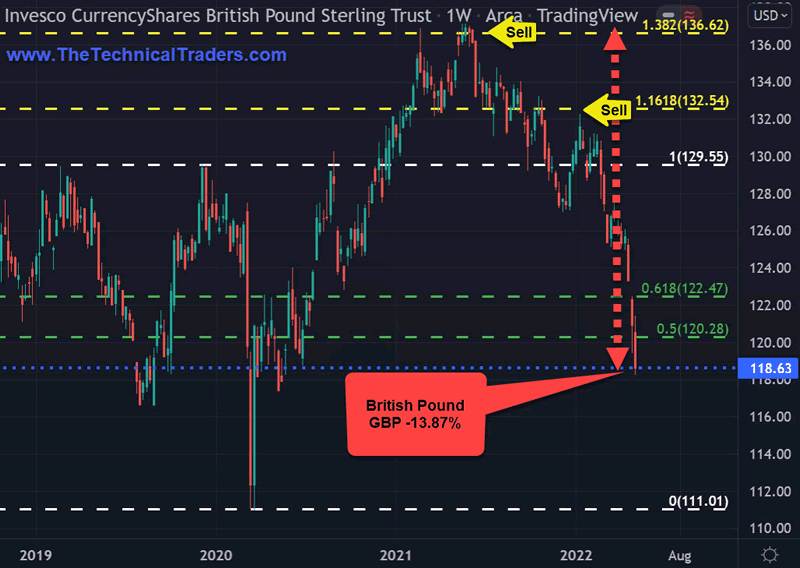

BRITISH POUND LOSING -13.87%

The British Pound GBP peaked in the first week of May 24, 2021. The GBP was the primary global reserve currency in the 19th century and the first half of the 20th century. However, that status ended when the UK almost bankrupted itself fighting World Wars I & 2. Since that time the US dollar has replaced the GBP as the primary reserve currency. The USD has a similar interest rate to the GBP and is also benefiting from its strong presence in energy and commodity markets. Therefore, the GBP is experiencing capital flows out of its currency and into the USD.

INVESCO CURRENCY SHARES • BRITISH POUND TRUST ETF • ARCA • WEEKLY

JAPANESE YEN LOSING -23.76%

The Japanese Yen JPY peaked in the first week of March 2, 2020. The JPY has also long been considered a safe haven for global capital during times of risk-off global market stress. However, the primary factor hurting the JPY is its current fiscal policy and negative interest rate of -0.10%. Therefore, the USD is still the preferred safe-haven currency due to the JPY’s negative rate. Capital continues to flow out of the JPY into the USD.

INVESCO CURRENCY SHARES • JAPANESE YEN TRUST ETF • ARCA • WEEKLY

how we CAN HELP YOU navigate current market trends

At TheTechnicalTraders.com, my team and I can do these things to assist you:

- We reduce your FOMO and manage your emotions.

- We have proven trading strategies for bull and bear markets.

- We provide quality trades you can trust.

- We tell you when to take profits and exit trades.

- We save you time with our research.

- We provide above-average returns/growth over the long run.

- We have consistent growth with low volatility/risks.

- We make trading and investing safer, more profitable, and educational.

Sign up for my free trading newsletter so you don’t miss the next opportunity!

Learn how I use specific tools to help me understand price cycles, set-ups, and price target levels in various sectors to identify strategic entry and exit points for trades. Over the next 12 to 24 months, I expect very large price swings in the US stock market and other asset classes across the globe. I believe we are seeing the markets beginning to transition away from the continued central bank support rally phase and have started a revaluation phase as global traders attempt to identify the next big trends. Precious Metals will likely start to act as a proper hedge as caution and concern start to drive traders/investors into metals, commodities, and other safe-havens.

Historically, bonds have served as one of these safe-havens, but that is not proving to be the case this time around. So if bonds are off the table, what bond alternatives are there and how can they be deployed in a bond replacement strategy?

We invite you to join our group of active traders and investors to learn and profit from our three ETF Technical Trading Strategies. We can help you protect and grow your wealth in any type of market condition by clicking on the following link: www.TheTechnicalTraders.com

Have a great day!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.